Travel Insurance for US Citizens: A Comprehensive Overview

Understanding the Basics of Travel Insurance for US Citizens

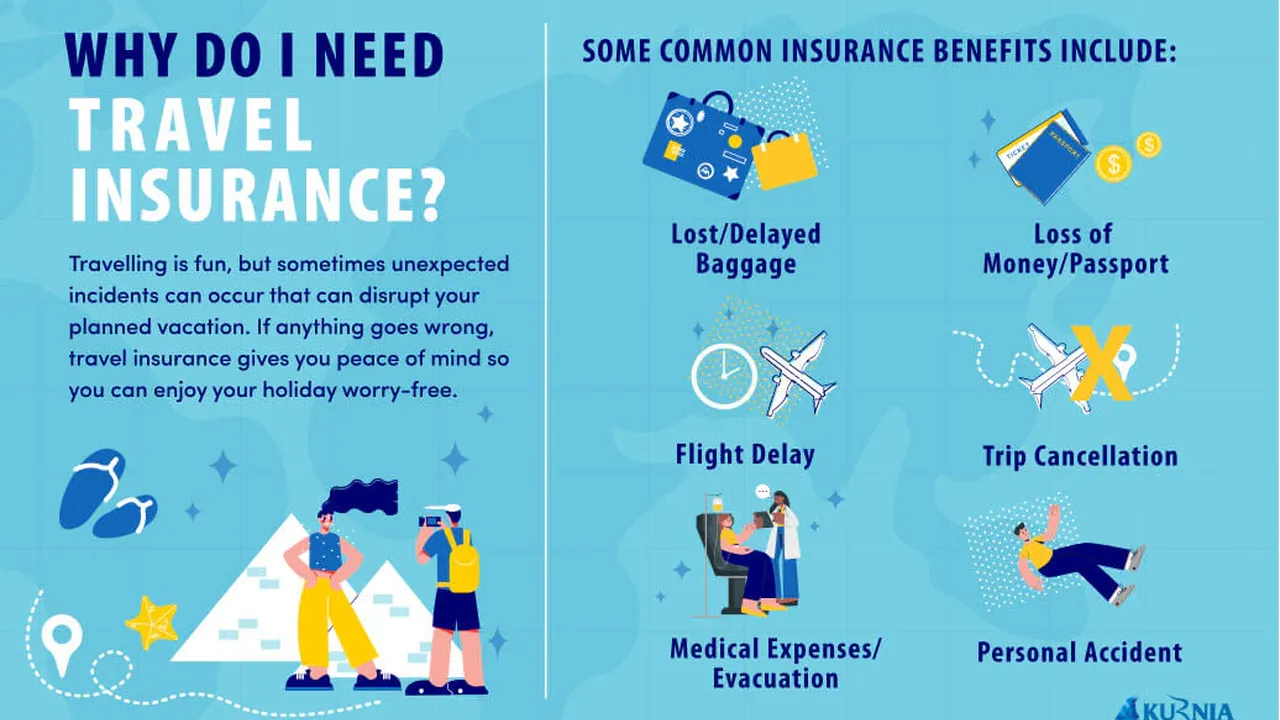

Okay, let's dive right in. You're an American citizen, you're itching to travel, and you're wondering if you need travel insurance. The short answer? Probably yes. But why? Well, your domestic health insurance might not cover you overseas. And even if it does, navigating foreign healthcare systems can be a nightmare. Travel insurance is like a safety net, catching you when things go wrong – from a sudden illness to a lost passport.

Think of it this way: You wouldn't drive your car without auto insurance, right? Traveling without travel insurance is like driving without a seatbelt. It's a risk you don't need to take. We'll cover the different types of travel insurance, what they cover, and how to choose the right one for your trip.

Types of Travel Insurance Policies Available to US Citizens

So, what kind of safety net are we talking about? Here are the main types of travel insurance you'll encounter:

- Trip Cancellation Insurance: This covers you if you have to cancel your trip before you even leave. Reasons can include illness, injury, a death in the family, or even a natural disaster at your destination.

- Trip Interruption Insurance: This is your lifesaver if something goes wrong during your trip. Maybe you get sick and have to cut your vacation short, or a hurricane hits your destination. This insurance can reimburse you for unused travel arrangements and even help you get home.

- Medical Insurance: This is crucial. It covers medical expenses if you get sick or injured while traveling. It can pay for doctor visits, hospital stays, medication, and even emergency medical evacuation. Seriously, don't leave home without it.

- Baggage Insurance: Lost luggage is a traveler's worst nightmare. This insurance can reimburse you for lost, stolen, or damaged luggage and personal belongings.

- Emergency Medical Evacuation Insurance: If you're seriously injured or ill in a remote location, this insurance can cover the costs of getting you to a hospital that can provide the care you need. This can be incredibly expensive without insurance.

What Does Travel Insurance Cover for US Travelers?

Now, let's get specific about what these policies actually cover. The devil is in the details, so pay attention!

- Medical Expenses: This is the big one. It typically covers doctor visits, hospital stays, surgery, medication, and other medical treatments. Check the policy limits and make sure they're high enough to cover potential medical costs in your destination.

- Emergency Medical Evacuation: As mentioned earlier, this covers the cost of transporting you to a medical facility if you need specialized care. This can include helicopter transport, ambulance rides, and even repatriation back to the US.

- Trip Cancellation/Interruption: These cover non-refundable trip costs if you have to cancel or interrupt your trip due to a covered reason. This can include flights, hotels, tours, and other prepaid expenses.

- Lost or Stolen Baggage: This covers the cost of replacing lost, stolen, or damaged luggage and personal belongings. There are usually limits on how much you can claim, so read the fine print.

- 24/7 Assistance: Many travel insurance policies offer 24/7 assistance services. This can be invaluable if you need help finding a doctor, translating medical documents, or arranging emergency transportation.

Important Note: Pre-existing conditions are often excluded from coverage. If you have a pre-existing medical condition, you may need to purchase a specific policy that covers it.

Choosing the Right Travel Insurance Policy for Your Needs

Okay, so you know you need travel insurance, but how do you choose the right policy? Here are some factors to consider:

- Your Destination: Some destinations are more expensive for medical care than others. If you're traveling to a country with high healthcare costs, you'll need a policy with higher medical coverage limits.

- Your Activities: If you're planning on participating in adventure activities like skiing, scuba diving, or rock climbing, you'll need a policy that covers those activities. Some policies exclude certain high-risk activities.

- Your Health: If you have any pre-existing medical conditions, you'll need to find a policy that covers them.

- Your Budget: Travel insurance policies range in price, so you'll need to find one that fits your budget. Don't skimp on coverage, but also don't overpay for features you don't need.

- Policy Limits: Pay attention to the policy limits for medical expenses, trip cancellation/interruption, and baggage loss. Make sure they're high enough to cover potential losses.

- Deductible: The deductible is the amount you have to pay out of pocket before your insurance kicks in. A higher deductible will usually result in a lower premium.

Comparing Travel Insurance Providers for US Citizens

Now for the fun part: shopping around! Here are a few reputable travel insurance providers that cater to US citizens:

- Allianz Global Assistance: Allianz is a well-known and respected travel insurance provider. They offer a wide range of policies with different coverage levels and prices.

- World Nomads: World Nomads is a popular choice for adventure travelers. They offer policies that cover a wide range of activities, including skiing, scuba diving, and rock climbing. They are known for their flexible policies.

- Travel Guard: Travel Guard is another reputable provider that offers a variety of policies for different types of travelers. They have a good reputation for customer service.

- Seven Corners: Seven Corners specializes in travel insurance for international travelers. They offer policies that are designed to meet the needs of US citizens traveling abroad.

- Generali Global Assistance: Generali Global Assistance is a global insurance company that offers a range of travel insurance policies. They are known for their comprehensive coverage options.

It's important to compare quotes from different providers to find the best policy for your needs and budget. Use websites like InsureMyTrip.com or Squaremouth.com to compare policies side-by-side.

Specific Travel Insurance Products and Their Uses

Let's get even more specific and look at some actual products and their ideal use cases:

- Allianz Travel Insurance OneTrip Prime: This is a good all-around policy for a typical vacation. It offers decent coverage for trip cancellation, interruption, medical expenses, and baggage loss. Use Case: A family taking a week-long vacation to Disney World.

- World Nomads Explorer Plan: This is a great option for adventure travelers. It covers a wide range of activities and offers high limits for medical expenses and emergency medical evacuation. Use Case: A solo traveler backpacking through Southeast Asia and planning on doing some trekking and scuba diving.

- Travel Guard Preferred Plan: This policy offers comprehensive coverage and includes features like trip interruption for any reason (within certain limitations). Use Case: Someone who wants extra peace of mind and is willing to pay a little more for comprehensive coverage.

- Seven Corners RoundTrip Choice: This policy is designed for international travelers and offers good coverage for medical expenses and emergency medical evacuation. Use Case: A retiree taking a long-term trip to Europe.

Comparing Travel Insurance Products: Features and Price

Here's a quick comparison table of the products mentioned above:

| Product | Trip Cancellation | Medical Expenses | Emergency Evacuation | Baggage Loss | Price (approx.) | Ideal For |

|---|---|---|---|---|---|---|

| Allianz OneTrip Prime | Up to 100% trip cost | $50,000 | $500,000 | $1,500 | $80 - $150 | Families, short vacations |

| World Nomads Explorer | Up to trip cost | Unlimited (within reason) | Unlimited (within reason) | $3,000 | $120 - $250 | Adventure travelers, long trips |

| Travel Guard Preferred | Up to 100% trip cost | $50,000 | $1,000,000 | $2,500 | $100 - $200 | Comprehensive coverage seekers |

| Seven Corners RoundTrip Choice | Up to 100% trip cost | $100,000 | $1,000,000 | $2,500 | $90 - $180 | International travel, retirees |

Note: Prices are approximate and can vary depending on the length of your trip, your age, and other factors.

Understanding the Cost of Travel Insurance

So, how much will all this cost you? The price of travel insurance depends on a number of factors, including:

- The length of your trip: Longer trips will generally cost more.

- Your age: Older travelers typically pay more.

- Your destination: Some destinations are more expensive to insure than others.

- The coverage limits: Higher coverage limits will result in a higher premium.

- The deductible: A lower deductible will result in a higher premium.

- Pre-existing conditions: Covering pre-existing conditions can increase the cost.

As a general rule, you can expect to pay between 4% and 10% of the total cost of your trip for travel insurance. For example, if your trip costs $5,000, you can expect to pay between $200 and $500 for travel insurance.

Real-Life Scenarios Where Travel Insurance Saved the Day

Let's look at some real-life examples of how travel insurance can save you from financial disaster:

- Scenario 1: You break your leg while skiing in Switzerland. You need surgery and a week-long hospital stay. Without travel insurance, you could be looking at a bill of tens of thousands of dollars. Travel insurance can cover your medical expenses and even the cost of flying you home.

- Scenario 2: Your passport is stolen while you're traveling in Italy. Travel insurance can help you replace your passport and cover the cost of any necessary travel arrangements.

- Scenario 3: You have to cancel your trip to Japan due to a family emergency. Travel insurance can reimburse you for your non-refundable flights, hotels, and tours.

- Scenario 4: Your luggage is lost on your flight to Mexico. Travel insurance can reimburse you for the cost of replacing your lost belongings.

Tips for Filing a Travel Insurance Claim

So, you had to use your travel insurance. Now what? Here are some tips for filing a claim:

- Document everything: Keep copies of all your receipts, medical records, and police reports.

- File your claim as soon as possible: Don't wait until you get home to file your claim. The sooner you file, the better.

- Be honest and accurate: Provide all the information requested by the insurance company and be honest about the circumstances of your claim.

- Follow up: If you haven't heard back from the insurance company within a reasonable amount of time, follow up to check on the status of your claim.

- Appeal if necessary: If your claim is denied, you have the right to appeal the decision.

Travel Insurance for US Citizens Traveling During Covid-19

The COVID-19 pandemic has added a new layer of complexity to travel insurance. Here's what you need to know about travel insurance and COVID-19:

- Check the policy coverage: Not all travel insurance policies cover COVID-19-related expenses. Make sure the policy you choose covers medical expenses if you contract COVID-19 while traveling.

- Trip cancellation/interruption: Some policies may cover trip cancellation or interruption if you test positive for COVID-19 before your trip or if you are required to quarantine.

- Review the terms and conditions: Carefully review the terms and conditions of the policy to understand what is and isn't covered.

- Consider "Cancel For Any Reason" coverage: If you're concerned about canceling your trip due to COVID-19-related reasons, consider purchasing a policy that includes "Cancel For Any Reason" (CFAR) coverage. This type of coverage allows you to cancel your trip for any reason and receive a partial refund. CFAR policies are more expensive, but they offer greater flexibility.

Traveling during COVID-19 requires extra planning and caution. Make sure you're up-to-date on the latest travel advisories and restrictions, and choose a travel insurance policy that provides adequate coverage for COVID-19-related risks.

The Importance of Reading the Fine Print

I can't stress this enough: READ THE FINE PRINT! Travel insurance policies can be complex and confusing. Before you purchase a policy, take the time to carefully read the terms and conditions. Pay attention to the exclusions, limitations, and deductibles. If you have any questions, contact the insurance company and ask for clarification.

Understanding the fine print can help you avoid surprises and ensure that you have the coverage you need if something goes wrong.

Travel Insurance and Pre-Existing Conditions for US Citizens

Pre-existing medical conditions can be a tricky issue when it comes to travel insurance. Many policies exclude coverage for pre-existing conditions, which are medical conditions that you have before you purchase the insurance. However, there are some policies that offer coverage for pre-existing conditions, either as standard coverage or as an optional add-on.

If you have a pre-existing medical condition, it's important to shop around and find a policy that provides adequate coverage. Look for policies that offer a "waiver of pre-existing conditions" if you purchase the policy within a certain timeframe of booking your trip. This waiver means that the policy will cover your pre-existing condition, even if it's normally excluded.

Be honest with the insurance company about your pre-existing conditions. Failing to disclose a pre-existing condition could result in your claim being denied.

Debunking Common Travel Insurance Myths

There are a lot of misconceptions about travel insurance. Let's debunk some common myths:

- Myth: Travel insurance is only for older people. Fact: Anyone can benefit from travel insurance, regardless of age.

- Myth: My credit card already provides travel insurance. Fact: Credit card travel insurance often has limited coverage and may not cover all the risks you face while traveling.

- Myth: Travel insurance is too expensive. Fact: Travel insurance is a relatively small price to pay for peace of mind and protection against unexpected expenses.

- Myth: I don't need travel insurance if I'm traveling to a safe country. Fact: Accidents and illnesses can happen anywhere, regardless of how safe the country is.

- Myth: Travel insurance covers everything. Fact: Travel insurance policies have exclusions and limitations. It's important to read the fine print to understand what is and isn't covered.

Don't let these myths prevent you from protecting yourself with travel insurance.

Final Thoughts on Travel Insurance for US Citizens

Traveling is an amazing experience, but it's important to be prepared for the unexpected. Travel insurance is an essential part of travel planning for US citizens. It can protect you from financial losses due to medical emergencies, trip cancellations, lost luggage, and other unforeseen events.

Take the time to research your options, compare policies, and choose the right travel insurance policy for your needs. It's a small investment that can provide you with peace of mind and protect you from financial disaster. Safe travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)