Comparing Travel Insurance: Single Trip vs. Annual Multi-Trip

Understanding Single Trip Travel Insurance Coverage for Your Vacation

So, you're planning a getaway? Awesome! First things first: travel insurance. When you only have one trip planned, single trip travel insurance is usually the simplest and most cost-effective choice. It covers you for a specific duration, from the moment you leave home until you return. Think of it as a safety net just for that one adventure. It usually covers things like trip cancellations, medical emergencies abroad, lost luggage, and even travel delays. It's designed to give you peace of mind knowing that unexpected hiccups won't completely derail your vacation (or your wallet).

Key benefits of single trip travel insurance:

- Cost-effective for single trips: Generally cheaper than an annual policy if you only travel once a year.

- Specific coverage: Tailored to the exact dates and destination of your trip.

- Easy to understand: Straightforward policy terms and conditions.

Exploring Annual Multi-Trip Travel Insurance Benefits for Frequent Travelers

Jet-setter alert! If you find yourself constantly packing your bags and hopping on planes, then an annual multi-trip travel insurance policy might be your best friend. This type of insurance covers you for multiple trips within a 12-month period. Think business trips, weekend getaways, spontaneous adventures – all under one umbrella. There's usually a limit on the duration of each individual trip (e.g., 31 days), but if you're doing lots of shorter trips, it can save you a ton of money and hassle compared to buying single-trip policies each time.

Key benefits of annual multi-trip travel insurance:

- Convenience: Covers all your trips within a year with a single policy.

- Cost-effective for frequent travelers: Usually cheaper than buying multiple single-trip policies.

- Peace of mind: You're always covered, no matter when or where you travel.

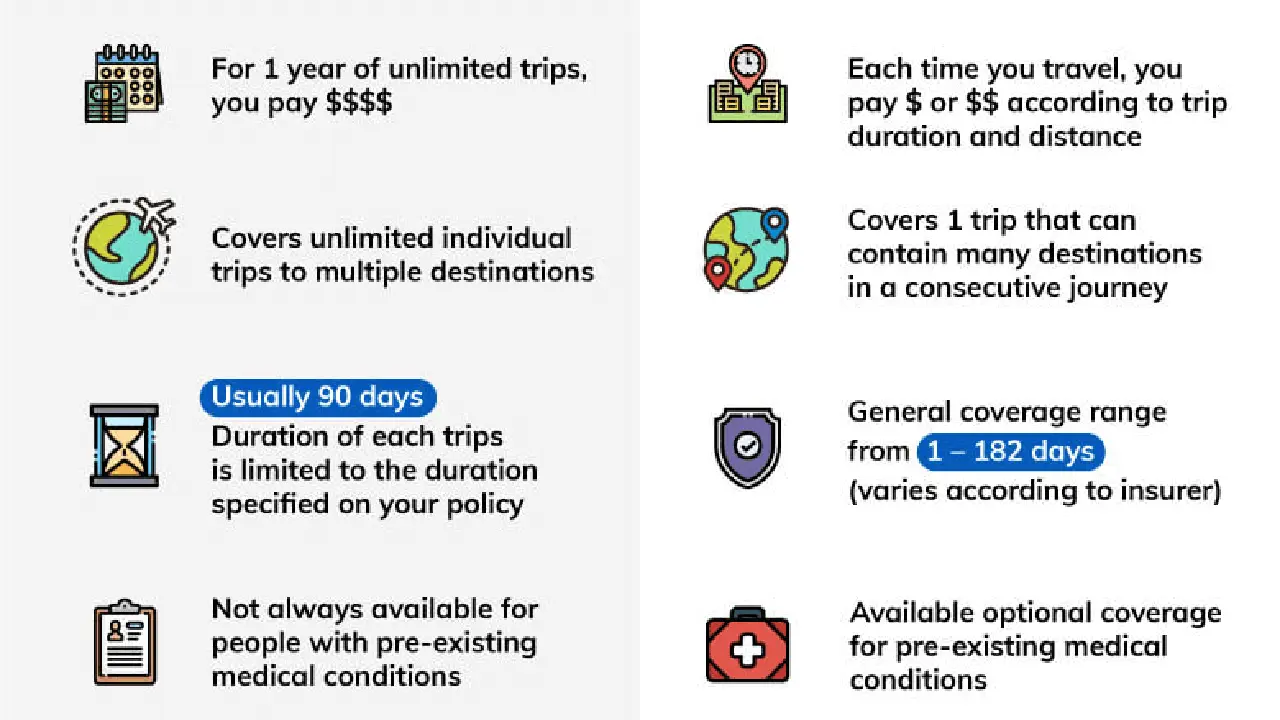

Single Trip vs Annual Multi Trip Travel Insurance A Detailed Comparison of Features and Costs

Okay, so which one is right for you? Let's break down the key differences:

| Feature | Single Trip Travel Insurance | Annual Multi-Trip Travel Insurance |

|---|---|---|

| Coverage Duration | Specific dates of a single trip | Multiple trips within a 12-month period |

| Cost | Generally lower for single trips | Potentially higher upfront cost, but cheaper for frequent travelers |

| Convenience | Requires purchasing a new policy for each trip | Covers all trips within the year with one policy |

| Trip Length Restrictions | None | Usually a maximum trip length (e.g., 31 days) |

| Who it's best for | People who only travel once a year | Frequent travelers who take multiple trips per year |

Consider your travel habits. If you only take one big vacation per year, single-trip insurance is the way to go. But if you're constantly on the move, annual multi-trip insurance will likely save you money and time.

Travel Insurance Product Recommendations Allianz Travel Insurance vs World Nomads

Alright, let's talk specifics. Here are a couple of well-regarded travel insurance providers and some potential products you might consider:

Allianz Travel Insurance Options and Pricing

Allianz is a big name in the insurance world, and their travel insurance options are pretty comprehensive. They offer both single-trip and annual multi-trip policies. Their single-trip plans often include coverage for trip cancellation, interruption, medical expenses, and baggage loss. Their annual plans cater to frequent travelers with similar coverage extended across multiple trips.

Example Products:

- Allianz TravelSmart: A solid single-trip option. Expect to pay around $50-$150 for a week-long trip, depending on your age, destination, and coverage level.

- Allianz AllTrips Premier: A great annual multi-trip plan. Costs can range from $300-$600 per year, offering robust coverage for numerous trips.

Using Allianz: Imagine you're planning a two-week trip to Europe. With Allianz TravelSmart, you're covered if you get sick and need medical attention, if your luggage gets lost, or if your flight is canceled. For the frequent business traveler, AllTrips Premier ensures you're protected on every business trip throughout the year without having to remember to buy a policy each time.

World Nomads Travel Insurance Plans and Scenarios

World Nomads is a popular choice, especially among backpackers and adventure travelers. They offer coverage for a wide range of activities, including adventure sports that other insurers might exclude. They also have a reputation for being easy to deal with when making a claim, which is a huge plus.

Example Products:

- World Nomads Explorer Plan: A comprehensive plan that covers adventure activities. Pricing varies greatly depending on your age, destination, trip length, and the specific activities you'll be doing. Expect to pay more than a basic single-trip plan.

- World Nomads Standard Plan: A more basic plan that still offers good coverage for medical emergencies, trip cancellations, and lost luggage.

Using World Nomads: Let’s say you’re planning a month-long backpacking trip through Southeast Asia, including some hiking and scuba diving. The World Nomads Explorer Plan would be a good fit because it covers those adventure activities. If you're simply planning a relaxing beach vacation, the Standard Plan might suffice.

Comparing Travel Insurance Coverage Options for Different Travel Styles

So, how do you choose between these (and other) options? Here's a breakdown based on different travel styles:

- Budget Travelers: Look for basic plans with essential coverage (medical, trip cancellation, lost luggage). Consider deductibles to lower the premium. Allianz TravelSmart or World Nomads Standard Plan are good starting points.

- Luxury Travelers: Opt for comprehensive plans with high coverage limits for medical expenses, trip delays, and baggage loss. Look for concierge services and 24/7 assistance. Allianz AllTrips Premier is a good option.

- Adventure Travelers: Choose plans that cover adventure activities like hiking, scuba diving, and skiing. World Nomads Explorer Plan is a must-consider.

- Business Travelers: Look for plans that cover trip interruptions, lost business equipment, and emergency medical expenses. Allianz AllTrips Premier can be a good fit.

- Family Travelers: Find plans that offer family coverage, including coverage for children. Look for plans that cover pre-existing conditions (if applicable) and offer assistance with childcare.

Understanding Travel Insurance Pricing Factors and How to Save Money

The cost of travel insurance depends on several factors:

- Age: Older travelers typically pay more.

- Destination: Traveling to countries with high medical costs (like the US) will increase the premium.

- Trip Length: Longer trips cost more to insure.

- Coverage Level: Comprehensive plans with high coverage limits are more expensive.

- Pre-existing Medical Conditions: Covering pre-existing conditions usually increases the premium.

Tips for saving money on travel insurance:

- Shop around: Compare quotes from multiple providers.

- Increase your deductible: A higher deductible will lower your premium.

- Consider a basic plan: If you only need essential coverage, opt for a basic plan.

- Check your existing coverage: You might already have some coverage through your credit card or health insurance.

Making a Travel Insurance Claim Step by Step Guide

Hopefully, you won't need to make a claim, but if you do, here's what to expect:

- Document everything: Keep copies of all your receipts, medical records, and police reports.

- Contact your insurance provider: Report the incident as soon as possible.

- Fill out a claim form: Provide all the necessary information and documentation.

- Follow up: Check on the status of your claim regularly.

- Be patient: Claims can take time to process.

Remember to read your policy carefully so you understand what's covered and what's not. Travel insurance is there to protect you from the unexpected, so choose a plan that fits your needs and travel style. Happy travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)