Buying Travel Insurance at the Last Minute: A Risky Move?

Understanding the Urgency Last Minute Travel Insurance and Peace of Mind

So, you're booking that dream vacation, the flight's confirmed, the hotel's secured, and excitement is building. But wait! Did you remember travel insurance? Often, it's an afterthought, something you scramble to find right before jetting off. Buying travel insurance at the last minute? It can feel like a relief, but is it really a smart move? Let’s dive in.

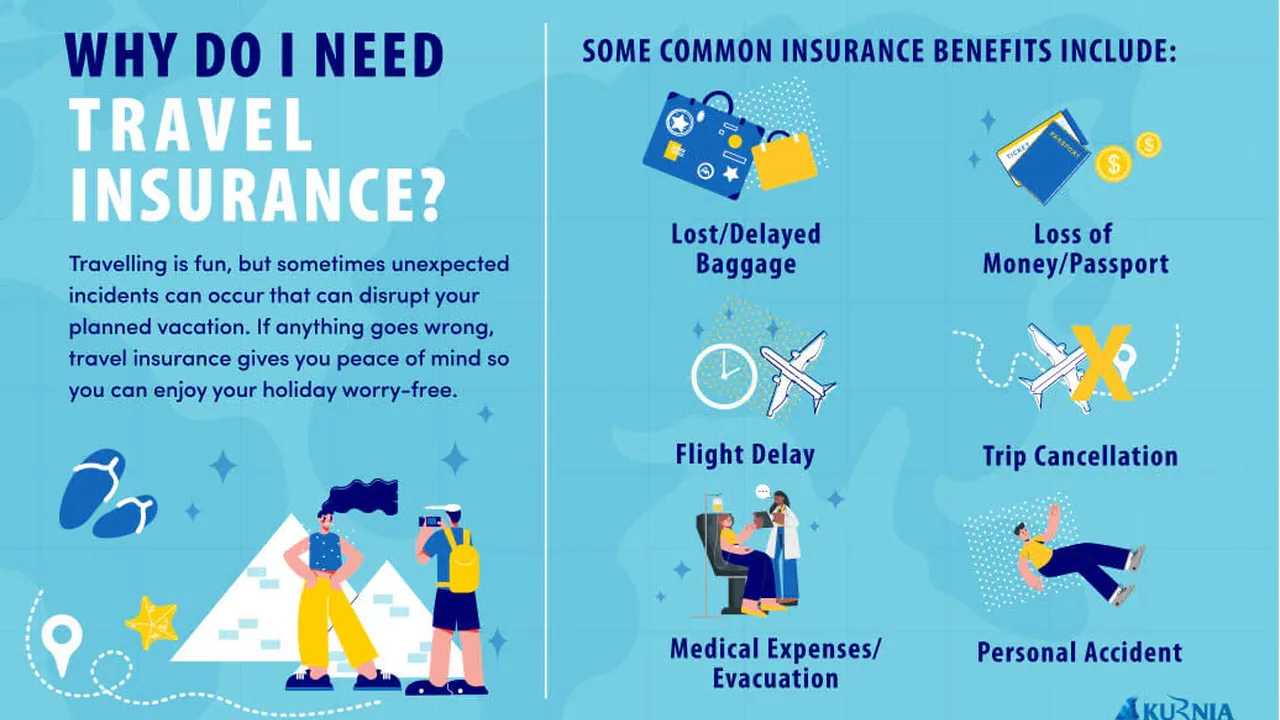

Think of travel insurance as your safety net. It's there to catch you if things go sideways – a sudden illness, a cancelled flight, lost luggage, or even a medical emergency in a foreign country. It’s the "what if" protection that allows you to actually relax and enjoy your trip. But rushing into a last-minute purchase can lead to overlooking critical details and potentially leaving yourself underinsured.

Potential Pitfalls of Last Minute Travel Insurance Decisions Limited Coverage and Exclusions

The biggest risk with last-minute travel insurance is simply not having enough time to properly research and compare policies. You might grab the first option you see, without fully understanding what it covers and, more importantly, what it doesn’t cover. This can be a costly mistake.

Many policies have exclusions for pre-existing medical conditions. If you buy insurance right before your trip and haven't disclosed a pre-existing condition, any related medical expenses during your trip might not be covered. Similarly, some policies have waiting periods for certain benefits to kick in. If you buy insurance the day before your flight and then need to cancel your trip due to illness, you might not be eligible for a refund.

Another crucial aspect is understanding the coverage limits. Does the policy cover enough for medical emergencies, lost luggage, or trip cancellations? Last-minute shoppers often overlook these details, potentially leaving themselves with inadequate protection.

The Benefits of Planning Ahead Securing Comprehensive Travel Insurance Coverage

Buying travel insurance well in advance of your trip allows you to carefully consider your needs and compare different policies. You have time to read the fine print, understand the exclusions, and choose a policy that offers the right level of coverage for your specific trip and circumstances.

Planning ahead also allows you to take advantage of early bird discounts or special promotions. Some insurers offer discounts for purchasing policies several weeks or months before your travel date. You also have the opportunity to ask questions, clarify any doubts, and ensure that you're fully informed about your coverage.

Moreover, buying early can provide peace of mind. Knowing that you're protected against unexpected events allows you to relax and focus on enjoying your trip. You won't have the nagging worry of "what if" hanging over your head.

Last Minute Travel Insurance Options What's Available When You're in a Rush

Okay, so maybe you *are* in a last-minute bind. What are your options? Thankfully, even at the eleventh hour, you're not completely out of luck. Several companies specialize in providing quick and easy travel insurance quotes and policies.

- Online Comparison Sites: Websites like InsureMyTrip, Squaremouth, and TravelInsurance.com allow you to compare quotes from multiple insurers in one place. This can save you time and effort in finding the best deal.

- Direct Insurers: Companies like Allianz Travel Insurance, World Nomads, and Travel Guard offer policies directly to consumers. These insurers often have a range of options to suit different budgets and needs.

- Credit Card Travel Insurance: Many credit cards offer travel insurance as a perk. Check your card's benefits guide to see what coverage is included. However, be aware that credit card travel insurance often has limitations and may not be as comprehensive as a standalone policy.

Recommended Travel Insurance Products and Their Use Cases

Let's look at some specific examples. Keep in mind pricing is approximate and always subject to change, so confirm directly with the insurer before purchasing.

- World Nomads Explorer Plan: This is a popular choice for adventurous travelers. It covers a wide range of activities, including hiking, scuba diving, and skiing. It's especially good for those who need medical coverage for injuries sustained during these activities. A 14-day trip to Europe might cost around $150-$250 depending on your age and destination.

- Allianz Travel Insurance OneTrip Prime: This plan is ideal for families and those who want comprehensive coverage for trip cancellations, interruptions, and medical emergencies. It offers high coverage limits and includes benefits like baggage loss and delay. A week-long trip to the Caribbean could be in the $80-$150 range.

- Travel Guard Essential: A more budget-friendly option that still provides essential coverage for medical expenses, trip cancellation, and baggage loss. It's a good choice for travelers on a tight budget who still want some protection. Expect to pay around $50-$100 for a week-long domestic trip.

- Seven Corners RoundTrip Choice: This provides excellent medical coverage, including pre-existing condition waivers (if purchased within a specific timeframe of your initial trip deposit). This is excellent for anyone who has a history of medical issues. Prices vary greatly based on age, destination, and coverage level, but generally lands in the mid-range of pricing.

Comparing Travel Insurance Products Key Features and Price Points

Here's a quick comparison table to help you visualize the differences:

| Insurance Provider | Plan Name | Key Features | Approximate Price (1 week trip to Europe) | Best For |

|---|---|---|---|---|

| World Nomads | Explorer Plan | Adventure activities, high medical coverage | $150-$250 | Adventurous travelers |

| Allianz Travel Insurance | OneTrip Prime | Comprehensive coverage, trip cancellation, baggage loss | $120-$200 | Families, travelers seeking broad protection |

| Travel Guard | Essential | Budget-friendly, essential medical coverage | $80-$150 | Budget-conscious travelers |

| Seven Corners | RoundTrip Choice | Excellent medical coverage, pre-existing condition waivers | $180-$300+ | Travelers with medical conditions |

Real World Scenarios When Last Minute Travel Insurance Can Be a Lifesaver

Let's say you book a last-minute trip to visit a sick relative. You purchase travel insurance the day before you leave. During your trip, you develop a severe allergic reaction and require hospitalization. Without insurance, you'd be facing potentially thousands of dollars in medical bills. But because you had a policy in place, your expenses are covered (assuming the policy covers allergic reactions and you disclosed any relevant pre-existing conditions). This is a perfect example of the utility of last-minute coverage.

Another scenario: You're traveling for business and your flight is unexpectedly cancelled due to bad weather. You need to book a new flight and hotel room. Your travel insurance policy can reimburse you for these unexpected expenses, saving you a significant amount of money and stress.

Tips for Buying Travel Insurance at the Last Minute Making Informed Choices Quickly

Even in a rush, you can make smart choices. Here's how:

- Prioritize Coverage: Focus on the most important coverage areas for your trip, such as medical expenses, trip cancellation, and baggage loss.

- Read the Key Details: Don't skip the fine print! Pay attention to exclusions, coverage limits, and claim procedures.

- Compare Quotes: Use online comparison sites to quickly compare quotes from multiple insurers.

- Consider Your Destination: Choose a policy that is appropriate for your destination. Some countries have specific requirements or higher medical costs.

- Disclose Pre-Existing Conditions: Be honest about any pre-existing medical conditions to avoid claim denials.

- Understand the Cancellation Policy: Know how to cancel your policy and what refund you're entitled to if your trip is cancelled.

Leveraging Credit Card Travel Insurance Benefits Understanding the Fine Print

Don't forget to check your credit card benefits! As mentioned earlier, many cards offer some form of travel insurance. This can include trip cancellation/interruption insurance, baggage delay/loss insurance, and even car rental insurance. The level of coverage varies widely depending on the card, so it's essential to read the benefits guide carefully. Credit card travel insurance is often secondary coverage, meaning it only kicks in after you've exhausted any other insurance policies you have.

One common misconception is that you automatically have coverage simply by holding the card. Often, you need to have used the card to pay for the trip (or a portion of it) to be eligible for the benefits. Always confirm the specific requirements with your credit card issuer.

The Role of Age and Health in Determining Travel Insurance Costs and Coverage

Your age and health significantly impact the cost and availability of travel insurance. Older travelers and those with pre-existing medical conditions typically pay higher premiums. Some policies may exclude coverage for certain pre-existing conditions altogether. It's crucial to be upfront about your health history when applying for travel insurance. Some insurers offer waivers for pre-existing conditions if you purchase the policy within a certain timeframe of your initial trip deposit.

If you have pre-existing medical conditions, it's especially important to shop around and compare policies. Look for insurers that specialize in covering travelers with medical conditions. You may also need to provide medical documentation to support your application.

Staying Informed About Travel Advisories and Insurance Implications

Before you travel, it's essential to stay informed about any travel advisories or warnings issued by your government. These advisories can provide valuable information about potential risks in your destination, such as political instability, natural disasters, or disease outbreaks. Travel insurance policies often have exclusions for events that occur in areas with active travel advisories. For example, if your government advises against traveling to a particular country due to political unrest, your travel insurance policy may not cover any losses you incur if you choose to travel there anyway. It's always best to check with your insurer to understand the specific policy terms and conditions.

Mobile Apps and Resources for Managing Your Travel Insurance On The Go

In today's digital age, managing your travel insurance is easier than ever thanks to mobile apps and online resources. Many insurers offer mobile apps that allow you to access your policy details, file claims, and contact customer support from your smartphone or tablet. These apps can be a lifesaver when you're traveling and need quick access to your insurance information.

Here are some useful mobile apps and resources:

- Insurer Apps: Download the app for your specific travel insurance provider.

- Travel Safety Apps: Apps like SmartTraveler and TripIt offer travel alerts and safety information.

- Online Claim Filing: Most insurers allow you to file claims online through their website.

- Emergency Contact Information: Keep a list of emergency contact numbers for your insurer, local authorities, and your embassy or consulate.

The Importance of Reading the Fine Print and Understanding Policy Exclusions

This cannot be stressed enough: READ. THE. FINE. PRINT. Travel insurance policies are legal contracts, and it's your responsibility to understand the terms and conditions. Pay close attention to the exclusions, which are the specific situations or events that the policy does not cover. Common exclusions include:

- Pre-existing medical conditions (unless waived)

- Participation in extreme sports (unless specifically covered)

- Acts of war or terrorism (in some cases)

- Traveling against medical advice

- Intoxication or drug use

If you're unsure about any aspect of your policy, don't hesitate to contact your insurer for clarification.

Making a Claim What to Expect and How to Expedite the Process

If you need to make a claim, it's important to follow the proper procedures to ensure a smooth and efficient process. Here are some tips:

- Notify Your Insurer Promptly: Contact your insurer as soon as possible after the event that gives rise to the claim.

- Gather Documentation: Collect all relevant documentation, such as medical records, police reports, receipts, and travel itineraries.

- Complete the Claim Form Accurately: Fill out the claim form completely and accurately, providing all the required information.

- Keep Copies of Everything: Make copies of all documents you submit to your insurer.

- Follow Up Regularly: Check the status of your claim and follow up with your insurer if you haven't heard back within a reasonable timeframe.

Beyond the Basics Additional Travel Insurance Considerations

While medical coverage and trip cancellation are the most common concerns, consider these additional factors:

- Rental Car Insurance: If you're renting a car, consider purchasing rental car insurance to protect yourself against damage or theft.

- Adventure Activities: If you're planning to participate in adventure activities, make sure your policy covers them.

- Business Travel: If you're traveling for business, consider purchasing business travel insurance to cover things like lost laptops or delayed meetings.

- Pet Travel: If you're traveling with a pet, consider purchasing pet travel insurance to cover veterinary expenses or lost pet fees.

Ultimately, buying travel insurance, even at the last minute, is almost always better than having no insurance at all. Just be sure to do your research, understand your policy, and choose a plan that meets your specific needs. Safe travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)