Travel Insurance Comparison Websites: Are They Reliable?

Understanding Travel Insurance Comparison Websites The Basics

So, you're planning a trip – awesome! But before you pack your bags and dream of sandy beaches or snow-capped mountains, let's talk about something less glamorous but equally important: travel insurance. And where do most people start their search? Travel insurance comparison websites, of course! They promise to simplify the process, showing you dozens of plans side-by-side. But are they really all they're cracked up to be? Let's dive in.

Think of these websites as online marketplaces for travel insurance. They gather information from various providers and present it in a (hopefully) easy-to-understand format. You enter your trip details – destination, dates, age, etc. – and the site spits out a list of plans that might be a good fit. Sounds perfect, right? Well, not always. The key is understanding how these websites operate and knowing what to look for.

The main benefit is convenience. Instead of visiting dozens of individual insurance company websites, you can see a range of options in one place. This saves you time and effort. Plus, many comparison sites offer filters to narrow down your search based on your specific needs, like coverage for pre-existing conditions, adventure sports, or electronics.

Potential Biases in Travel Insurance Comparisons Watch Out

Here's the catch: travel insurance comparison websites aren't always completely unbiased. They often get paid a commission by the insurance companies they list. This means that the plans you see might not be the absolute best for you, but rather the ones that pay the website the most. It's like going to a car dealership where the salesperson only shows you the cars that give them the biggest bonus.

Another thing to watch out for is incomplete information. Not all travel insurance companies participate in these comparison sites. So, you might be missing out on some excellent plans that aren't listed. It's crucial to remember that these websites are a starting point, not the definitive answer.

Finally, the devil is in the details. Comparison websites often focus on price, but the cheapest plan isn't always the best. You need to carefully read the policy wording to understand what's covered and what's not. Don't just look at the headline price; delve into the fine print.

Key Features to Compare in Travel Insurance Plans Coverage and Limits

Okay, so you're using a comparison website. What should you actually be looking at? Here are some key features to compare:

- Medical Coverage: This is arguably the most important. Make sure the plan covers medical expenses, including hospitalization, doctor visits, and emergency medical evacuation. Check the coverage limits – are they high enough for your destination? Medical care can be incredibly expensive in some countries.

- Trip Cancellation/Interruption: What happens if you have to cancel your trip due to illness, injury, or other unforeseen circumstances? Will you get your money back? Trip interruption coverage protects you if your trip is cut short after it's already started.

- Baggage Loss/Delay: Losing your luggage is a nightmare. Make sure the plan covers lost, stolen, or delayed baggage. Check the limits and the requirements for filing a claim.

- Emergency Assistance: Does the plan offer 24/7 emergency assistance? This can be invaluable if you run into trouble while traveling.

- Pre-existing Conditions: If you have any pre-existing medical conditions, make sure the plan covers them. Many plans exclude coverage for pre-existing conditions, or they require you to pay an extra premium.

- Activities: Planning on skydiving, scuba diving, or other adventurous activities? Make sure the plan covers them. Some plans exclude coverage for certain activities.

Top Travel Insurance Providers and Their Specializations A Quick Overview

Let's talk about some specific travel insurance providers. Keep in mind that this isn't an exhaustive list, and the best plan for you will depend on your individual needs and circumstances.

- World Nomads: Popular with backpackers and adventure travelers. They offer comprehensive coverage for a wide range of activities and destinations. They're known for their flexible policies and their ability to extend coverage while you're already traveling.

- Allianz Global Assistance: A well-established company with a wide range of plans, from basic to comprehensive. They are often recommended for trip cancellation and interruption coverage.

- Travel Guard: Offers a variety of plans with different levels of coverage. They're known for their excellent customer service and their ability to customize plans to meet specific needs.

- Seven Corners: Specializes in international travel insurance, particularly for students and expats. They offer comprehensive medical coverage and emergency assistance services.

- IMG (International Medical Group): Focuses on medical travel insurance, often used by those travelling for medical procedures or with pre-existing conditions.

Real World Scenarios Choosing the Right Travel Insurance for Your Trip

Let's look at some real-world scenarios to illustrate how to choose the right travel insurance:

- Scenario 1: Family Vacation to Disney World. You're taking your family to Disney World. What do you need? Medical coverage is essential, as is trip cancellation/interruption coverage in case someone gets sick. Look for a plan that covers pre-existing conditions, just in case. Also, consider baggage loss/delay coverage, as luggage can easily get lost or delayed at airports. Allianz Global Assistance or Travel Guard might be good options here.

- Scenario 2: Backpacking Trip Through Southeast Asia. You're backpacking through Southeast Asia for several months. You need a plan that covers a wide range of activities, including hiking, snorkeling, and maybe even some more adventurous things. Emergency medical evacuation is crucial, as is 24/7 emergency assistance. World Nomads is a popular choice for this type of trip.

- Scenario 3: Business Trip to Europe. You're going to Europe for a business trip. You need a plan that covers trip cancellation/interruption in case your meetings get cancelled or delayed. You also need medical coverage in case you get sick or injured. Travel Guard or Allianz Global Assistance could be suitable options.

- Scenario 4: A Cruise to the Caribbean. Cruises can be expensive, and often involve travel to remote locations. Comprehensive trip cancellation/interruption is key. Medical coverage should include emergency evacuation from the ship. Consider plans from Travel Guard that are specifically designed for cruises.

Comparing Specific Travel Insurance Products Side By Side

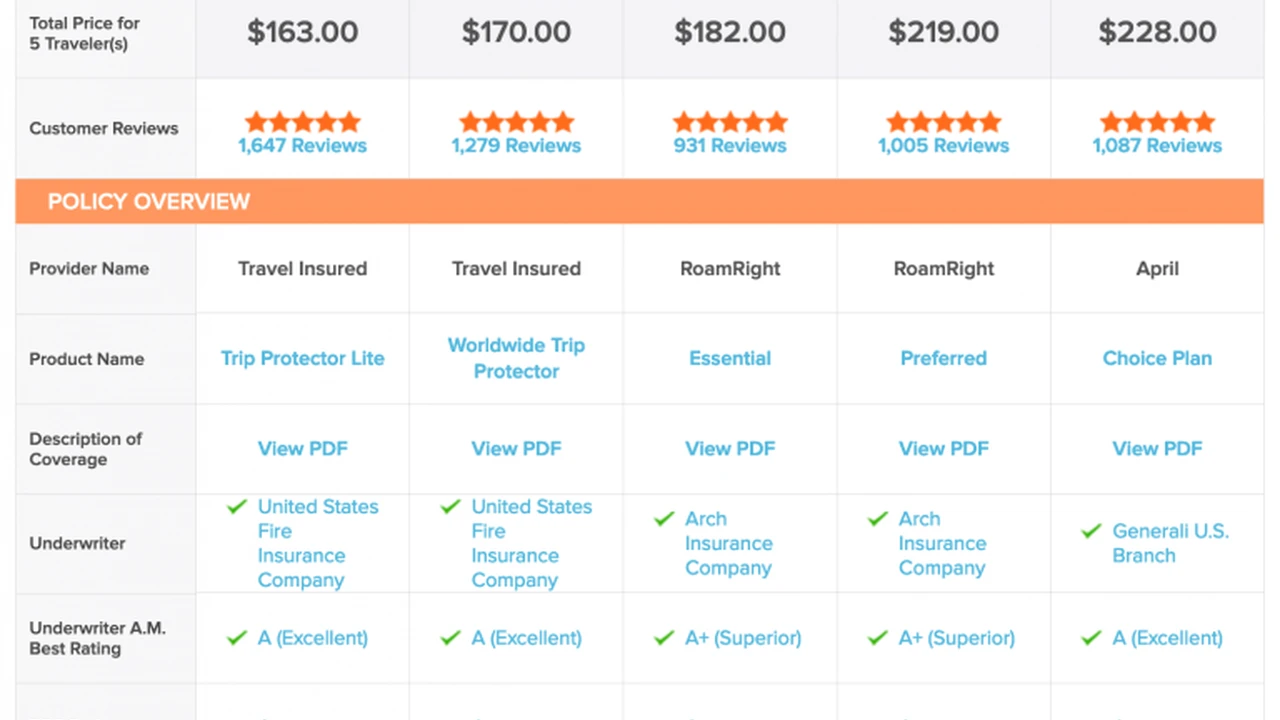

Let's compare some specific products to give you a better idea of what's available:

World Nomads Explorer vs. Allianz Global Assistance Comprehensive Plan:

* **World Nomads Explorer:** Generally more expensive but offers broader coverage for adventure activities. Higher limits for medical evacuation. Appeals to younger, more adventurous travelers. * **Allianz Global Assistance Comprehensive Plan:** Often cheaper, especially for families. Excellent trip cancellation/interruption benefits. Better for those prioritizing cost and trip-related coverage over extreme activities.Travel Guard Preferred vs. Seven Corners RoundTrip Choice:

* **Travel Guard Preferred:** Customizable. Good customer service reputation. Offers options for covering pre-existing conditions. * **Seven Corners RoundTrip Choice:** Focuses on international medical coverage. Strong for students and expats. May have lower trip cancellation/interruption limits.Understanding Travel Insurance Costs Factors Influencing Premiums

The cost of travel insurance varies depending on several factors:

* **Age:** Older travelers typically pay more, as they are statistically more likely to have medical issues. * **Destination:** Some destinations are more expensive to insure than others, due to higher medical costs or increased risk of theft or natural disasters. * **Trip Length:** The longer your trip, the more you'll pay. * **Coverage Level:** More comprehensive plans with higher coverage limits will cost more. * **Pre-existing Conditions:** Covering pre-existing conditions will usually increase the premium.You can expect to pay anywhere from 5% to 10% of the total cost of your trip for travel insurance. So, if your trip costs $5,000, you might pay $250 to $500 for insurance.

Specific Product Pricing Examples and Where to Buy

Here are some approximate price ranges for specific products (prices can vary significantly based on individual circumstances):

* **World Nomads Explorer (2-week trip to Europe, 30-year-old):** $150 - $250 * **Allianz Global Assistance Comprehensive Plan (1-week family trip to Disney World):** $100 - $200 * **Travel Guard Preferred (10-day business trip to Asia):** $80 - $150 * **Seven Corners RoundTrip Choice (6-month student trip to South America):** $400 - $700You can purchase these plans directly from the insurance company's website or through a travel insurance comparison website. Be sure to compare prices and coverage options before making a decision. Reputable comparison sites include:

* InsureMyTrip * Squaremouth * TravelInsurance.comTips for Choosing a Reliable Travel Insurance Comparison Website

So, how do you choose a reliable travel insurance comparison website?

* **Look for Transparency:** Does the website clearly disclose how it makes money? Does it list all the insurance companies it works with? * **Read Reviews:** Check out reviews of the website on independent review sites like Trustpilot or the Better Business Bureau. * **Compare Multiple Sites:** Don't just rely on one website. Compare results from several different sites to get a broader view of the available options. * **Read the Fine Print:** Always read the policy wording carefully before purchasing a plan, regardless of where you found it. * **Consider Independent Agents:** Sometimes, working with an independent travel insurance agent can be beneficial. They can provide unbiased advice and help you find the best plan for your needs.The Future of Travel Insurance Comparisons What to Expect

The world of travel insurance is constantly evolving. We can expect to see more personalized plans, driven by data and artificial intelligence. Comparison websites will likely become more sophisticated, offering more detailed and accurate information. Blockchain technology could also play a role, making it easier to verify claims and prevent fraud.

Ultimately, the key is to stay informed and do your research. Travel insurance comparison websites can be a valuable tool, but they're not a substitute for careful planning and a thorough understanding of your own needs.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)