Travel Insurance: What It Is & Why You Need It

Understanding Travel Insurance Basics What is Travel Insurance?

So, you're planning a trip! Exciting, right? But before you pack your bags and dream of sunny beaches or bustling city streets, let's talk about something a little less thrilling but just as important: travel insurance. What exactly *is* travel insurance? Think of it as your safety net for unexpected hiccups during your travels. It's a policy that can cover a wide range of potential problems, from lost luggage and delayed flights to medical emergencies and even trip cancellations. Basically, it's there to protect your wallet and your well-being when things go sideways.

Now, you might be thinking, "Do I *really* need travel insurance? I'm a careful traveler!" And that's great! But even the most meticulous planners can't predict everything. A sudden illness, a missed connection, or a natural disaster can throw a wrench into your travel plans. Travel insurance can help you recoup your losses and get back on track.

Why is Travel Insurance Essential for Every Traveler? Key Benefits and Coverage

Okay, so you know what travel insurance is, but why is it so darn important? Let's break down the key benefits:

- Medical Expenses: This is arguably the most crucial benefit. If you get sick or injured while traveling, your regular health insurance might not cover you, or it might have limited coverage. Travel insurance can cover doctor visits, hospital stays, emergency medical transportation, and even repatriation (returning you home for treatment). Imagine breaking your leg while hiking in the Alps – the medical bills could be astronomical without insurance!

- Trip Cancellation and Interruption: Life happens. A family emergency, a sudden illness, or even a terrorist attack can force you to cancel or cut short your trip. Travel insurance can reimburse you for non-refundable travel expenses, such as flights, hotels, and tours.

- Lost or Delayed Luggage: We've all been there – standing at the baggage carousel, watching everyone else claim their bags, while yours is nowhere to be seen. Travel insurance can compensate you for lost, stolen, or delayed luggage, allowing you to replace essential items.

- Flight Delays and Missed Connections: Flights get delayed all the time, and sometimes these delays can cause you to miss connecting flights or pre-booked tours. Travel insurance can cover the cost of accommodation, meals, and transportation while you wait for your flight.

- Emergency Assistance: Many travel insurance policies offer 24/7 emergency assistance services. This means you can call a helpline anytime, anywhere, for help with medical referrals, legal assistance, or even translation services.

Types of Travel Insurance Policies Finding the Right Coverage for Your Trip

Not all travel insurance policies are created equal. There are different types of policies designed to meet different needs. Here's a rundown of the most common types:

- Single-Trip Insurance: This covers a single trip, from the day you leave home to the day you return. It's a good option if you only travel occasionally.

- Multi-Trip Insurance (Annual Travel Insurance): This covers multiple trips within a year. It's a cost-effective option if you travel frequently.

- Medical Travel Insurance: This focuses primarily on medical coverage. It's a good option if you're traveling to a country with expensive healthcare or if you have pre-existing medical conditions.

- Adventure Travel Insurance: This covers activities like hiking, skiing, scuba diving, and other adventure sports. It's essential if you're planning on participating in any high-risk activities.

- Cruise Travel Insurance: This is specifically designed for cruises, covering things like missed port departures, cabin confinement, and medical emergencies at sea.

Choosing the Right Travel Insurance Policy Factors to Consider

With so many options available, choosing the right travel insurance policy can feel overwhelming. Here are some factors to consider:

- Your Destination: Some countries have higher healthcare costs than others. Make sure your policy provides adequate medical coverage for your destination.

- Your Activities: If you're planning on participating in any adventure sports, make sure your policy covers those activities.

- Your Health: If you have pre-existing medical conditions, make sure your policy covers them. You might need to purchase a special policy or add a rider to your existing policy.

- Your Budget: Travel insurance policies vary in price. Shop around and compare quotes to find a policy that fits your budget.

- The Policy Limits: Pay attention to the policy limits for each type of coverage. Make sure the limits are high enough to cover your potential losses.

- The Deductible: The deductible is the amount you have to pay out of pocket before your insurance kicks in. A lower deductible will result in a higher premium, and vice versa.

Travel Insurance Products Recommendations and Comparisons Featuring Specific Providers

Okay, let's get down to brass tacks and talk about some specific travel insurance products. Keep in mind that prices and coverage can change, so it's always best to get a quote directly from the provider.

World Nomads Explorer Plan: For Adventure Seekers

Use Case: Backpacking through Southeast Asia, hiking the Inca Trail, or surfing in Bali.

Description: World Nomads is a popular choice for adventurous travelers. Their Explorer Plan offers comprehensive coverage for medical emergencies, trip cancellations, lost luggage, and a wide range of adventure activities. They also have a great online claims process and 24/7 emergency assistance.

Features:

- Emergency medical coverage up to $100,000

- Trip cancellation/interruption coverage up to $10,000

- Lost/delayed luggage coverage up to $3,000

- Coverage for over 200 adventure activities

Price: Prices vary depending on your age, destination, and trip length, but expect to pay around $100-$200 for a two-week trip.

Pros: Excellent coverage for adventure activities, easy online claims process, 24/7 emergency assistance.

Cons: Can be more expensive than other policies.

Allianz Global Assistance OneTrip Prime Plan: For Peace of Mind

Use Case: Family vacation to Disney World, cruise to the Caribbean, or a European city break.

Description: Allianz Global Assistance is a well-known and reputable travel insurance provider. Their OneTrip Prime Plan offers comprehensive coverage for medical emergencies, trip cancellations, lost luggage, and flight delays. They also have a great customer service reputation.

Features:

- Emergency medical coverage up to $50,000

- Trip cancellation/interruption coverage up to 100% of trip cost

- Lost/delayed luggage coverage up to $1,500

- Flight delay coverage up to $800

Price: Prices vary depending on your age, destination, and trip length, but expect to pay around $80-$150 for a two-week trip.

Pros: Comprehensive coverage, good customer service, affordable price.

Cons: Lower medical coverage limits compared to World Nomads.

Travelex Insurance Services Travel Select Plan: For Budget Travelers

Use Case: Weekend getaway, business trip, or a short vacation.

Description: Travelex Insurance Services offers a variety of travel insurance plans, including their Travel Select Plan, which is a good option for budget travelers. It provides basic coverage for medical emergencies, trip cancellations, and lost luggage at an affordable price.

Features:

- Emergency medical coverage up to $50,000

- Trip cancellation/interruption coverage up to 100% of trip cost

- Lost/delayed luggage coverage up to $1,000

Price: Prices vary depending on your age, destination, and trip length, but expect to pay around $50-$100 for a two-week trip.

Pros: Affordable price, decent coverage for basic needs.

Cons: Lower coverage limits compared to other policies, limited customer service options.

Understanding Travel Insurance Costs Factors Affecting Premiums

So, what determines how much you'll pay for travel insurance? Several factors come into play:

- Age: Older travelers typically pay higher premiums because they are statistically more likely to experience medical problems.

- Destination: Traveling to countries with high healthcare costs or a high risk of political instability will increase your premium.

- Trip Length: Longer trips will generally cost more to insure.

- Coverage Level: The more coverage you need, the higher your premium will be.

- Pre-Existing Medical Conditions: If you have pre-existing medical conditions, you may need to pay a higher premium or purchase a special policy.

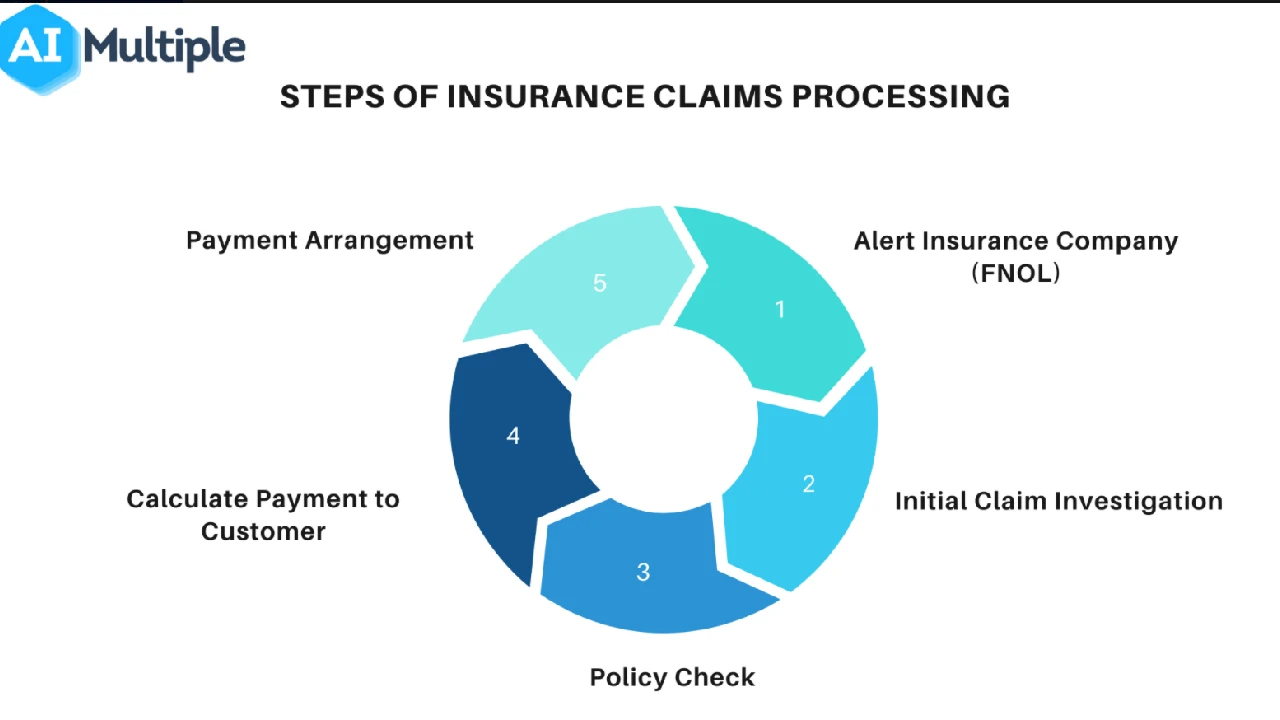

Making a Travel Insurance Claim A Step-by-Step Guide

Okay, so you've had an unfortunate incident and need to file a travel insurance claim. Here's a general guide:

- Document Everything: Keep copies of all your receipts, medical records, police reports, and any other documentation related to your claim.

- Contact Your Insurance Provider: Contact your insurance provider as soon as possible after the incident. They will provide you with a claim form and instructions on how to file your claim.

- Fill Out the Claim Form: Fill out the claim form completely and accurately. Be sure to provide all the required documentation.

- Submit Your Claim: Submit your claim form and documentation to your insurance provider.

- Follow Up: Follow up with your insurance provider to check on the status of your claim.

- Be Patient: Processing a travel insurance claim can take time. Be patient and persistent.

Travel Insurance Tips for a Smooth Trip Proactive Planning

Here are a few extra tips to make your travel insurance experience smoother:

- Read the Fine Print: Before you purchase a policy, read the fine print carefully to understand the coverage limits, exclusions, and terms and conditions.

- Keep Your Policy Information Handy: Keep a copy of your policy information with you at all times, both in paper form and on your phone.

- Know Your Emergency Contact Information: Make sure your insurance provider has your emergency contact information.

- Compare Quotes: Shop around and compare quotes from different providers to find the best deal.

- Don't Wait Until the Last Minute: Purchase your travel insurance policy as soon as you book your trip. This will protect you in case you need to cancel your trip due to unforeseen circumstances.

Travel Insurance Exclusions What's Not Covered

It's crucial to understand what travel insurance *doesn't* cover. Common exclusions include:

- Pre-existing medical conditions (unless specifically covered)

- Injuries sustained while under the influence of alcohol or drugs

- Participation in illegal activities

- War or acts of terrorism (in some cases)

- Cosmetic surgery

- Routine medical care

- Extreme sports (unless specifically covered)

Always check the policy exclusions before you buy!

Travel Insurance for Specific Situations Tailoring Coverage to Your Needs

Let's consider some specific travel scenarios and how travel insurance can help:

* **Family Vacation with Young Children:** Look for policies with generous medical coverage and trip cancellation/interruption benefits. Consider coverage for lost or stolen passports. * **Backpacking Trip:** Prioritize medical coverage, especially for emergency evacuation. Ensure coverage for adventurous activities. * **Business Trip:** Focus on trip cancellation/interruption coverage and lost luggage protection. * **Cruise:** Find a policy designed for cruises, covering missed port departures and onboard medical emergencies. * **Traveling with Expensive Electronics:** Check the coverage limits for lost or stolen items, especially electronics. Consider adding extra coverage if necessary.By considering your specific needs and circumstances, you can choose a travel insurance policy that provides the right level of protection for your trip. Remember, travel insurance is an investment in your peace of mind. It's better to have it and not need it than to need it and not have it. Happy travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)