The Importance of Reading the Fine Print in Travel Insurance

Understanding Travel Insurance Fine Print Key Terms and Definitions

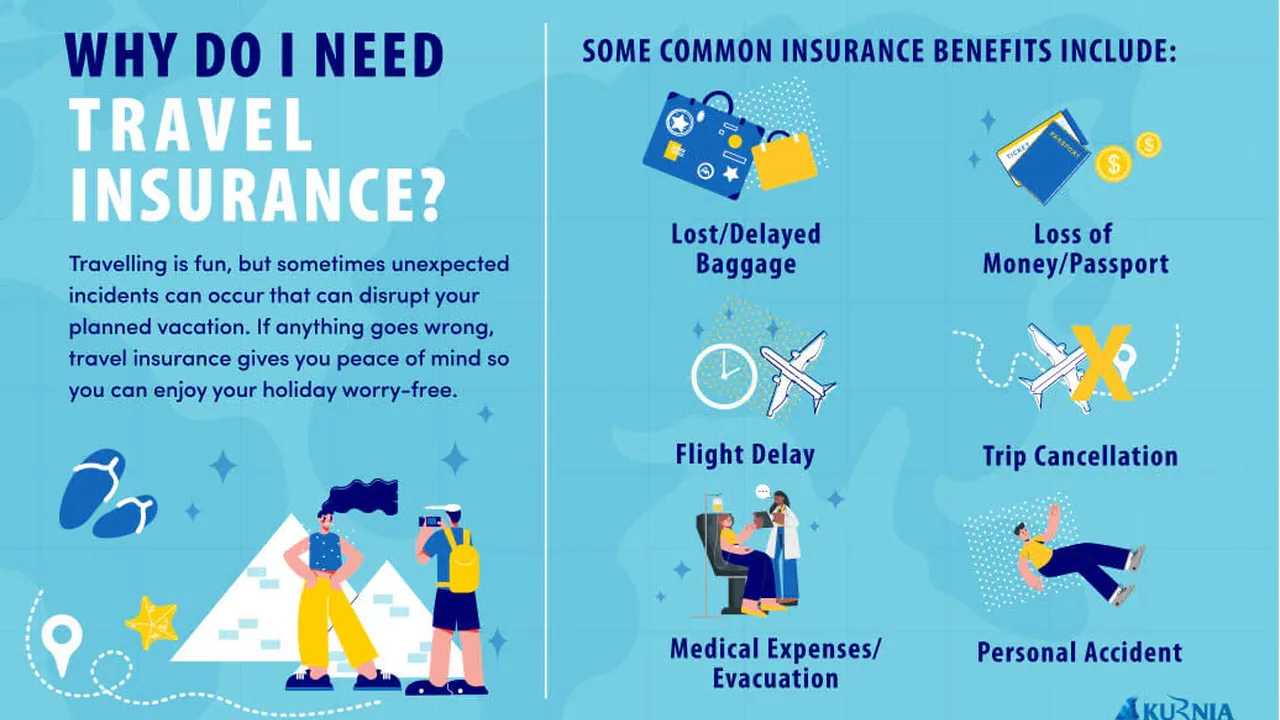

Okay, so you're planning a trip. Awesome! Flights are booked, hotel's confirmed, and you're practically dreaming of sipping cocktails on the beach. But hold up! Did you get travel insurance? Good. Did you *actually* read it? Probably not, right? Don't worry, you're not alone. But trust me, understanding the fine print of your travel insurance is crucial. It's the difference between a minor inconvenience and a major financial headache. Let's break down some key terms you'll find lurking in those documents.

First up: Deductible. This is the amount you have to pay out of pocket before your insurance kicks in. Think of it like your car insurance deductible. A higher deductible usually means a lower premium, but it also means you're responsible for more of the initial costs. So, if your deductible is $500 and your medical bill is $700, you pay $500 and the insurance covers the remaining $200. Choose wisely based on your risk tolerance and budget.

Next, Exclusions. This is where things get tricky. Exclusions are specific situations or activities that your insurance *won't* cover. Common exclusions include pre-existing medical conditions (unless specifically covered), extreme sports (like skydiving or bungee jumping), and acts of war or terrorism. Always, always check the exclusions list carefully. If you're planning on doing something adventurous, make sure it's covered, or consider getting supplemental insurance.

Then there's Coverage Limits. Your policy will have limits on how much it will pay out for different types of claims. For example, there might be a limit of $100,000 for medical expenses, $5,000 for lost luggage, and $2,000 for trip cancellation. Make sure these limits are sufficient for your needs. If you're traveling to a country with high medical costs, you'll want a higher medical expense limit.

Finally, Pre-existing Conditions. This is a big one. Many travel insurance policies have strict rules about pre-existing conditions. Generally, they won't cover any medical expenses related to a condition you already had before you bought the policy. However, some policies offer waivers for pre-existing conditions if you meet certain requirements, like buying the policy within a certain timeframe of booking your trip. Read the fine print carefully and be honest about your medical history.

Navigating Travel Insurance Claims Process Understanding Documentation Requirements

So, something went wrong on your trip. Bummer. Now you need to file a claim. But before you start panicking, take a deep breath and gather your documentation. The more organized you are, the smoother the claims process will be.

First, you'll need your policy documents. This includes your insurance certificate, policy number, and a copy of the terms and conditions. Keep these in a safe place, both physically and digitally.

Next, you'll need proof of your loss. This could include medical bills, police reports (if you were a victim of theft), receipts for lost or damaged items, and documentation from your airline or hotel. The more evidence you can provide, the better.

You'll also need to fill out a claim form. This will require you to provide details about what happened, when it happened, and how much you're claiming. Be as accurate and detailed as possible. Don't leave anything out.

Once you've gathered all your documentation, submit your claim to the insurance company. Be sure to keep a copy of everything you send. Follow up with the insurance company regularly to check on the status of your claim. Be patient, but persistent. It can take time for them to process your claim, but don't be afraid to ask questions and advocate for yourself.

Here's a pro tip: Take photos of everything before you pack! That way, if your luggage gets lost, you have visual proof of what was inside.

Travel Insurance Product Comparison Allianz vs World Nomads vs Travel Guard

Okay, let's talk specifics. There are tons of travel insurance companies out there, each offering different levels of coverage and different price points. Here's a quick comparison of three popular options: Allianz, World Nomads, and Travel Guard.

Allianz Travel Insurance: Allianz is a well-established company with a wide range of plans to choose from. They offer comprehensive coverage for trip cancellation, medical expenses, lost luggage, and more. They're a good option for travelers who want a reliable and reputable insurer.

World Nomads Travel Insurance: World Nomads is a popular choice for adventure travelers and backpackers. They offer coverage for a wide range of activities, including extreme sports and off-the-beaten-path destinations. They're also known for their flexible policies, which allow you to extend your coverage while you're already traveling.

Travel Guard Travel Insurance: Travel Guard is another reputable insurer with a variety of plans to suit different needs and budgets. They offer 24/7 assistance and a wide range of coverage options, including trip cancellation, medical expenses, and lost luggage. They're a good option for families and travelers who want comprehensive coverage.

Here's a quick table summarizing the key differences:

| Company | Best For | Key Features | Approximate Price (for a 1-week trip to Europe) |

|---|---|---|---|

| Allianz | General Travel | Comprehensive coverage, reputable brand | $50 - $100 |

| World Nomads | Adventure Travel | Covers extreme sports, flexible policies | $75 - $150 |

| Travel Guard | Families | 24/7 assistance, wide range of options | $60 - $120 |

Note: Prices are estimates and can vary depending on your age, destination, and coverage options.

Real-World Scenarios When Travel Insurance is Crucial Pre-Trip and During Travel

Let's paint some pictures. Imagine these scenarios:

Scenario 1: Trip Cancellation. You've been planning this dream vacation to Italy for months. Flights, hotels, tours – everything is booked. Then, a week before you're supposed to leave, you get sick. Seriously sick. You can't travel. Without travel insurance, you're out thousands of dollars. With trip cancellation coverage, you can get reimbursed for your non-refundable expenses.

Scenario 2: Lost Luggage. You arrive in Bangkok, excited to start your adventure. But your luggage doesn't. It's gone. Vanished. And it contains all your clothes, toiletries, and essential medications. Travel insurance with lost luggage coverage can help you replace your belongings and cover the cost of necessities while you wait for your luggage to be found (or declared lost).

Scenario 3: Medical Emergency. You're hiking in the Andes Mountains when you slip and break your leg. You need to be airlifted to a hospital and undergo surgery. Medical care in foreign countries can be incredibly expensive. Travel insurance with medical expense coverage can cover the cost of your medical treatment and evacuation.

Scenario 4: Flight Delay. Your flight is delayed for 12 hours due to bad weather. You miss your connecting flight and have to spend the night in an airport hotel. Travel insurance with trip delay coverage can reimburse you for the cost of your hotel and meals.

These are just a few examples of how travel insurance can save you from financial disaster. It's not just about protecting your money; it's about protecting your peace of mind.

Understanding Different Types of Travel Insurance Coverage Trip Cancellation vs Medical vs Baggage

Travel insurance isn't a one-size-fits-all kind of deal. There are different types of coverage designed to protect you from different risks. Let's break down the most common types:

Trip Cancellation Insurance: This covers you if you have to cancel your trip due to unforeseen circumstances, such as illness, injury, or a death in the family. It can reimburse you for non-refundable expenses, such as flights, hotels, and tours.

Medical Insurance: This covers you for medical expenses incurred while traveling. It can cover doctor visits, hospital stays, medication, and even emergency medical evacuation. It's especially important if you're traveling to a country with high medical costs or if you have pre-existing medical conditions.

Baggage Insurance: This covers you if your luggage is lost, stolen, or damaged while traveling. It can reimburse you for the cost of your belongings, up to a certain limit.

Trip Interruption Insurance: This covers you if your trip is interrupted due to unforeseen circumstances, such as illness, injury, or a natural disaster. It can reimburse you for the cost of returning home and any unused portion of your trip.

Travel Delay Insurance: This covers you if your flight or other transportation is delayed. It can reimburse you for the cost of meals, accommodation, and other expenses incurred due to the delay.

Most comprehensive travel insurance policies include all of these types of coverage. However, you can also purchase individual policies if you only need coverage for a specific risk.

Travel Insurance Cost Factors Age Destination Trip Length and Coverage Level

So, how much does travel insurance cost? The price of travel insurance depends on several factors:

Age: Older travelers typically pay more for travel insurance because they're considered to be at higher risk of medical problems.

Destination: Travel insurance is usually more expensive for trips to countries with high medical costs or a high risk of crime or terrorism.

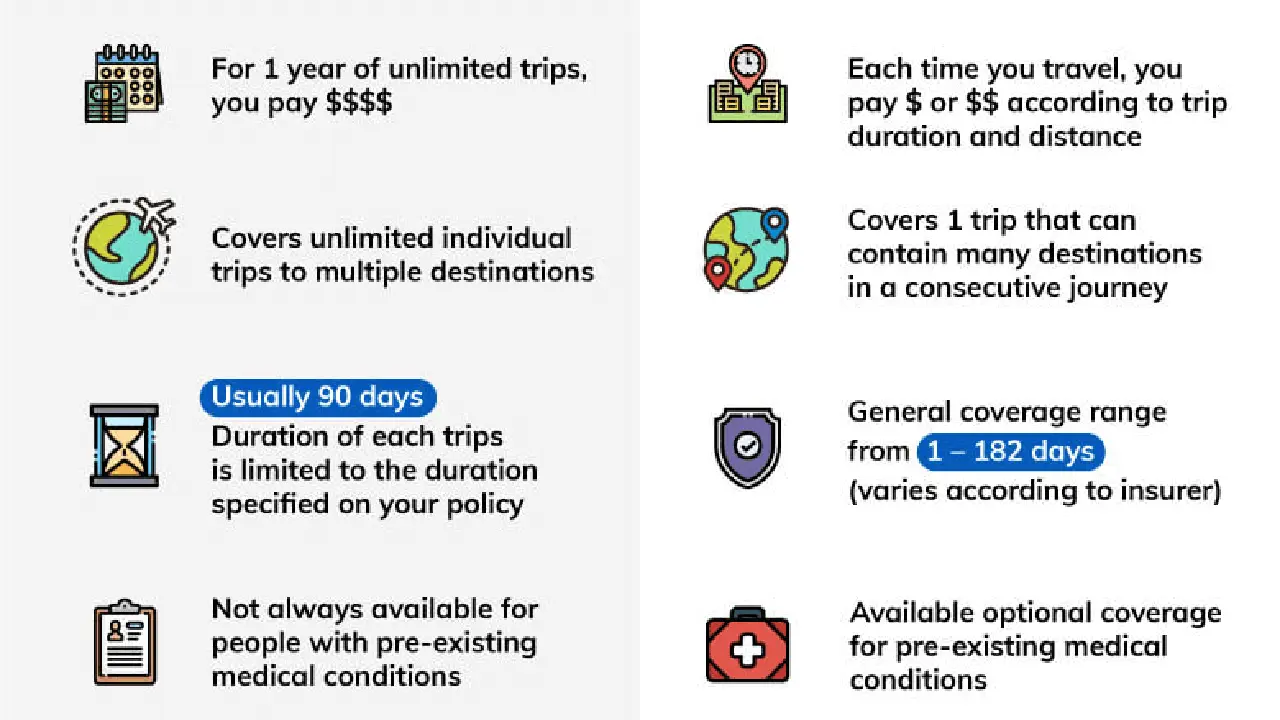

Trip Length: The longer your trip, the more you'll pay for travel insurance.

Coverage Level: The more coverage you need, the more you'll pay. Comprehensive policies with high coverage limits will be more expensive than basic policies with low coverage limits.

Pre-existing Conditions: If you have pre-existing medical conditions, you may have to pay more for travel insurance or accept a policy with limited coverage.

To get an accurate quote, compare prices from different insurance companies and consider the factors that affect the cost of travel insurance.

Tips for Choosing the Right Travel Insurance Policy for Your Specific Needs

Choosing the right travel insurance policy can be overwhelming. Here are some tips to help you make the right decision:

Assess Your Needs: Consider your destination, activities, and medical history. What are the biggest risks you're likely to face? What kind of coverage do you need?

Compare Quotes: Get quotes from multiple insurance companies and compare their coverage options, prices, and exclusions.

Read the Fine Print: Don't just look at the price. Read the fine print carefully and understand what's covered and what's not.

Check the Exclusions: Pay close attention to the exclusions list. Make sure the policy covers the activities you're planning to do and any pre-existing medical conditions you have.

Consider the Deductible: Choose a deductible that you're comfortable paying out of pocket.

Look for 24/7 Assistance: Make sure the insurance company offers 24/7 assistance in case of an emergency.

Read Reviews: Check online reviews to see what other travelers have to say about their experience with the insurance company.

By following these tips, you can choose the right travel insurance policy for your specific needs and enjoy your trip with peace of mind.

Understanding the Claims Process Step-by-Step Guide

We touched on this earlier, but let's reiterate. Filing a travel insurance claim can feel daunting, but it doesn't have to be. Here's a step-by-step guide to help you navigate the process:

Step 1: Gather Your Documentation. As mentioned before, collect your policy documents, proof of loss, and any other relevant information.

Step 2: Contact Your Insurance Company. Notify your insurance company as soon as possible after the incident occurs. They will provide you with a claim form and instructions on how to file your claim.

Step 3: Fill Out the Claim Form. Complete the claim form accurately and thoroughly. Provide all the necessary information and attach copies of your documentation.

Step 4: Submit Your Claim. Submit your claim to the insurance company according to their instructions. Keep a copy of everything you send.

Step 5: Follow Up. Follow up with the insurance company regularly to check on the status of your claim. Be patient, but persistent.

Step 6: Appeal if Necessary. If your claim is denied, you have the right to appeal. Review the reason for the denial and gather any additional information that supports your claim. Submit your appeal to the insurance company according to their instructions.

Remember, the key to a successful claim is to be organized, thorough, and persistent.

Debunking Common Travel Insurance Myths

There are a lot of misconceptions about travel insurance. Let's bust some common myths:

Myth #1: I Don't Need Travel Insurance Because I'm Healthy. Even if you're healthy, you can still experience unexpected events, such as trip cancellations, lost luggage, or flight delays. Travel insurance can protect you from these risks.

Myth #2: My Credit Card Offers Travel Insurance. Some credit cards offer limited travel insurance benefits, but they may not provide adequate coverage for your needs. Check the terms and conditions of your credit card's travel insurance policy carefully to see what's covered and what's not.

Myth #3: Travel Insurance is Too Expensive. Travel insurance is a relatively small cost compared to the potential financial losses you could incur without it. Think of it as an investment in your peace of mind.

Myth #4: Travel Insurance Covers Everything. Travel insurance policies have exclusions and limitations. Read the fine print carefully to understand what's covered and what's not.

Myth #5: I Can Buy Travel Insurance After Something Happens. You typically need to purchase travel insurance before your trip begins. Most policies won't cover events that have already occurred.

Understanding Emergency Medical Evacuation Coverage and When You Need It

Emergency medical evacuation coverage is one of the most important aspects of travel insurance, especially if you're traveling to remote areas or participating in adventurous activities. This coverage pays for the cost of transporting you to a medical facility if you're seriously injured or ill and require immediate medical attention.

When do you need emergency medical evacuation coverage?

- Traveling to Remote Areas: If you're traveling to a remote area where medical facilities are limited or non-existent, you'll need emergency medical evacuation coverage to transport you to a hospital if you get sick or injured.

- Participating in Adventurous Activities: If you're participating in adventurous activities, such as hiking, climbing, or skiing, you're at higher risk of injury. Emergency medical evacuation coverage can cover the cost of transporting you to a hospital if you get hurt.

- Traveling with Pre-existing Medical Conditions: If you have pre-existing medical conditions, you're at higher risk of experiencing a medical emergency while traveling. Emergency medical evacuation coverage can ensure that you receive prompt medical attention.

Emergency medical evacuation can be incredibly expensive, potentially costing tens of thousands of dollars. Make sure your travel insurance policy includes adequate coverage for emergency medical evacuation.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)