Travel Insurance for Destination Weddings: Protecting Your Investment

Why Destination Wedding Travel Insurance is a Must Have

So, you're planning a destination wedding? Congrats! That's super exciting. Think sun, sand, and saying "I do" in paradise. But before you get swept away in visions of tropical cocktails and picturesque sunsets, let's talk about something less glamorous but equally important: travel insurance. Seriously, don't roll your eyes! It might not be as fun as picking out floral arrangements, but it's the safety net you'll be incredibly grateful for if things go sideways.

Destination weddings are a significant investment. We're talking flights, accommodations, venue rentals, catering, and all the other bells and whistles that come with planning a big event. Now, imagine this: a hurricane blows through your chosen island a week before the big day, or your photographer's equipment gets stolen, or worse, someone in your wedding party gets seriously ill and can't make it. Suddenly, your dream wedding is a nightmare, and you're potentially out thousands of dollars. That's where travel insurance swoops in to save the day (or at least your bank account).

Understanding the Risks Unique to Destination Weddings

Destination weddings, while dreamy, come with their own unique set of risks that aren't typically associated with weddings closer to home. Let's break down some of the most common scenarios where travel insurance can be a lifesaver:

- Weather Woes: Hurricanes, tropical storms, and other natural disasters can wreak havoc on your wedding plans. Travel insurance can cover cancellation or postponement costs if your venue becomes unusable due to weather.

- Vendor Problems: Imagine your photographer cancels at the last minute, or your caterer goes out of business. Travel insurance can help you find and pay for a replacement vendor.

- Medical Emergencies: Accidents and illnesses can happen anywhere, but they're especially stressful when you're far from home. Travel insurance can cover medical expenses, emergency evacuations, and repatriation costs.

- Lost or Stolen Items: Luggage gets lost, cameras get stolen – it happens. Travel insurance can reimburse you for the cost of replacing essential items.

- Travel Delays and Cancellations: Flights get delayed or canceled all the time. Travel insurance can cover the cost of unexpected accommodations and meals if you're stranded.

- Wedding Dress Disaster: Your dress gets lost, damaged, or delayed? Travel insurance can help cover the cost of alterations or even a replacement dress.

Essential Coverage Types for Destination Wedding Travel Insurance

Okay, so you're convinced that travel insurance is a good idea. Now, what kind of coverage do you need? Here's a rundown of the key components to look for:

- Trip Cancellation/Interruption: This is the big one. It covers you if you have to cancel or cut short your trip due to unforeseen circumstances, such as illness, injury, or a natural disaster.

- Medical Coverage: This covers medical expenses, emergency evacuations, and repatriation costs if you get sick or injured while you're away. Make sure the policy covers pre-existing conditions if applicable.

- Baggage Loss/Delay: This covers the cost of replacing lost, stolen, or delayed luggage.

- Travel Delay: This covers the cost of unexpected accommodations and meals if your flight is delayed.

- Wedding Attire Coverage: Some policies offer specific coverage for wedding attire, including loss, damage, or delay.

- Vendor Default: This covers you if a vendor cancels or goes out of business.

- Cancel For Any Reason (CFAR): This is the most comprehensive coverage, allowing you to cancel your trip for any reason, even if it's not covered by a standard policy. However, it typically only reimburses a percentage of your trip cost.

Recommended Travel Insurance Products for Destination Weddings

Alright, let's get down to brass tacks. Here are a few travel insurance providers and specific plans that are worth considering for your destination wedding:

World Nomads Explorer Plan

Suitable for: Adventurous couples and guests who plan on participating in activities like scuba diving or hiking.

Coverage Highlights: Comprehensive medical coverage, including emergency evacuation; covers a wide range of activities; 24/7 emergency assistance.

Price: Varies depending on trip duration and destination, but expect to pay around $150-$300 per person for a week-long trip.

Pros: Excellent coverage for adventurous activities; flexible policy options; reputable company.

Cons: Can be more expensive than other options; may not be the best choice for those primarily concerned with trip cancellation coverage.

Allianz Global Assistance AllTrips Premier Plan

Suitable for: Couples and guests who want comprehensive coverage, including trip cancellation, medical coverage, and baggage protection.

Coverage Highlights: Generous trip cancellation/interruption coverage; medical coverage up to $500,000; baggage loss/delay coverage.

Price: Typically ranges from $100-$250 per person for a week-long trip.

Pros: Comprehensive coverage; reputable company; good customer service.

Cons: Can be more expensive than basic plans; may not be the best choice for those seeking coverage for specific activities.

Travel Guard Preferred Plan

Suitable for: Couples and guests who want a balance of coverage and affordability.

Coverage Highlights: Trip cancellation/interruption coverage; medical coverage; baggage loss/delay coverage; 24/7 emergency assistance.

Price: Generally falls in the range of $80-$200 per person for a week-long trip.

Pros: Affordable; decent coverage; reputable company.

Cons: Medical coverage may be lower than other options; may not offer as many add-on options.

IMG iTravelInsured Travel LX

Suitable for: Couples seeking high levels of cancellation coverage and vendor default protection.

Coverage Highlights: High trip cancellation limits, coverage for supplier default, medical coverage, and baggage protection.

Price: Varies based on trip cost and duration, typically ranging from $120-$350 per person.

Pros: Strong cancellation and vendor default coverage; customizable add-ons.

Cons: Potentially more expensive than basic plans; may require careful policy review to understand all coverage details.

Comparing Travel Insurance Products: A Detailed Look

Choosing the right travel insurance can feel overwhelming, so let's break down a side-by-side comparison of the recommended products:

| Feature | World Nomads Explorer | Allianz AllTrips Premier | Travel Guard Preferred | IMG iTravelInsured Travel LX |

|---|---|---|---|---|

| Trip Cancellation/Interruption | Yes | Yes | Yes | Yes (High Limits) |

| Medical Coverage | Excellent (incl. Evacuation) | High ($500,000) | Good | Good |

| Baggage Loss/Delay | Yes | Yes | Yes | Yes |

| Vendor Default | No | No | No | Yes |

| Activities Coverage | Excellent | Limited | Limited | Limited |

| Price (per person, week) | $150-$300 | $100-$250 | $80-$200 | $120-$350 |

Key Takeaways:

- World Nomads is your go-to if you're planning adventurous activities.

- Allianz offers robust all-around coverage with high medical limits.

- Travel Guard provides a good balance of coverage and affordability.

- IMG excels in cancellation and vendor default protection, ideal for high-value weddings.

Real-World Scenarios: How Travel Insurance Saved the Day

Let's look at a few real-world scenarios where travel insurance proved invaluable:

- Scenario 1: Hurricane Havoc. Sarah and Mark were planning a destination wedding in the Caribbean. A week before the big day, a hurricane hit the island, rendering their venue unusable. They had purchased trip cancellation insurance, which covered the cost of canceling their wedding and rescheduling it at a later date.

- Scenario 2: Medical Emergency. John, the groom's father, suffered a heart attack the day before the wedding. He was rushed to the hospital and required emergency surgery. Their travel insurance policy covered the cost of his medical expenses and emergency evacuation back home.

- Scenario 3: Vendor Default. Emily and David booked a photographer for their destination wedding, but the photographer went out of business a month before the event. They had purchased vendor default coverage, which helped them find and pay for a replacement photographer.

Tips for Choosing the Right Travel Insurance Policy

Here are a few tips to help you choose the right travel insurance policy for your destination wedding:

- Read the fine print: Make sure you understand the terms and conditions of the policy, including what's covered and what's not.

- Compare quotes from multiple providers: Don't just settle for the first policy you find. Shop around and compare quotes from different providers to find the best deal.

- Consider your specific needs: Think about the specific risks associated with your destination wedding and choose a policy that covers those risks.

- Purchase your policy early: The sooner you purchase your policy, the better protected you'll be. Some policies offer coverage for pre-existing conditions if you purchase them within a certain timeframe of booking your trip.

- Keep your policy documents handy: Make sure you have a copy of your policy documents with you while you're traveling.

Budgeting for Travel Insurance: How Much Should You Spend?

The cost of travel insurance can vary depending on several factors, including the length of your trip, the destination, the amount of coverage you need, and the provider you choose. As a general rule of thumb, you should expect to spend between 4% and 8% of your total trip cost on travel insurance. While it might seem like an added expense, think of it as a small price to pay for peace of mind.

For a destination wedding, it's often wise to encourage your guests to also purchase travel insurance. Include information about recommended providers and coverage options on your wedding website or in your invitation inserts. This ensures that everyone is protected in case of unforeseen circumstances.

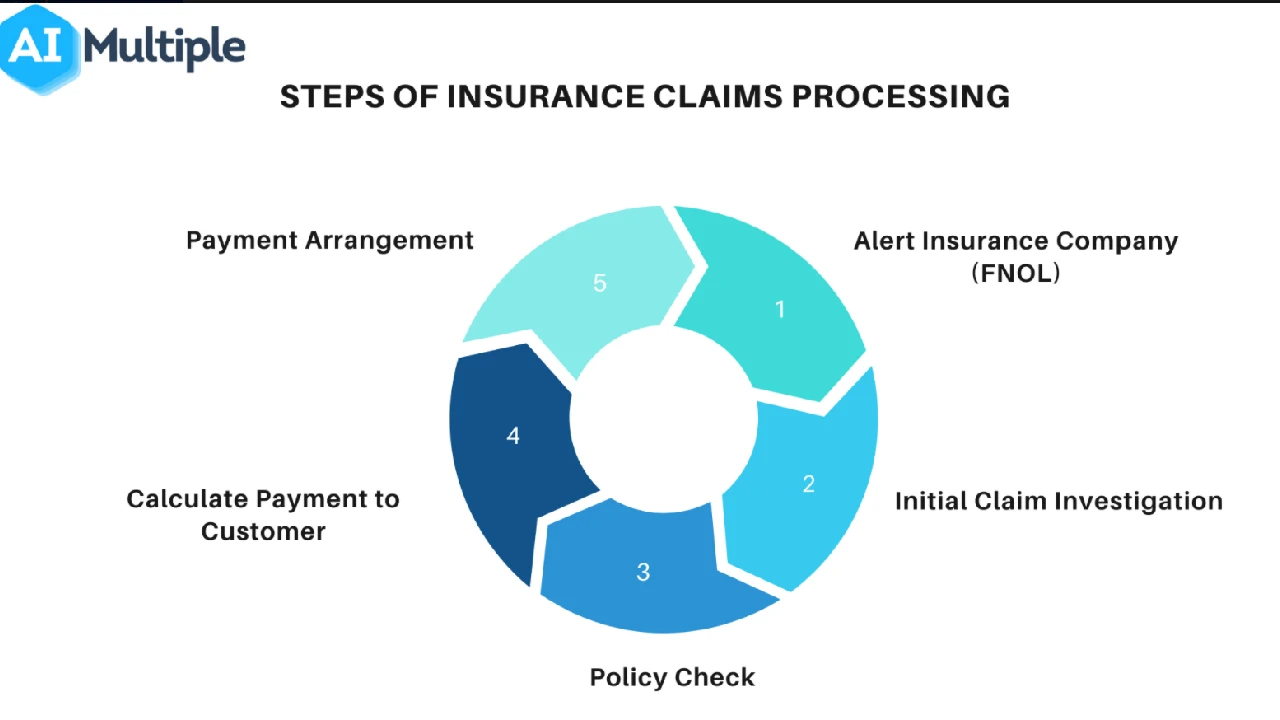

Making a Claim: What to Do When Things Go Wrong

Okay, so you've purchased travel insurance, and unfortunately, something has gone wrong. Here's what you need to do to make a claim:

- Contact your insurance provider as soon as possible: Let them know what happened and ask about the claims process.

- Gather documentation: You'll need to provide documentation to support your claim, such as medical records, police reports, and receipts.

- Fill out the claim form: Complete the claim form accurately and thoroughly.

- Submit your claim: Submit your claim and all supporting documentation to your insurance provider.

- Follow up: Check in with your insurance provider regularly to track the progress of your claim.

Travel Insurance Jargon Buster: Understanding the Lingo

Travel insurance policies are often filled with jargon that can be confusing. Here's a quick glossary of some common terms:

- Deductible: The amount you have to pay out-of-pocket before your insurance coverage kicks in.

- Pre-existing condition: A medical condition that you had before you purchased your insurance policy.

- Exclusion: A specific event or circumstance that is not covered by your insurance policy.

- Emergency evacuation: The transportation of a sick or injured person to a medical facility.

- Repatriation: The return of a deceased person to their home country.

- Waiver: An agreement to give up a right or claim.

Alternative to Travel Insurance: Weighing the Options

While travel insurance is highly recommended, are there alternatives? Potentially, but they come with significant risks. Some credit cards offer travel protections, but these are often limited and may not cover all the risks associated with a destination wedding. Self-insuring, meaning setting aside a fund to cover potential losses, is another option, but this can be risky if a major event occurs. Relying on vendor guarantees might seem appealing, but those guarantees often have loopholes and may not be sufficient to cover all your losses. Bottom line: travel insurance offers the most comprehensive and reliable protection.

Specific Product Recommendations with Pricing

Remember, prices can fluctuate. Always get a quote directly from the insurer.

- John Hancock Insurance Gold Plan: Known for its excellent customer service and comprehensive coverage. A week-long trip for two with a $10,000 trip cost could be around $350-$500 total.

- Seven Corners RoundTrip Choice: Offers solid coverage at a competitive price point. The same trip could be insured for approximately $280-$400.

Using Travel Insurance in Different Scenarios

- Scenario: Bride's Wedding Dress is Lost: Many policies will cover the cost to rent a replacement dress, or reimburse you for the loss if a replacement isn't possible in time. Keep receipts and documentation of the loss.

- Scenario: Groom Breaks His Leg: Medical coverage will handle costs, and trip interruption can cover his return travel, and potentially reimburse other costs if the wedding is significantly impacted.

- Scenario: Guest's Flight is Severely Delayed: Policies can reimburse for missed connections, extra hotel nights, and meals incurred due to the delay.

The Importance of Reading Reviews and Comparing Policies

Don't just take the insurance company's word for it! Read online reviews from other customers to get a sense of their experiences with the company's claims process and customer service. Use comparison websites to easily compare different policies side-by-side, focusing on the coverage limits, exclusions, and price. Websites like InsureMyTrip and Squaremouth are excellent resources.

Don't Leave Home Without It!

Planning a destination wedding is a big undertaking. By investing in travel insurance, you're not just protecting your financial investment, you're also protecting your peace of mind. So, do your research, compare policies, and choose the coverage that's right for you. Then, relax and enjoy your dream wedding, knowing that you're prepared for whatever comes your way.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)