7 Factors to Consider When Choosing a Travel Insurance Plan

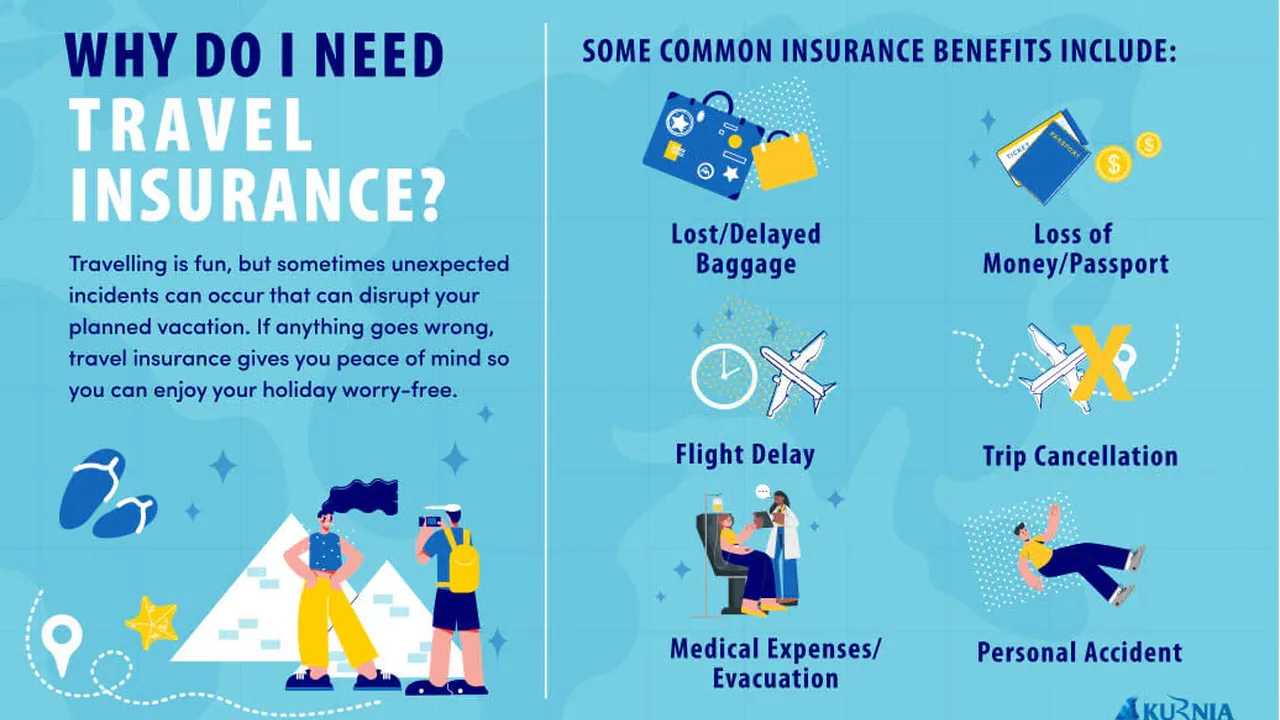

Understanding Your Travel Insurance Needs Before Comparing Plans

Okay, so you're planning a trip! Awesome! But before you start packing your bags and dreaming of sunny beaches, let's talk about something a little less exciting but super important: travel insurance. Think of it as your safety net while you're exploring the world. But with so many options out there, how do you even begin to choose the right one? First, let's figure out what you actually *need*.

Ask yourself these questions:

- Where are you going? A weekend trip to a neighboring state requires less coverage than a backpacking adventure across Southeast Asia.

- What are you doing? Are you planning on just relaxing on the beach, or are you going to be hiking, scuba diving, or participating in other adventurous activities? Some policies exclude certain activities.

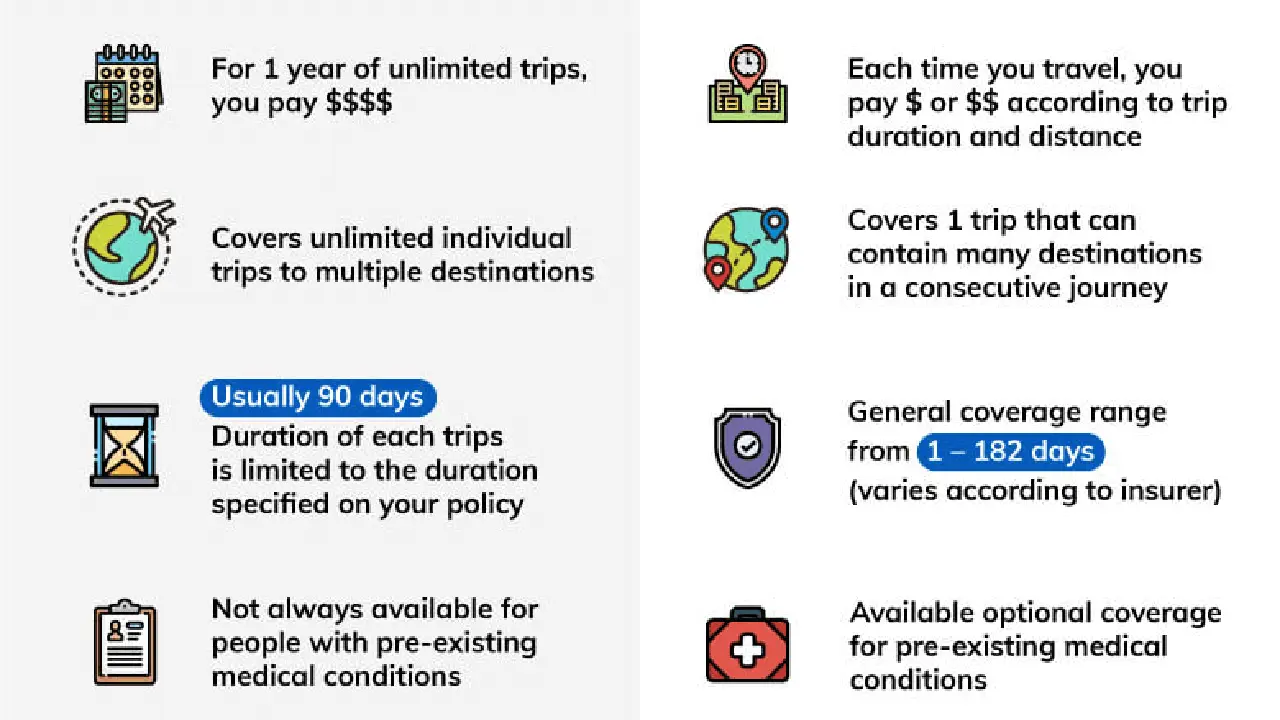

- What's your health like? Do you have any pre-existing medical conditions? You'll need to find a policy that covers them, or be prepared to pay out-of-pocket for any related medical expenses.

- What's your budget? Travel insurance is an investment, but you don't want to break the bank. Figure out how much you're willing to spend and then look for policies that fit within your budget.

- What are your belongings worth? Consider the value of your luggage, electronics, and other personal items. Make sure the policy's coverage limits are sufficient to replace them if they're lost or stolen.

Key Factors to Consider When Comparing Travel Insurance Plans and Finding the Best Coverage

Now that you know what you need, let's dive into the nitty-gritty of comparing travel insurance plans. Here are some key factors to keep in mind:

- Coverage Limits: This is the maximum amount the insurance company will pay for each type of claim. Make sure the limits are high enough to cover your potential expenses. Pay close attention to medical expense limits, especially if you're traveling to a country with high healthcare costs.

- Deductibles: This is the amount you have to pay out-of-pocket before the insurance company starts paying. A higher deductible usually means a lower premium, but you'll be responsible for paying more if you have a claim.

- Exclusions: This is what the policy *doesn't* cover. Read the fine print carefully and make sure you understand what's excluded. Common exclusions include pre-existing medical conditions, extreme sports, and acts of war.

- Trip Cancellation/Interruption Coverage: This covers you if you have to cancel or interrupt your trip due to unforeseen circumstances, such as illness, injury, or a family emergency. Make sure the policy covers the full cost of your trip.

- Medical Coverage: This covers medical expenses incurred while traveling, including doctor's visits, hospital stays, and prescription medications. Look for a policy that offers comprehensive medical coverage, including emergency evacuation.

- Baggage Loss/Delay Coverage: This covers you if your baggage is lost, stolen, or delayed. Make sure the policy's coverage limits are sufficient to replace your belongings. Also, check the policy's definition of "delay" – some policies only cover delays of 24 hours or more.

- 24/7 Assistance: This provides you with access to a helpline that can assist you with medical emergencies, lost passports, and other travel-related issues. Make sure the helpline is available 24/7 and offers multilingual support.

Travel Insurance Plan Comparison Understanding Different Types of Travel Insurance

Alright, before we get to specific product recommendations, let's quickly break down the main types of travel insurance:

- Single-Trip Insurance: This covers you for a single trip. It's a good option if you only travel occasionally.

- Annual Multi-Trip Insurance: This covers you for multiple trips within a year. It's a good option if you travel frequently.

- Medical Travel Insurance: This focuses specifically on medical coverage and is often a good choice for those with pre-existing conditions.

- Trip Cancellation Insurance: This primarily covers trip cancellation and interruption, but may have limited medical or baggage coverage.

Real-World Travel Insurance Scenarios How Different Plans Can Help

Let's imagine a few scenarios to see how different travel insurance plans can come in handy:

- Scenario 1: You're hiking in the Himalayas and break your leg. A comprehensive travel insurance plan with high medical coverage and emergency evacuation benefits would cover your medical expenses, helicopter evacuation to a hospital, and repatriation back home.

- Scenario 2: Your flight is canceled due to a volcanic eruption, and you miss your connecting flight. A travel insurance plan with trip interruption coverage would reimburse you for the cost of your missed flight, hotel accommodations, and meals.

- Scenario 3: Your luggage is lost by the airline, and you need to buy new clothes and toiletries. A travel insurance plan with baggage loss coverage would reimburse you for the cost of your lost belongings.

- Scenario 4: You get sick with the flu before your trip and have to cancel. A travel insurance plan with trip cancellation coverage would reimburse you for your non-refundable travel expenses, such as flights and hotel bookings.

Specific Travel Insurance Product Recommendations For Various Travel Needs

Okay, let's get to the good stuff! Here are a few travel insurance products I'd recommend, keeping in mind that the best choice depends on your individual needs and risk tolerance. Always check the policy details carefully before purchasing.

World Nomads Travel Insurance A Popular Choice for Adventurers

World Nomads is a popular choice for adventurous travelers. They offer comprehensive coverage for medical emergencies, trip cancellation, baggage loss, and a wide range of adventure activities. They have two main plans: Standard and Explorer. The Explorer plan offers higher coverage limits and covers more adventurous activities.

- Pros: Good coverage for adventure activities, flexible policy options, 24/7 assistance.

- Cons: Can be more expensive than other options, may not be the best choice for travelers with pre-existing medical conditions.

- Typical Scenarios: Backpacking trips, hiking, scuba diving, snowboarding.

- Pricing: Varies depending on the destination, duration of the trip, and age of the traveler. Expect to pay around $50-$150 for a 2-week trip.

Allianz Travel Insurance A Trusted Provider With Various Plan Options

Allianz Travel Insurance offers a variety of plans to suit different needs and budgets. Their plans include trip cancellation, trip interruption, medical coverage, and baggage loss coverage. They also offer 24/7 assistance.

- Pros: Wide range of plan options, competitive pricing, good customer service.

- Cons: May not be the best choice for travelers participating in extreme sports, some plans have lower coverage limits.

- Typical Scenarios: Family vacations, business trips, cruises.

- Pricing: Varies depending on the destination, duration of the trip, and age of the traveler. Expect to pay around $40-$120 for a 2-week trip.

Travel Guard Travel Insurance Comprehensive Coverage For Medical Emergencies

Travel Guard is known for its comprehensive medical coverage, making it a good choice for travelers with pre-existing medical conditions or those traveling to countries with high healthcare costs. They also offer trip cancellation, trip interruption, and baggage loss coverage.

- Pros: Excellent medical coverage, good customer service, wide range of plan options.

- Cons: Can be more expensive than other options, some plans have limited coverage for adventure activities.

- Typical Scenarios: Travelers with pre-existing medical conditions, travelers visiting countries with high healthcare costs.

- Pricing: Varies depending on the destination, duration of the trip, and age of the traveler. Expect to pay around $60-$180 for a 2-week trip.

Comparing Travel Insurance Plans Side-By-Side Key Features and Costs

Let's break down the key differences between these three providers in a simple table:

| Feature | World Nomads | Allianz Travel Insurance | Travel Guard |

|---|---|---|---|

| Medical Coverage | Good, especially for adventure activities | Good, various options available | Excellent, known for comprehensive coverage |

| Trip Cancellation/Interruption | Comprehensive | Comprehensive | Comprehensive |

| Baggage Loss/Delay | Included | Included | Included |

| Pre-Existing Conditions | May not be the best choice | Varies by plan | Good coverage options |

| Adventure Activities | Excellent coverage | Limited coverage | Limited coverage |

| Price (approx. for 2-week trip) | $50-$150 | $40-$120 | $60-$180 |

Affordable Travel Insurance Options Finding the Best Value For Your Money

Looking to save some money? Here are a few tips for finding affordable travel insurance:

- Compare quotes from multiple providers: Don't just settle for the first quote you get. Shop around and compare prices from different companies.

- Choose a higher deductible: A higher deductible will lower your premium.

- Opt for a basic plan: If you don't need comprehensive coverage, a basic plan may be sufficient.

- Consider travel insurance through your credit card: Some credit cards offer travel insurance as a perk. Check your card's benefits guide to see if you're covered.

- Buy travel insurance early: Buying travel insurance early can protect you from unforeseen events that may occur before your trip, such as illness or injury.

Understanding Travel Insurance Fine Print What You Need to Know Before You Buy

Before you click "buy," make sure you understand the fine print. Here are a few things to look out for:

- Pre-existing condition clauses: Understand how the policy defines and covers pre-existing conditions.

- Exclusions for specific activities: Make sure your planned activities are covered.

- Time limits for filing claims: Know how long you have to file a claim after an incident occurs.

- Definition of "trip interruption": Understand what constitutes a trip interruption and what expenses are covered.

- Cancellation policies: Know how to cancel your policy and what refund you're entitled to.

Making a Travel Insurance Claim A Step-By-Step Guide

So, you need to make a claim? Here's a quick rundown of the process:

- Contact your insurance provider: As soon as possible, contact your insurance provider to report the incident and start the claims process.

- Gather documentation: Collect all relevant documentation, such as medical bills, police reports, and receipts.

- Fill out the claim form: Complete the claim form accurately and thoroughly.

- Submit your claim: Submit your claim and all supporting documentation to your insurance provider.

- Follow up: Follow up with your insurance provider to check on the status of your claim.

Travel Insurance for Specific Destinations Tailoring Coverage to Your Trip

Keep in mind that the best travel insurance for you might depend on your destination. For example:

- USA: Healthcare is expensive, so high medical coverage is crucial.

- Europe: Ensure coverage complies with Schengen visa requirements.

- Southeast Asia: Dengue fever and other tropical diseases are a risk, so comprehensive medical coverage is important.

Staying Safe and Insured On Your Adventures A Final Reminder

Choosing the right travel insurance can seem daunting, but it's a crucial step in planning your trip. By understanding your needs, comparing your options, and reading the fine print, you can find a policy that provides you with peace of mind and protects you from unexpected events. Happy travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)