Travel Insurance and Cruise Vacations: What to Consider

Understanding Travel Insurance for Cruise Vacations Key Considerations

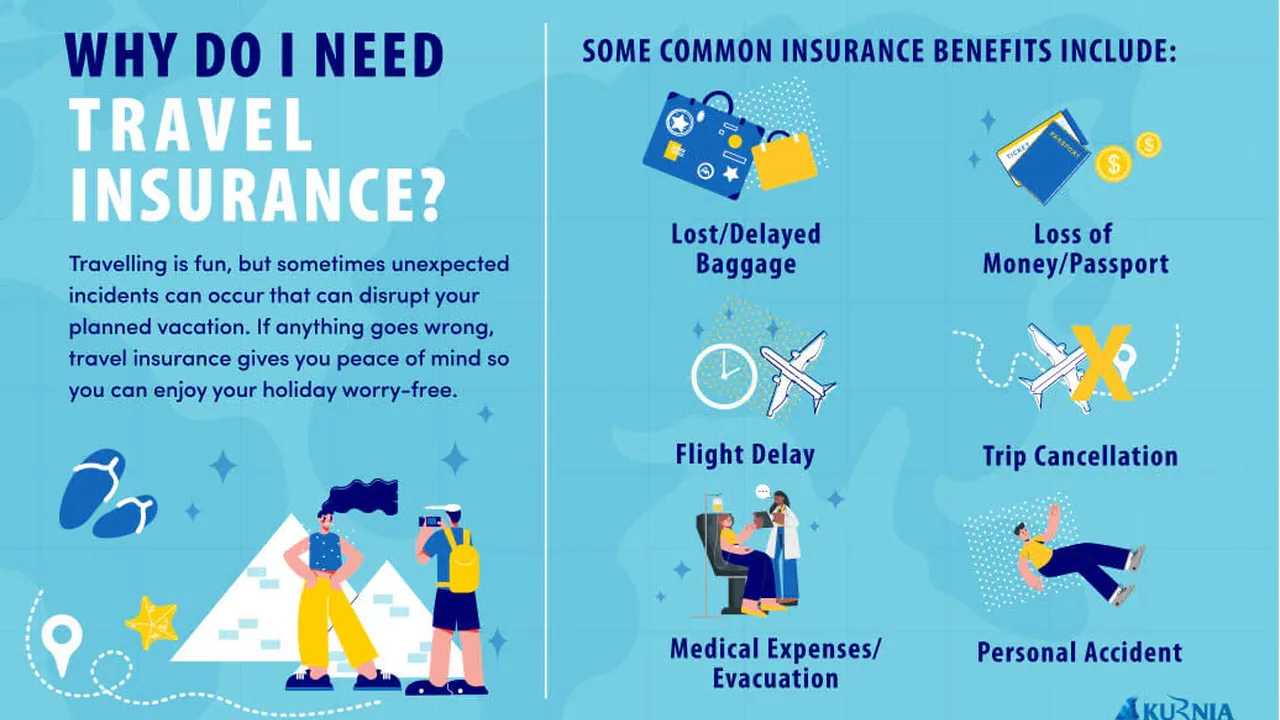

So, you're thinking about a cruise! Awesome! Sun, sea, and endless buffets – what's not to love? But before you pack your Hawaiian shirts and sunscreen, let's talk about something a little less exciting but super important: travel insurance. Cruises are amazing, but they also come with unique risks. You're out on the open water, potentially far from medical facilities, and relying on the ship for everything. That's where travel insurance comes in, acting as your safety net should things go sideways. We'll dive deep into the things you need to consider when choosing travel insurance for your cruise vacation.

Cruise Travel Insurance Coverage What's Included

First things first, let's break down what good cruise travel insurance should cover. Think of it as your "just in case" checklist:

- Trip Cancellation and Interruption: Life happens. Maybe you get sick before the cruise, or a family emergency pops up. Trip cancellation coverage can reimburse you for non-refundable cruise costs if you have to cancel. Trip interruption covers you if something happens mid-cruise and you need to head home early. Imagine getting a call that your house has flooded – interruption coverage can help with flights and unexpected expenses.

- Medical Expenses: This is HUGE. Medical care on a cruise ship or in a foreign country can be incredibly expensive. Your regular health insurance might not cover you, or might have limited coverage. Travel insurance with medical expense coverage can pay for doctor visits, hospital stays, medication, and even emergency medical evacuation. Seriously, don't skimp on this one!

- Emergency Medical Evacuation: Speaking of evacuation, this is a big deal. If you need to be airlifted off the ship to a hospital, it can cost tens of thousands of dollars. Make sure your policy includes adequate emergency medical evacuation coverage.

- Lost or Delayed Baggage: Picture this: you arrive at your port of embarkation, excited for your cruise, but your luggage is nowhere to be found. Lost or delayed baggage coverage can help you replace essential items while you wait for your bags to catch up. It's also useful if the airline loses your luggage altogether.

- Missed Connection Coverage: Flights get delayed, and sometimes you miss your cruise departure. Missed connection coverage can help cover the costs of catching up to the ship at the next port of call, including transportation and accommodation.

Specific Cruise Travel Insurance Policies Types and Features

Now, let's look at some specific types of policies and what they offer. Remember, it's always best to read the fine print and compare policies before you buy!

- Comprehensive Travel Insurance: This is your all-in-one option, covering everything we just talked about – trip cancellation, medical expenses, baggage loss, and more. It’s generally the most expensive option, but also offers the most peace of mind.

- Trip Cancellation Insurance: If you're primarily worried about having to cancel your cruise, this might be a good option. It focuses on reimbursing you for non-refundable costs if you cancel for a covered reason.

- Medical Travel Insurance: This focuses on medical expenses and emergency medical evacuation. It's a good option if you're less concerned about trip cancellation and more worried about potential medical emergencies.

Product Recommendations Specific Travel Insurance Options

Okay, let's get down to brass tacks. Here are a few travel insurance companies known for their cruise-specific coverage:

- Allianz Travel Insurance: Allianz offers a range of plans, including comprehensive options with high medical expense limits and emergency evacuation coverage. They also have excellent customer service. Look at their "AllTrips Premier" plan for a comprehensive option.

- World Nomads: World Nomads is popular with adventurous travelers, and they offer coverage for a wide range of activities. Their policies are flexible and can be extended if you decide to prolong your trip. They are a good choice for younger travelers or those engaging in activities like snorkeling or diving during their cruise.

- Travel Guard: Travel Guard is a well-established travel insurance provider with a variety of plans to choose from. They offer options with pre-existing condition waivers (more on that later!) and 24/7 assistance. Check out their "Deluxe" plan for comprehensive coverage.

Travel Insurance Product Comparison Features and Pricing

Let's compare these options a little more closely:

| Company | Plan Example | Key Features | Approximate Price (for a 7-day cruise, 2 adults, aged 40) |

|---|---|---|---|

| Allianz Travel Insurance | AllTrips Premier | High medical limits, emergency evacuation, trip cancellation, pre-existing condition exclusion waiver (with conditions) | $250 - $350 |

| World Nomads | Explorer Plan | Coverage for adventure activities, flexible policy extensions, 24/7 assistance | $180 - $280 |

| Travel Guard | Deluxe Plan | Trip cancellation, medical expenses, baggage loss, pre-existing condition waiver (with conditions), 24/7 assistance | $220 - $320 |

Note: Prices are estimates and can vary based on age, trip cost, and other factors. Always get a quote based on your specific circumstances.

Cruise Travel Insurance Usage Scenarios Real-World Examples

Let's paint a picture of how travel insurance can come to the rescue:

- Scenario 1: The Unexpected Illness: You wake up on day three of your cruise with a nasty stomach bug. The ship's doctor charges $200 for a consultation and $50 for medication. Your travel insurance covers these expenses.

- Scenario 2: The Missed Flight: Your connecting flight to your cruise departure city is delayed due to bad weather. You miss your cruise. Your travel insurance covers the cost of catching up to the ship at the next port of call, including a flight and hotel.

- Scenario 3: The Lost Luggage: Your luggage is lost by the airline. You need to buy essential toiletries and clothing. Your travel insurance reimburses you for these expenses.

- Scenario 4: The Medical Emergency: You slip and fall on the pool deck, breaking your arm. You need to be evacuated to a hospital on land. Your travel insurance covers the cost of the evacuation and your medical expenses.

Pre-Existing Conditions and Travel Insurance Understanding the Fine Print

Now, let's talk about pre-existing conditions. These are medical conditions you already have before you buy travel insurance. Many policies have exclusions or limitations on coverage for pre-existing conditions. However, some policies offer waivers that will cover pre-existing conditions if you meet certain requirements (usually purchasing the policy within a certain timeframe of booking your cruise and being medically fit to travel). It's crucial to understand the policy's terms regarding pre-existing conditions before you buy.

Cruise Travel Insurance and Adventure Activities Considerations

Planning on snorkeling, diving, or zip-lining during your cruise? Make sure your travel insurance covers these activities! Some policies exclude coverage for certain adventure activities, so read the fine print carefully. If you're planning on engaging in any risky activities, consider a policy like World Nomads, which is known for its coverage of adventure sports.

Comparing Cruise Travel Insurance Policies Key Factors

When comparing policies, consider these key factors:

- Coverage Limits: How much will the policy pay out for medical expenses, emergency evacuation, and other covered losses?

- Deductibles: How much will you have to pay out of pocket before the insurance kicks in?

- Exclusions: What isn't covered by the policy?

- Pre-Existing Condition Waivers: Does the policy offer a waiver for pre-existing conditions?

- 24/7 Assistance: Does the insurance company offer 24/7 assistance in case of an emergency?

- Customer Reviews: What do other customers say about the insurance company's service and claims process?

Cruise Travel Insurance Cost Factors Influencing Price

The cost of travel insurance depends on several factors:

- Age: Older travelers generally pay more for travel insurance.

- Trip Cost: The higher the cost of your cruise, the more you'll pay for travel insurance.

- Coverage Limits: Higher coverage limits will increase the price of the policy.

- Deductibles: Lower deductibles will increase the price of the policy.

- Destination: Some destinations are considered higher risk than others, which can affect the price of travel insurance.

- Pre-Existing Conditions: If you have pre-existing conditions, you may pay more for coverage.

Purchasing Cruise Travel Insurance Timing and Recommendations

When should you buy travel insurance? The sooner, the better! Ideally, you should purchase it within a few weeks of booking your cruise. This will give you the best chance of getting a pre-existing condition waiver (if needed) and will protect you in case you need to cancel your trip for a covered reason. Don't wait until the last minute!

Making a Claim on Cruise Travel Insurance Step-by-Step Guide

Okay, so you need to make a claim. What now? Here's a quick rundown:

- Contact the Insurance Company ASAP: Let them know what happened and that you'll be filing a claim.

- Gather Documentation: Collect all relevant documentation, such as medical bills, receipts, police reports (if applicable), and your cruise booking confirmation.

- Fill Out the Claim Form: Complete the claim form accurately and honestly.

- Submit Your Claim: Submit the claim form and all supporting documentation to the insurance company.

- Follow Up: Follow up with the insurance company to check on the status of your claim.

Cruise Travel Insurance and COVID-19 Considerations

COVID-19 has changed the travel landscape. Many travel insurance policies now offer coverage for COVID-19 related issues, such as trip cancellation or interruption due to illness or quarantine. However, it's important to carefully review the policy's terms and conditions regarding COVID-19 coverage, as some policies may have exclusions or limitations. Look for policies that specifically state they cover COVID-19 related expenses.

Cruise Line Insurance vs Independent Travel Insurance Which is Better

Cruise lines often offer their own travel insurance. While convenient, it's usually not as comprehensive as independent travel insurance. Cruise line insurance may have lower coverage limits, more exclusions, and may only cover issues directly related to the cruise. Independent travel insurance offers more flexibility and often better coverage. It's generally recommended to compare both options and choose the one that best meets your needs.

Tips for Finding the Best Cruise Travel Insurance Deals

Want to save some money on travel insurance? Here are a few tips:

- Shop Around: Compare quotes from multiple insurance companies.

- Adjust Coverage Limits: Consider lowering your coverage limits if you're comfortable with a higher deductible.

- Look for Discounts: Some insurance companies offer discounts for seniors, students, or members of certain organizations.

- Buy Early: Buying early can sometimes help you get a better price.

Cruise Travel Insurance and Accessibility Needs Ensuring Coverage

If you or a travel companion have accessibility needs, it's crucial to ensure your travel insurance covers those needs. This may include coverage for medical equipment, assistance animals, or modifications to your accommodations. Contact the insurance company to discuss your specific needs and ensure they are covered by the policy.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)