Travel Insurance and Adventure Activities: Know Your Coverage

Understanding Travel Insurance for Adventure Seekers Adventure Travel Insurance

So, you're planning an epic adventure! Climbing Kilimanjaro, diving the Great Barrier Reef, maybe even bungee jumping in New Zealand? Awesome! But before you pack your bags and chase those thrills, let's talk about something a little less exciting but incredibly important: travel insurance. Specifically, travel insurance for adventure activities. It’s not always as straightforward as you might think, and assuming your standard policy covers everything could leave you seriously exposed. Think of it as your safety net – the thing that catches you when things go sideways (literally, if you're ziplining!).

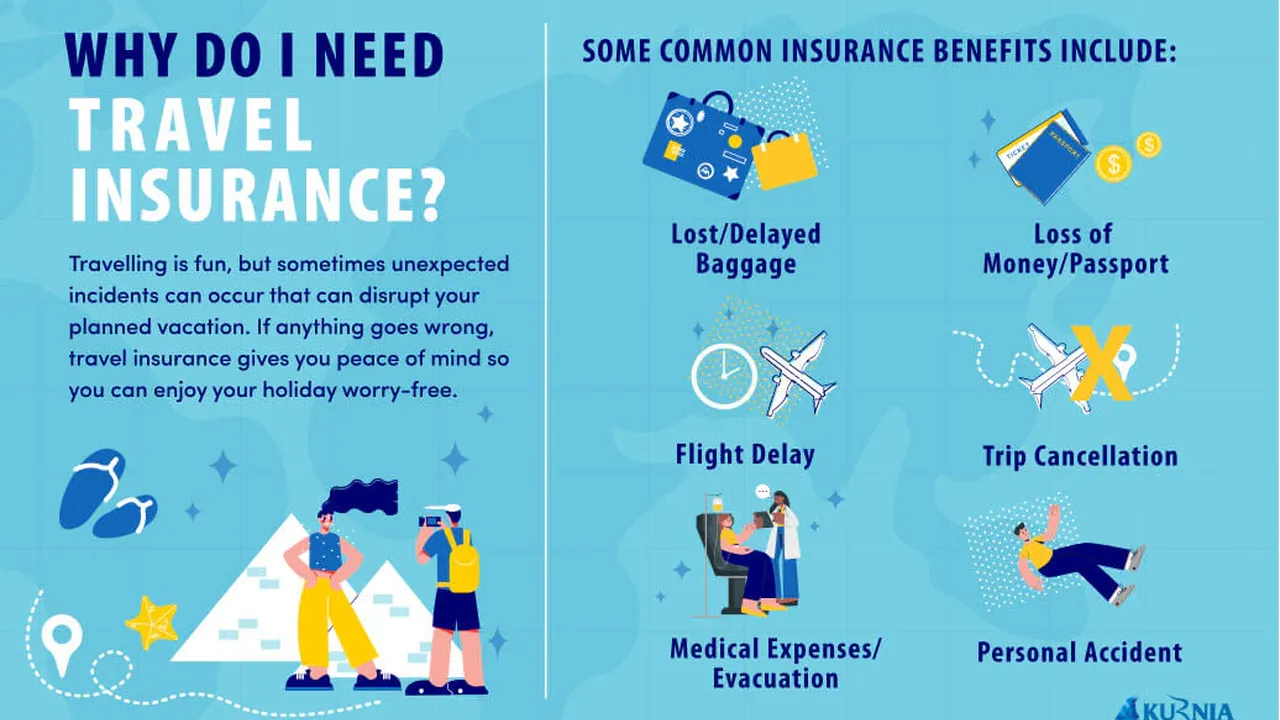

The thing is, most standard travel insurance policies have exclusions. They might cover you for a lost suitcase or a delayed flight, but when it comes to activities deemed "high-risk," you could find yourself on your own. That's where adventure travel insurance comes in. It's a specialized type of policy designed to cover you for those adrenaline-pumping experiences. But even within adventure travel insurance, there are nuances and levels of coverage to consider.

Defining Adventure Activities What is Considered High Risk Travel Insurance

What exactly *is* an adventure activity anyway? This is where things get a little fuzzy. Insurers all have different definitions. Generally, it includes anything that carries a higher-than-average risk of injury or requires specialized equipment or training. Think skiing, snowboarding (especially off-piste), rock climbing, scuba diving, white water rafting, and even something as seemingly benign as horseback riding. The key is to carefully read the fine print of your policy and see what activities are explicitly covered or excluded. Don't just assume; clarify!

Some policies might have a list of covered activities, while others might have a list of exclusions. If an activity isn't listed, it's best to contact the insurance provider and get confirmation in writing that it's covered. This is crucial to avoid any nasty surprises later on. For example, if you're planning on doing some high-altitude trekking, make sure your policy covers altitude sickness and any related medical expenses.

Key Considerations When Choosing Adventure Travel Insurance Adventure Sports Travel Insurance

Okay, so you know you need adventure travel insurance. But how do you choose the right policy? Here are some key things to consider:

- Coverage Limits: How much will the policy pay out for medical expenses, evacuation, and other covered events? Make sure the limits are high enough to cover potential costs in the countries you're visiting. Medical care in some countries can be incredibly expensive, and emergency evacuation can cost tens of thousands of dollars.

- Specific Activity Coverage: Does the policy specifically cover the activities you're planning to participate in? Don't just assume that "adventure activities" are covered; check the list of covered activities carefully.

- Pre-existing Medical Conditions: If you have any pre-existing medical conditions, make sure the policy covers them. Some policies may exclude coverage for conditions that existed before the policy was purchased.

- Geographic Restrictions: Are there any geographic restrictions on the policy? Some policies may not cover certain countries or regions.

- Policy Exclusions: What activities or situations are specifically excluded from coverage? Common exclusions include extreme sports, activities undertaken against the advice of local authorities, and activities involving illegal substances.

- Repatriation: Does the policy cover repatriation of your body in the event of death? This is a morbid thought, but it's an important consideration, especially if you're traveling to remote or dangerous areas.

- 24/7 Assistance: Does the insurance provider offer 24/7 assistance in case of an emergency? This can be invaluable if you need help in a foreign country.

Popular Adventure Travel Insurance Products and Their Uses Travel Insurance Comparison

Let's look at some specific adventure travel insurance products and their ideal use cases:

- World Nomads Explorer Plan: This is a popular choice for adventure travelers, offering comprehensive coverage for a wide range of activities, including scuba diving, rock climbing, and skiing. They have a good reputation for handling claims efficiently.

- Use Case: Ideal for long-term travelers and those participating in multiple adventure activities.

- Pros: Comprehensive coverage, good customer service, ability to extend coverage while traveling.

- Cons: Can be more expensive than other options.

- Price: Varies depending on age, destination, and length of trip, but expect to pay around $100-$300 per month.

- IMG Signature Travel Insurance: This plan is a good option for those looking for a more affordable option with decent coverage.

- Use Case: Budget-conscious travelers looking for basic coverage for common adventure activities.

- Pros: Affordable, covers a decent range of activities.

- Cons: Coverage limits may be lower than other options, customer service can be slow.

- Price: Varies depending on age, destination, and length of trip, but expect to pay around $50-$150 per month.

- Allianz Travel Insurance (Specific Adventure Plans): Allianz offers specific plans tailored to certain adventure activities, such as skiing or scuba diving.

- Use Case: Travelers participating in a specific adventure activity and wanting specialized coverage.

- Pros: Tailored coverage for specific activities, can be more affordable than general adventure travel insurance.

- Cons: May not cover other adventure activities outside of the chosen specialty.

- Price: Varies depending on the activity and coverage level, but expect to pay around $75-$250 per month.

Comparing Adventure Travel Insurance Products Choosing the Right Policy

Choosing the right adventure travel insurance policy can be overwhelming. Here's a quick comparison of the products mentioned above:

| Feature | World Nomads Explorer | IMG Signature Travel | Allianz (Adventure Specific) |

|---|---|---|---|

| Coverage | Comprehensive | Basic | Specialized |

| Price | Higher | Lower | Variable |

| Customer Service | Good | Average | Average |

| Best For | Long-term travelers, multiple activities | Budget travelers | Specific activity |

Ultimately, the best policy for you will depend on your individual needs and circumstances. Consider your budget, the activities you're planning to participate in, and your risk tolerance. It's always a good idea to get quotes from multiple providers and compare the coverage and prices carefully.

Understanding Policy Exclusions What Isn't Covered

Pay close attention to the policy exclusions. These are the situations or activities that the policy *won't* cover. Common exclusions include:

- Extreme Sports: Some policies may exclude extreme sports like BASE jumping, wingsuit flying, or heli-skiing.

- Activities Undertaken Against Advice: If you ignore warnings from local authorities or tour operators, your policy may not cover you.

- Illegal Activities: Activities involving illegal substances or criminal behavior are typically excluded.

- Unattended Belongings: Theft of unattended belongings is often excluded or has limited coverage.

- Alcohol or Drug-Related Incidents: Injuries or illnesses resulting from alcohol or drug use are usually excluded.

Read the fine print carefully to understand what's covered and what's not. If you're unsure about anything, contact the insurance provider and ask for clarification.

Tips for Filing a Travel Insurance Claim Travel Insurance Claim Process

Okay, so you've got your adventure travel insurance policy, and unfortunately, you need to file a claim. Here are some tips to make the process as smooth as possible:

- Report the Incident Immediately: Contact your insurance provider as soon as possible after the incident occurs.

- Gather Documentation: Collect all relevant documentation, including medical records, police reports, receipts, and photos.

- Be Honest and Accurate: Provide accurate and truthful information on your claim form.

- Keep Copies: Keep copies of all documents you submit to the insurance provider.

- Follow Up: Follow up with the insurance provider regularly to check on the status of your claim.

- Be Patient: The claims process can take time, so be patient and persistent.

By following these tips, you can increase your chances of a successful claim.

Real-Life Examples of Travel Insurance in Action Adventure Travel Stories

Let's look at a few real-life examples of how adventure travel insurance can save the day:

- The Broken Leg in Nepal: A hiker in Nepal slipped and broke their leg. Their adventure travel insurance covered the cost of emergency evacuation by helicopter, medical treatment in a local hospital, and repatriation back home. Without insurance, they would have been facing a bill of tens of thousands of dollars.

- The Lost Scuba Gear in Thailand: A scuba diver in Thailand had their gear stolen from their hotel room. Their adventure travel insurance covered the cost of replacing the gear, allowing them to continue their diving trip.

- The Altitude Sickness in Peru: A trekker in Peru developed severe altitude sickness. Their adventure travel insurance covered the cost of medical treatment and a descent to a lower altitude.

These are just a few examples of how adventure travel insurance can protect you from unexpected costs and provide peace of mind while you're exploring the world.

The Importance of Reading the Fine Print Understanding Your Policy

I know, reading insurance policies is about as exciting as watching paint dry. But trust me, it's essential! The fine print contains all the details about what's covered, what's excluded, and the terms and conditions of the policy. Don't just skim it; read it carefully and make sure you understand it. If you have any questions, don't hesitate to contact the insurance provider and ask for clarification. It’s better to be safe than sorry. Knowing exactly what your policy covers can save you a lot of heartache and money down the road.

Staying Safe and Enjoying Your Adventure Travel Smart

Ultimately, the best way to avoid needing to use your adventure travel insurance is to stay safe and be prepared. Here are a few tips:

- Research Your Destination: Learn about the local customs, laws, and potential hazards.

- Get Vaccinated: Make sure you're up-to-date on all recommended vaccinations for your destination.

- Pack Appropriately: Pack the right gear for the activities you're planning to participate in.

- Listen to Local Advice: Follow the advice of local authorities and tour operators.

- Stay Hydrated: Drink plenty of water, especially in hot climates or at high altitudes.

- Be Aware of Your Surroundings: Pay attention to your surroundings and be aware of potential risks.

By following these tips, you can minimize your risk of accidents and injuries and enjoy a safe and memorable adventure.

So, there you have it! A comprehensive guide to adventure travel insurance. Remember, it's not just about ticking a box; it's about protecting yourself and ensuring that you can enjoy your adventure to the fullest, knowing that you're covered if something goes wrong. Happy travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)