The Role of Travel Advisories and Travel Insurance

Understanding Travel Advisories and Travel Insurance for Trip Planning

So, you're planning a trip! Exciting times ahead. But before you pack your bags and dream of sun-soaked beaches or majestic mountains, let's talk about two crucial elements for a smooth and safe journey: travel advisories and travel insurance. Think of them as your dynamic duo for navigating the unpredictable world of travel.

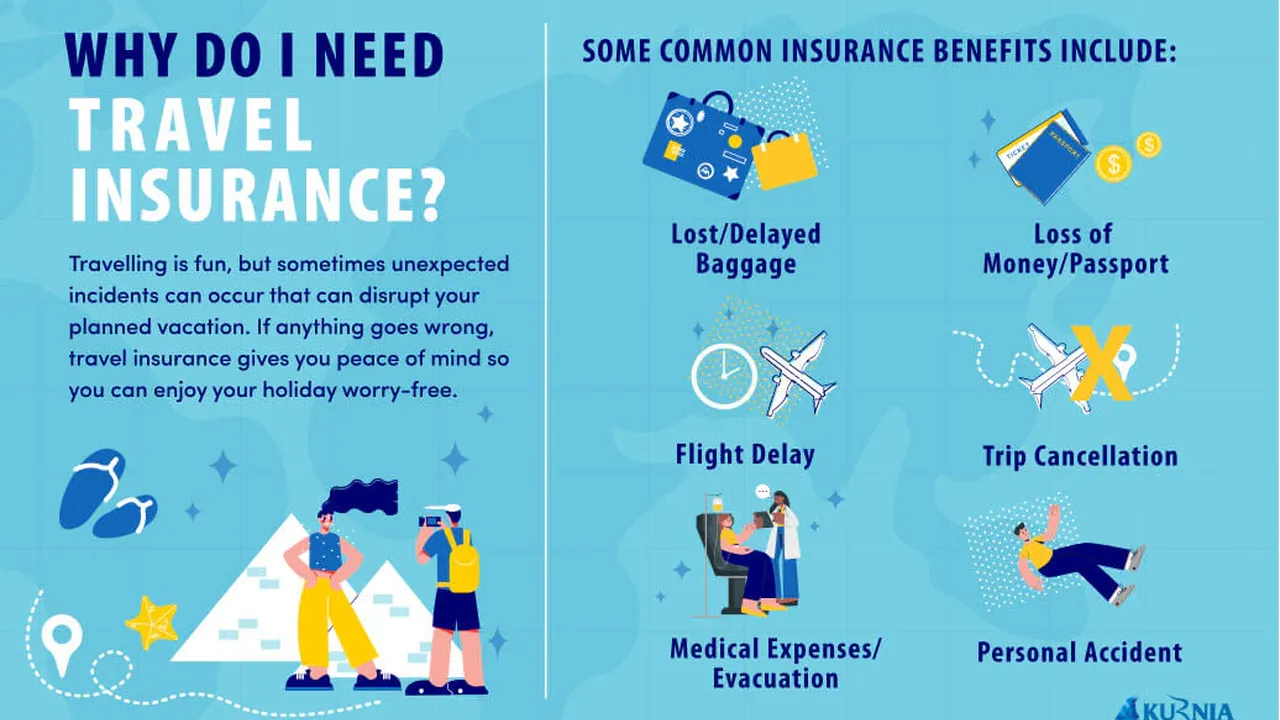

Travel advisories, issued by governments, are like weather forecasts for specific countries or regions. They provide up-to-date information on safety and security risks, ranging from petty theft to serious political instability or natural disasters. Travel insurance, on the other hand, is your financial safety net, covering unexpected costs related to medical emergencies, trip cancellations, lost luggage, and more.

Decoding Travel Advisories: Types, Levels, and How to Use Them

Different countries use different systems for travel advisories. The US State Department, for example, uses a four-level system: Level 1 (Exercise Normal Precautions), Level 2 (Exercise Increased Caution), Level 3 (Reconsider Travel), and Level 4 (Do Not Travel). Other countries, like Canada and the UK, have their own systems, but the underlying principle is the same: to inform travelers about potential risks.

It's crucial to understand what each level means. "Exercise Normal Precautions" doesn't mean the country is perfectly safe, but rather that the risks are similar to those you might encounter at home. "Exercise Increased Caution" indicates a higher risk of certain issues, like crime or terrorism. "Reconsider Travel" suggests that you should seriously weigh the risks before going. "Do Not Travel" is the strongest warning, typically reserved for countries experiencing war, widespread violence, or other extreme dangers.

So, how do you use this information? Before booking your trip, check the travel advisories for your destination. Monitor them regularly leading up to your departure, as situations can change quickly. Pay attention to the specific risks highlighted in the advisory, and take appropriate precautions. For example, if the advisory warns about pickpocketing, be extra vigilant with your belongings. If it warns about political unrest, consider avoiding large gatherings and staying informed about local news.

Travel Insurance: Your Financial Safety Net on the Road

Now, let's talk about travel insurance. It's not just about protecting your financial investment in the trip; it's about protecting your health and well-being while you're away from home. Imagine you're hiking in the Alps and break your leg. Without travel insurance, you could face massive medical bills and the logistical nightmare of getting back home. Travel insurance can cover these costs, as well as evacuation expenses, emergency medical assistance, and even translation services.

But not all travel insurance policies are created equal. It's essential to understand the different types of coverage and choose a policy that meets your specific needs. Here's a breakdown of some common types of travel insurance:

- Trip Cancellation Insurance: Reimburses you for non-refundable trip costs if you have to cancel your trip due to a covered reason, such as illness, injury, or a family emergency.

- Trip Interruption Insurance: Covers expenses if your trip is interrupted after it has begun due to a covered reason, such as a medical emergency or a natural disaster.

- Medical Insurance: Pays for medical expenses incurred while traveling, including doctor visits, hospital stays, and emergency medical transportation.

- Baggage Insurance: Covers the loss, theft, or damage of your luggage and personal belongings.

- Travel Delay Insurance: Reimburses you for expenses incurred due to travel delays, such as meals, accommodation, and transportation.

Comparing Travel Insurance Policies: Features, Coverage, and Price

Choosing the right travel insurance policy can feel overwhelming. Here's a breakdown of some key factors to consider:

- Coverage Limits: How much will the policy pay out for different types of claims? Make sure the limits are sufficient for your needs. For example, if you're traveling to a country with high medical costs, you'll want a policy with a high medical coverage limit.

- Deductible: How much will you have to pay out-of-pocket before the insurance company starts paying? A lower deductible means you'll pay less upfront, but your premium will be higher.

- Exclusions: What is not covered by the policy? Common exclusions include pre-existing medical conditions, extreme sports, and acts of terrorism. Read the fine print carefully to understand the exclusions.

- Pre-existing Conditions: Some policies will cover pre-existing conditions if you meet certain requirements, such as purchasing the policy within a certain timeframe after booking your trip.

- Activities Covered: If you plan on participating in adventurous activities like skiing, scuba diving, or rock climbing, make sure the policy covers these activities.

- 24/7 Assistance: Does the policy offer 24/7 emergency assistance? This can be invaluable if you need help in a foreign country.

Recommended Travel Insurance Products: Specific Examples and Use Cases

Alright, let's get down to some specific recommendations. These are just examples, and it's always best to do your own research and compare policies based on your individual needs and trip details.

World Nomads: Adventure Travel Insurance for Active Travelers

Use Case: Backpacking through Southeast Asia, hiking in the Himalayas, or surfing in Costa Rica.

World Nomads is a popular choice for adventure travelers. They offer comprehensive coverage for a wide range of activities, including extreme sports. Their policies are flexible and can be extended or modified while you're on the road. They also have a good reputation for customer service.

Key Features: Coverage for adventure activities, 24/7 emergency assistance, online claims filing.

Price: Varies depending on your trip duration, destination, and coverage level. Expect to pay around $50-$150 for a two-week trip.

Allianz Travel Insurance: Comprehensive Coverage for Peace of Mind

Use Case: Family vacation to Europe, cruise to the Caribbean, or business trip to Asia.

Allianz Travel Insurance offers a wide range of policies to suit different needs. They have comprehensive plans that cover trip cancellation, trip interruption, medical expenses, baggage loss, and more. They also offer 24/7 emergency assistance and a mobile app for managing your policy.

Key Features: Comprehensive coverage, 24/7 emergency assistance, mobile app, option to add rental car coverage.

Price: Varies depending on your trip duration, destination, and coverage level. Expect to pay around $80-$200 for a two-week trip.

Travel Guard: Budget-Friendly Options for Essential Coverage

Use Case: Weekend getaway, short domestic trip, or budget-conscious traveler.

Travel Guard offers more affordable travel insurance options that provide essential coverage for trip cancellation, trip interruption, and medical expenses. They may not offer as many bells and whistles as some of the more expensive policies, but they can be a good choice for travelers on a budget.

Key Features: Affordable prices, essential coverage, 24/7 emergency assistance.

Price: Varies depending on your trip duration, destination, and coverage level. Expect to pay around $40-$100 for a two-week trip.

Travel Insurance Cost Breakdown and Value Assessment

Let's talk about the price tag. Travel insurance costs can vary widely depending on several factors:

- Your Age: Older travelers typically pay more due to a higher risk of medical issues.

- Your Destination: Countries with high medical costs or a higher risk of theft will result in higher premiums.

- Trip Duration: Longer trips will cost more to insure.

- Coverage Level: More comprehensive policies with higher coverage limits will cost more.

- Deductible: Lower deductibles mean higher premiums.

It's important to weigh the cost of travel insurance against the potential financial risks of traveling without it. A serious medical emergency or a trip cancellation can easily cost thousands of dollars. Travel insurance can provide peace of mind and protect you from these unexpected expenses.

Travel Insurance Claim Process: What to Expect and How to Prepare

So, you've purchased travel insurance, and something goes wrong on your trip. What happens next? Here's a breakdown of the claim process:

- Contact Your Insurance Company: As soon as possible after the incident, contact your insurance company to report the claim. They will provide you with instructions on how to file a claim.

- Gather Documentation: You'll need to gather documentation to support your claim. This may include medical records, receipts for expenses, police reports, and proof of trip cancellation or interruption.

- File Your Claim: Submit your claim to the insurance company along with all the required documentation.

- Follow Up: Follow up with the insurance company to check on the status of your claim. They may need additional information or documentation.

- Appeal if Necessary: If your claim is denied, you have the right to appeal the decision.

To make the claim process smoother, it's a good idea to keep copies of all your travel documents, including your insurance policy, passport, and itinerary. Also, keep detailed records of any expenses you incur due to the incident.

Travel Advisories and Insurance: A Combined Approach for Safe Travels

Ultimately, the best approach to travel safety is to combine the information provided by travel advisories with the protection offered by travel insurance. By staying informed about potential risks and having a financial safety net in place, you can travel with confidence and enjoy your trip to the fullest.

Remember to always check travel advisories before booking your trip and to monitor them regularly leading up to your departure. Choose a travel insurance policy that meets your specific needs and provides adequate coverage for potential risks. And most importantly, be prepared for the unexpected and stay safe!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)