Travel Insurance Claim Processing Times: What to Expect

Understanding Travel Insurance Claim Processing Times Travel Insurance Claim

So, you've just returned from an amazing trip, but now you're facing the less glamorous task of filing a travel insurance claim. You're probably wondering, "How long is this going to take?" Well, the truth is, travel insurance claim processing times can vary quite a bit. There's no one-size-fits-all answer, but let's break down what influences these timelines and what you can expect.

First off, the complexity of your claim plays a huge role. A simple lost luggage claim is usually processed much faster than a claim for medical expenses incurred overseas. Think about it: lost luggage often involves a quick verification with the airline, while medical claims require gathering medical records, translating documents (if applicable), and assessing the validity of the charges. That takes time!

Another factor is the completeness of your documentation. Imagine submitting a claim with missing receipts, incomplete forms, or a vague description of the incident. The insurance company will need to reach out to you for clarification, which inevitably delays the process. The more organized and thorough you are from the start, the faster things will move.

The insurance company itself also has an impact. Some insurers have streamlined their processes and invested in technology to expedite claims, while others might be a bit more old-school. Larger companies might have dedicated claims departments that can handle a high volume of claims efficiently, while smaller companies might have fewer resources. It's worth researching the insurer's reputation for claims handling before you even purchase a policy.

Finally, the time of year can also influence processing times. Peak travel seasons (like summer or holidays) often lead to a surge in claims, which can create a backlog. So, if you're filing a claim during a busy period, be prepared for a potentially longer wait.

Factors Affecting Claim Processing Time Insurance Claim Time

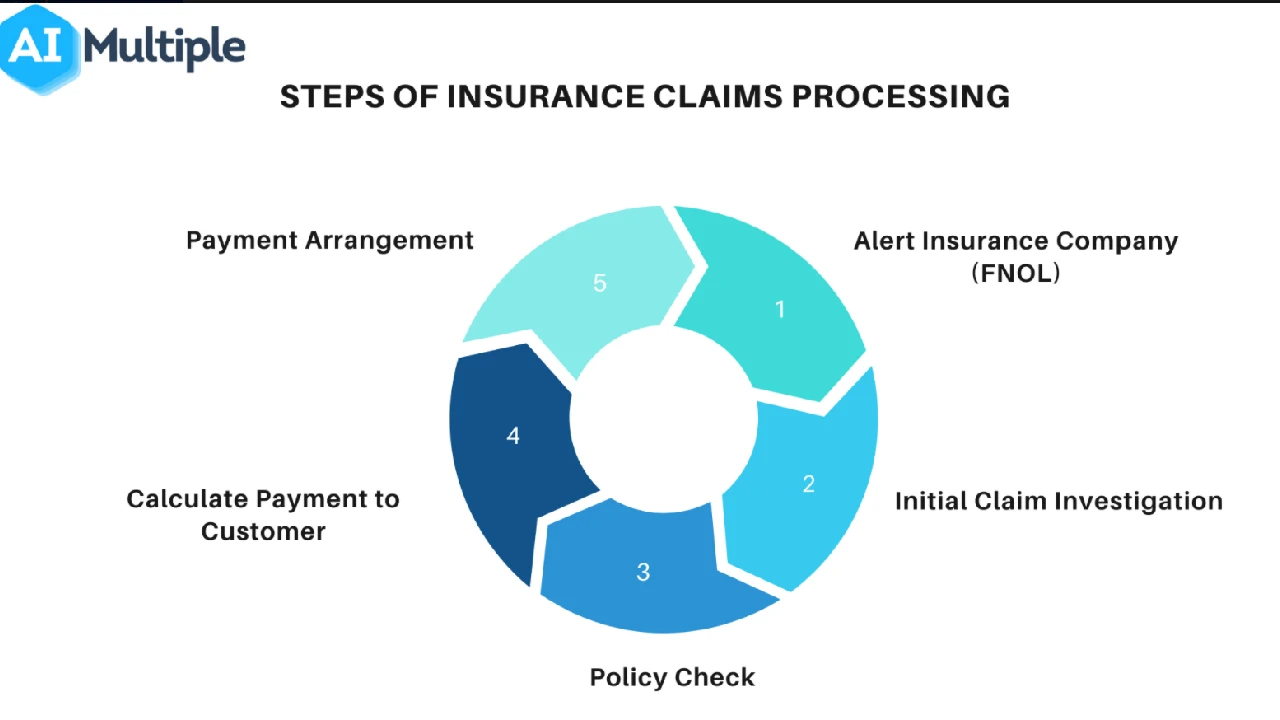

Let's dive deeper into those factors that determine how long you'll be waiting for your travel insurance claim to be processed:

- Complexity of the Claim: As mentioned earlier, simple claims are generally faster. Lost luggage, trip delays, and minor medical expenses tend to be resolved quicker than claims involving serious injuries, complex medical conditions, or legal disputes.

- Completeness of Documentation: This is crucial! Gather all relevant documents, including your policy details, receipts, medical reports, police reports (if applicable), and any other supporting evidence. Make sure everything is clear, legible, and properly organized.

- Communication with the Insurer: Respond promptly to any requests from the insurance company. If they need additional information or clarification, provide it as quickly as possible. The faster you respond, the faster they can process your claim.

- Policy Coverage: The terms and conditions of your policy will determine what is covered and what is not. If your claim falls outside the scope of your coverage, it will likely be denied, which can also take time to determine. Read your policy carefully before submitting a claim.

- Internal Processes of the Insurance Company: Some insurers have more efficient claims handling processes than others. They may use automated systems or have dedicated claims adjusters who specialize in certain types of claims.

- External Factors: Sometimes, external factors beyond your control can delay the process. For example, if your claim involves a third party (like an airline or a hospital), the insurance company may need to wait for information from them.

Typical Claim Processing Timelines Travel Insurance Timeline

While there's no guaranteed timeframe, here's a general idea of what you can expect:

- Simple Claims (e.g., lost luggage, trip delays): These can often be processed within a few weeks, sometimes even faster if you provide all the necessary documentation.

- Medical Claims: Medical claims tend to take longer, typically several weeks to a few months, depending on the complexity of the medical condition and the availability of medical records.

- Complex Claims (e.g., legal disputes, serious injuries): These can take several months or even longer to resolve, as they often require extensive investigation and negotiation.

Keep in mind that these are just estimates. Your actual processing time may vary depending on the specific circumstances of your claim.

Tips for Expediting Your Claim Travel Insurance Claim Tips

Want to speed things up? Here are some practical tips:

- Read Your Policy Carefully: Understand what is covered and what is not before you even travel. This will help you avoid submitting claims that are likely to be denied.

- Gather All Necessary Documentation: Before submitting your claim, make sure you have all the required documents, including your policy details, receipts, medical reports, and any other supporting evidence.

- Submit Your Claim Promptly: Don't wait until the last minute to file your claim. The sooner you submit it, the sooner the insurance company can start processing it.

- Be Clear and Concise: When describing the incident, be clear and concise. Provide all the relevant details, but avoid unnecessary information.

- Respond Promptly to Requests: Check your email and phone regularly for any communication from the insurance company. Respond promptly to any requests for additional information or clarification.

- Keep Records: Keep copies of all documents you submit to the insurance company, as well as any correspondence you have with them.

- Follow Up: If you haven't heard back from the insurance company within a reasonable timeframe, follow up with them to check on the status of your claim.

Choosing the Right Travel Insurance Travel Insurance Comparison

Selecting the right travel insurance is crucial. Here are a few options with different features and price points:

- World Nomads: Known for its comprehensive coverage, especially for adventurous travelers. They offer policies that cover a wide range of activities, including extreme sports. Price: Around $80-$150 for a 2-week trip depending on coverage level. Good for: Backpackers, adventure travelers, and those engaging in risky activities.

- Allianz Travel Insurance: A well-established company with a variety of plans to suit different needs and budgets. They offer plans that cover trip cancellations, medical expenses, and lost luggage. Price: $50-$120 for a 2-week trip. Good for: Families, leisure travelers, and those seeking basic coverage.

- Travel Guard: Offers customizable plans with a range of add-ons, such as coverage for pre-existing medical conditions and rental car damage. Price: $60-$130 for a 2-week trip. Good for: Travelers with specific needs or pre-existing medical conditions.

- Seven Corners: Specializes in international medical insurance and offers plans that cover medical expenses, evacuation, and repatriation. Price: $70-$140 for a 2-week trip. Good for: Long-term travelers, expats, and those traveling to remote areas.

Remember to compare policies carefully and choose one that meets your specific needs and budget. Consider factors such as coverage limits, deductibles, and exclusions. Also, read customer reviews to get an idea of the company's reputation for claims handling.

Real-World Scenarios and Claim Examples Travel Insurance Examples

Let's look at some real-world scenarios to illustrate how travel insurance claims work:

- Scenario 1: Lost Luggage. You arrive at your destination, but your luggage doesn't. You file a claim with the airline, but they can't locate your bag. With travel insurance, you can file a claim for the value of your lost belongings, up to the policy limits. This can help you replace essential items like clothing, toiletries, and medications.

- Scenario 2: Trip Cancellation. You have to cancel your trip due to a sudden illness. With trip cancellation insurance, you can be reimbursed for non-refundable expenses, such as flights, hotels, and tours. You'll typically need to provide documentation from your doctor to support your claim.

- Scenario 3: Medical Emergency. You get sick while traveling and need to see a doctor or go to the hospital. With travel medical insurance, you can be covered for medical expenses, including doctor's visits, hospital stays, and prescription medications. Some policies also cover medical evacuation if you need to be transported to a better medical facility.

- Scenario 4: Trip Delay. Your flight is delayed due to bad weather, causing you to miss a connecting flight and incur additional expenses. With trip delay insurance, you can be reimbursed for expenses such as meals, accommodation, and transportation.

Navigating Claim Denials Travel Insurance Denials

Sometimes, claims get denied. Here's what to do if it happens to you:

- Understand the Reason for Denial: The insurance company should provide you with a written explanation of why your claim was denied. Read this explanation carefully to understand the reason for the denial.

- Review Your Policy: Review your policy to see if the denial is justified. Make sure you understand the terms and conditions of your policy, including any exclusions or limitations.

- Gather Additional Evidence: If you believe the denial is incorrect, gather any additional evidence that supports your claim. This might include medical records, police reports, or witness statements.

- Appeal the Decision: Most insurance companies have an appeals process. Follow the instructions provided by the insurance company to appeal the decision. Be sure to include all relevant documentation and a clear explanation of why you believe the denial is incorrect.

- Contact a Consumer Protection Agency: If you're still not satisfied after appealing the decision, you can contact a consumer protection agency in your state or country. These agencies can help you resolve disputes with insurance companies.

The Future of Travel Insurance Claims Travel Insurance Trends

The world of travel insurance is evolving. Here are some trends to watch:

- Increased Use of Technology: Insurers are increasingly using technology to streamline claims processing, such as automated systems, mobile apps, and artificial intelligence.

- Personalized Insurance Products: Insurers are offering more personalized insurance products that are tailored to individual needs and preferences.

- Focus on Customer Experience: Insurers are placing a greater emphasis on customer experience, making it easier for travelers to file claims and get assistance when they need it.

- Integration with Travel Platforms: Travel insurance is becoming increasingly integrated with travel booking platforms, making it easier for travelers to purchase insurance when they book their trips.

- Coverage for New Risks: Insurers are developing new products to cover emerging risks, such as pandemics, cyber attacks, and political instability.

By staying informed about these trends, you can make sure you have the right travel insurance coverage for your needs and that you're prepared to navigate the claims process effectively.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)