The Importance of Disclosure: Pre-Existing Conditions & Travel

Understanding Pre Existing Conditions Travel Insurance and Why Disclosure Matters

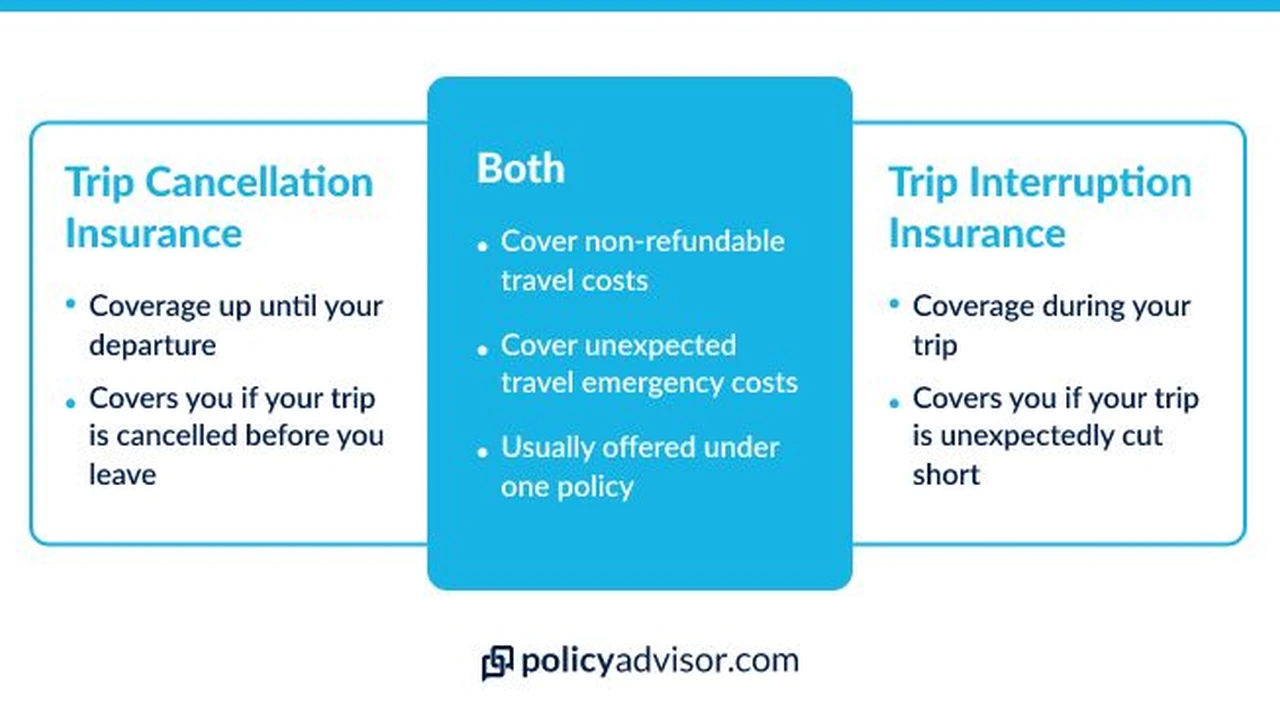

Okay, let's talk travel insurance. Specifically, let's dive into the murky waters of pre-existing conditions. Seems straightforward, right? You've got a medical condition, you tell the insurance company, and they figure out if they'll cover you. But trust me, it's rarely that simple. Not disclosing a pre-existing condition can completely invalidate your travel insurance policy, leaving you high and dry in a foreign country with a hefty medical bill. Nobody wants that! So, what exactly is a pre-existing condition, and why is disclosure so crucial?

A pre-existing condition is essentially any medical condition you've been diagnosed with or received treatment for before you purchase your travel insurance policy. This can range from something as seemingly minor as seasonal allergies to more serious conditions like heart disease, diabetes, or even a previous surgery. The key here is "diagnosis" or "treatment." If you've had symptoms but haven't seen a doctor about them, it's still a grey area. But if you've been officially diagnosed, you need to disclose it.

Why is disclosure so important? Well, insurance companies are in the business of assessing risk. They want to know how likely you are to need medical care while you're traveling. Pre-existing conditions increase that risk. If they don't know about your condition, they can't accurately assess the risk, and they may argue that you weren't honest when you bought the policy. This can lead to them refusing to pay out a claim if you need medical attention related to that condition while you're abroad.

Navigating Travel Insurance for Pre Existing Conditions Finding the Right Policy

So, how do you find travel insurance that covers pre-existing conditions? It's not always easy, but it's definitely possible. Here's what you need to do:

- Be honest and upfront: When you're getting a quote, be completely honest about your medical history. Don't try to downplay anything. The more information you provide, the better.

- Read the fine print: This is crucial! Pay close attention to the policy wording regarding pre-existing conditions. Look for any exclusions or limitations. Some policies may cover pre-existing conditions automatically, while others may require you to pay an extra premium for coverage.

- Shop around: Don't just go with the first policy you find. Get quotes from several different insurance companies and compare their coverage and prices. Websites like InsureMyTrip and Squaremouth are great resources for comparing policies.

- Consider a waiver: Some policies offer a waiver for pre-existing conditions. This means that the insurance company will cover your condition as long as you meet certain requirements, such as purchasing the policy within a certain timeframe after booking your trip.

Specific Travel Insurance Products for Pre Existing Conditions A Comparison

Alright, let's get down to brass tacks. Here are a few specific travel insurance products that often offer coverage for pre-existing conditions. Keep in mind that coverage can vary depending on your specific condition and the policy you choose, so always read the fine print!

- World Nomads: World Nomads is a popular choice for travelers, and they often offer coverage for pre-existing conditions with certain limitations. Their Explorer plan is generally considered to offer more comprehensive coverage. They have a medical questionnaire you fill out during the application process, which helps them determine if they can cover your specific condition. Price Range: Varies widely depending on trip length, destination, and age, but expect to pay anywhere from $50 to $200+ for a two-week trip.

- Allianz Travel Insurance: Allianz is a well-known insurance provider that offers a variety of travel insurance plans. Their plans often include coverage for pre-existing conditions if you meet certain eligibility requirements, such as purchasing the policy within a certain timeframe of booking your trip. Price Range: Similar to World Nomads, expect to pay $50 to $200+ for a two-week trip, depending on coverage level.

- Travelex Insurance Services: Travelex offers comprehensive travel insurance plans, including options for covering pre-existing conditions. They have a pre-existing condition exclusion that can be waived if you meet certain criteria. Price Range: Their prices are generally competitive, falling within the same range as World Nomads and Allianz.

- Seven Corners: Seven Corners offers specialized travel medical insurance, particularly geared towards international travel. They have several plans that may cover pre-existing conditions, with specific requirements that need to be met. Price Range: Often a bit more expensive than the previous options, reflecting their specialized medical coverage. Expect to pay $75 to $250+ for a two-week trip.

Product Comparison Table:

| Insurance Provider | Plan Example | Pre-Existing Condition Coverage | Approximate Price (2-week trip) | Best For |

|---|---|---|---|---|

| World Nomads | Explorer Plan | May cover with limitations; requires medical questionnaire. | $50 - $200+ | Backpackers and adventure travelers. |

| Allianz Travel Insurance | OneTrip Prime Plan | May cover if purchased within a certain timeframe of booking. | $50 - $200+ | Families and those seeking comprehensive coverage. |

| Travelex Insurance Services | Travel Select Plan | Pre-existing condition exclusion can be waived with specific criteria. | $50 - $200+ | Travelers looking for customizable coverage options. |

| Seven Corners | Liaison Continent Plan | May cover with specific requirements. Geared towards international travel. | $75 - $250+ | Travelers with complex medical needs. |

Understanding Stability Periods and Exclusions Know Your Policy

Now, let's talk about "stability periods." Many travel insurance policies have a stability period clause, which means that your pre-existing condition must have been stable for a certain period of time (usually 60 to 180 days) before you purchased the policy. "Stable" means that there haven't been any changes in your medication, treatment, or symptoms during that time. If your condition hasn't been stable, the insurance company may not cover any claims related to that condition.

Also, be aware of any specific exclusions in the policy. Some policies may exclude coverage for certain pre-existing conditions altogether, such as cancer, heart disease, or mental health conditions. It's crucial to read the policy wording carefully to understand what's covered and what's not.

Real Life Scenarios When Disclosure Matters A Story

Let me tell you a quick story. I know a friend, let's call her Sarah, who has asthma. She went on a trip to Europe and didn't disclose her asthma when she bought her travel insurance. While she was there, she had a severe asthma attack and needed to be hospitalized. The insurance company found out about her asthma and refused to pay her medical bills, because she hadn't disclosed it. Sarah ended up paying thousands of dollars out of pocket. Ouch! This is a prime example of why disclosure is so important. Even if you think your condition is minor, it's always better to be safe than sorry.

Tips for Traveling with Pre Existing Conditions Stay Safe and Prepared

Okay, so you've got your travel insurance sorted out. Great! But there are still a few things you can do to stay safe and prepared while traveling with a pre-existing condition:

- Talk to your doctor: Before you travel, talk to your doctor about your trip and get their advice on managing your condition. They may recommend adjusting your medication or taking extra precautions.

- Carry a copy of your medical records: It's a good idea to carry a copy of your medical records with you, including a list of your medications and any allergies you have.

- Learn the local emergency numbers: Make sure you know the local emergency numbers in the country you're visiting.

- Pack extra medication: Pack enough medication to last for the entire trip, plus a few extra days in case of delays. Keep your medication in its original packaging and carry it in your carry-on luggage.

- Inform someone about your condition: Let a travel companion or someone at your destination know about your condition and what to do in case of an emergency.

The Cost of Travel Insurance for Pre Existing Conditions Is It Worth It

Let's be real, travel insurance for pre-existing conditions can be more expensive. But is it worth it? Absolutely! Think about it this way: the cost of travel insurance is a small price to pay compared to the potential cost of medical treatment in a foreign country. Medical bills can be astronomical, and without insurance, you could be stuck with a huge debt. Plus, travel insurance can also cover other things like lost luggage, trip cancellations, and travel delays. So, it's not just about medical coverage; it's about peace of mind.

Travel Insurance Claim Time Dealing With Denials and Appeals

Even if you've disclosed your pre-existing condition and purchased a policy that covers it, there's still a chance that your claim could be denied. If this happens, don't panic! You have the right to appeal the decision. Here are a few tips for dealing with denials and appeals:

- Read the denial letter carefully: Understand why your claim was denied. The denial letter should explain the reason for the denial and provide instructions on how to appeal.

- Gather supporting documentation: Collect any documentation that supports your claim, such as medical records, doctor's notes, and receipts.

- Write a clear and concise appeal letter: Explain why you believe your claim should be approved. Be polite and professional.

- Keep copies of everything: Keep copies of all correspondence with the insurance company.

- Consider seeking legal advice: If your claim is denied and you're not sure how to proceed, consider seeking legal advice from an attorney who specializes in insurance claims.

Future of Travel Insurance for Pre Existing Conditions What's Next

The travel insurance industry is constantly evolving, and there are some interesting developments on the horizon when it comes to coverage for pre-existing conditions. We're seeing more and more insurance companies offering policies that automatically cover certain pre-existing conditions, without requiring a medical questionnaire. We're also seeing the rise of personalized travel insurance, where policies are tailored to your specific needs and medical history. This could make it easier and more affordable for people with pre-existing conditions to get the coverage they need. The future looks promising!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)