Travel Insurance and Rental Car Coverage: What You Need to Know

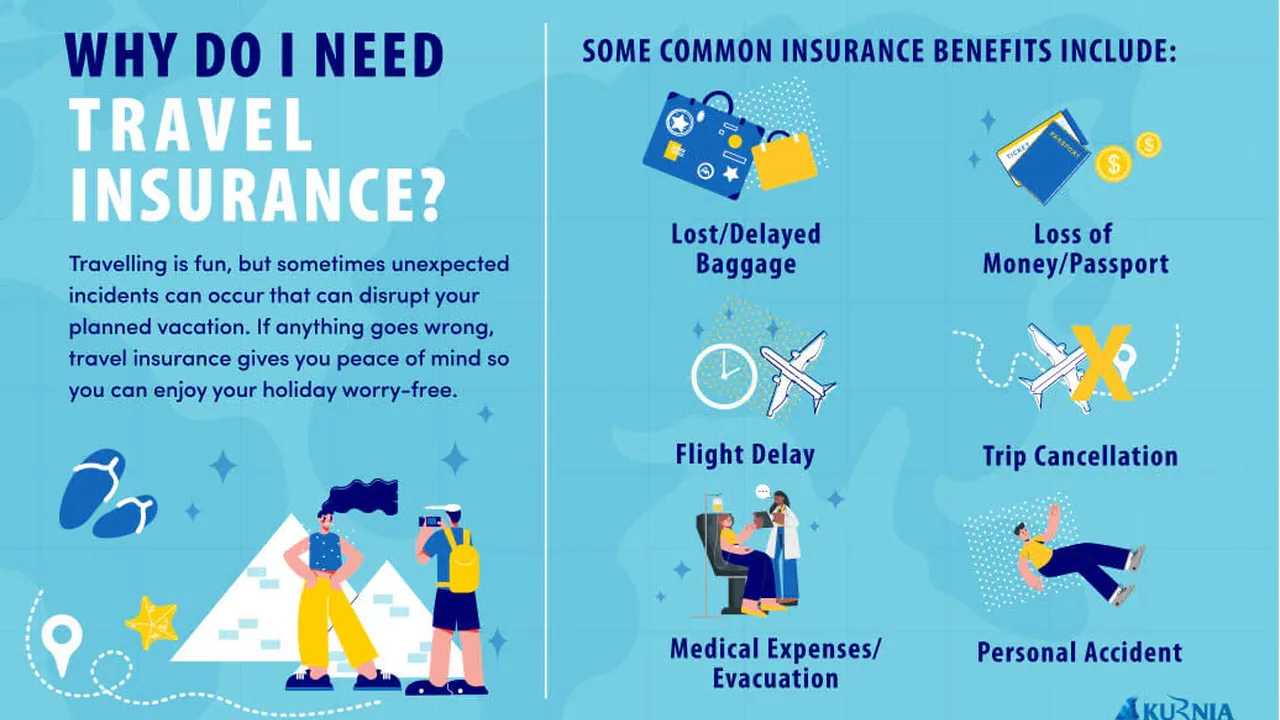

Understanding the Basics Rental Car Insurance and Travel Insurance

So, you're planning a trip and thinking about renting a car? Smart move! But before you sign on the dotted line, let's talk about rental car insurance and how it fits into your travel insurance picture. It can be a bit confusing, but we'll break it down. Basically, you've got a few options when it comes to protecting yourself financially if something happens to that rental vehicle.

First, there's the rental company's insurance. They'll happily sell you a Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW). These waivers essentially mean they won't hold you responsible for damage to the car, even if it's your fault. Sounds great, right? Well, it can be pricey. And often, it duplicates coverage you already have.

That's where your personal auto insurance and your credit card benefits come in. Many auto insurance policies extend coverage to rental cars, but it depends on the policy and the type of car you're renting. Call your insurance company and ask! Also, check your credit card agreement. Many cards offer rental car insurance as a perk. However, these benefits often have limitations and exclusions.

And then there's travel insurance. While travel insurance isn't *specifically* rental car insurance, it can come into play in certain situations. We'll get to those scenarios in a bit.

Types of Rental Car Insurance Coverage Options Available

Let's dive a little deeper into the different types of coverage. The rental company's CDW/LDW, as mentioned, waives your responsibility for damage to the car. This can be useful if you don't have other coverage, or if you're worried about your rates going up on your personal auto policy after an accident.

Your personal auto insurance typically provides liability coverage, which covers damages you cause to *other* people and property. It might also cover damage to the rental car itself, depending on your policy. The key is to understand your policy limits and deductibles.

Credit card rental car insurance usually comes in two forms: primary and secondary. Primary coverage means the credit card company pays out first, before any other insurance. Secondary coverage means they only pay after your other insurance policies have been exhausted. Primary coverage is obviously the better option, but it's rarer.

Travel Insurance and Rental Car Coverage How They Intersect

Okay, so where does travel insurance fit in? Travel insurance doesn't typically cover damage to the rental car itself. That's usually handled by the options we've already discussed. However, travel insurance can be invaluable in other rental car-related situations.

For example, let's say you have an accident in your rental car, and you're injured. Your travel insurance can cover medical expenses, emergency transportation, and even repatriation (returning you home). It can also cover trip interruption costs if you have to cut your trip short due to the accident.

Another scenario: You rent a car, and then your flight gets delayed, causing you to miss the first day of your rental. Some travel insurance policies offer coverage for unused, non-refundable expenses, including rental car costs.

Finally, if your rental car is stolen, and you lose personal belongings that were inside, your travel insurance can cover those losses (up to your policy limits, of course).

Specific Travel Insurance Products with Rental Car Benefits Product Recommendations

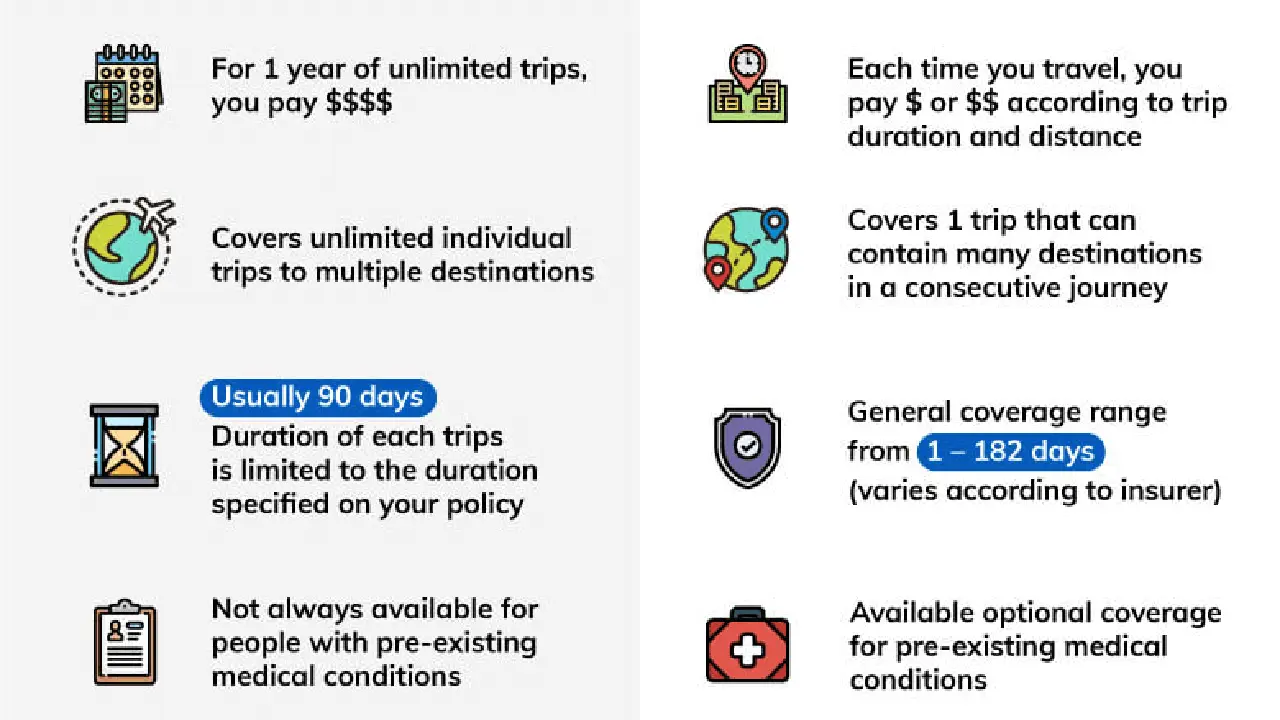

Alright, let's get down to brass tacks and talk about some specific travel insurance products that offer benefits related to rental cars. Keep in mind that policies vary, so always read the fine print and understand the coverage details before you buy.

World Nomads Explorer Plan: This is a popular option for adventurous travelers. While it doesn't directly cover rental car damage, it offers robust medical coverage, trip interruption coverage, and baggage coverage, all of which can be helpful in rental car-related incidents. It's particularly strong for covering adventure activities that might void other insurance policies.

Allianz Global Assistance AllTrips Executive Plan: This plan often includes rental car collision coverage, but it's usually secondary coverage, meaning it only kicks in after your personal auto insurance. However, it also offers trip cancellation/interruption coverage, medical coverage, and baggage loss coverage. The price varies depending on the trip length and traveler age, but expect to pay around $200-$500 for a two-week trip for a family of four.

Seven Corners RoundTrip Choice Plan: This plan provides primary rental car collision coverage, which is a big plus. It also includes trip interruption, medical, and baggage coverage. It is generally a bit more expensive than the Allianz plan, but the primary rental car coverage often makes it worth it. Expect to pay around $300-$600 for a two-week trip for a family of four.

Comparing Travel Insurance Products for Rental Car Scenarios A Detailed Comparison

Let's break down how these products compare in different rental car scenarios:

* **Minor fender bender (damage to the car):** World Nomads won't cover this. Allianz might cover it as secondary coverage, after your auto insurance. Seven Corners will likely cover it as primary coverage. * **Injury in an accident:** All three plans will cover medical expenses, but the coverage limits and specific benefits (like emergency transportation) will vary. Check the policy details carefully. World Nomads is generally considered very strong on medical coverage. * **Trip interruption due to an accident:** All three plans will cover trip interruption costs, but the coverage limits and eligible expenses will vary. * **Stolen belongings from the car:** All three plans will cover stolen belongings, but there are often limits on specific items (like electronics) and you'll need to file a police report. * **Flight delay causing you to miss a rental car day:** Allianz and Seven Corners are more likely to cover this scenario under their trip delay benefits, depending on the specific policy terms. World Nomads might not cover this.Rental Car Insurance Coverage in Different Travel Scenarios Using Your Insurance Wisely

The best travel insurance and rental car insurance combination depends on your travel style and risk tolerance. Consider these scenarios:

* **Business trip:** If you're renting a car for a business trip, your employer's insurance might cover you. Check with your HR department. If not, consider a policy with primary rental car coverage like Seven Corners. * **Family vacation:** If you're traveling with family, medical coverage is crucial. World Nomads and Allianz are good options. If you are concerned about accidents, Seven Corners might be worth the added expense. * **Adventure travel:** If you're planning to drive on unpaved roads or engage in off-road activities, standard rental car insurance might not cover you. World Nomads might be the best option for its coverage of adventure activities. * **International travel:** In some countries, rental car insurance is mandatory. Make sure you understand the local laws and requirements before you rent a car.Understanding Rental Car Insurance Costs and Pricing Factors

The cost of rental car insurance and travel insurance varies widely depending on several factors:

* **Rental car company's CDW/LDW:** This can range from $10 to $30 per day, depending on the car and the location. * **Travel insurance:** As noted above, travel insurance can range from $100 to $600 or more, depending on the coverage level, trip length, and traveler age. * **Your personal auto insurance deductible:** If you use your personal auto insurance, you'll have to pay your deductible if you have an accident. * **Credit card rental car insurance:** This is often free as a perk of your credit card, but the coverage might be limited.Tips for Saving Money on Rental Car Insurance A Practical Guide

Here are some tips for saving money on rental car insurance:

* **Check your existing coverage:** Before you buy any additional insurance, check your personal auto insurance policy and your credit card benefits. * **Decline the rental company's CDW/LDW if you have adequate coverage elsewhere.** * **Consider a higher deductible on your personal auto insurance:** This will lower your premium, but you'll have to pay more out-of-pocket if you have an accident. * **Shop around for travel insurance:** Compare quotes from multiple providers to find the best deal. * **Consider an annual travel insurance policy:** If you travel frequently, an annual policy might be cheaper than buying individual policies for each trip.Navigating Rental Car Insurance Claims A Step-by-Step Guide

If you have an accident in your rental car, here are the steps you should take:

1. **Ensure everyone's safety:** The most important thing is to make sure everyone involved is safe and receives medical attention if needed. 2. **Call the police:** File a police report, especially if there's significant damage or injuries. 3. **Gather information:** Exchange information with the other driver (if applicable), including their name, address, insurance information, and license plate number. 4. **Contact the rental car company:** Report the accident to the rental car company as soon as possible. 5. **Contact your insurance companies:** Notify your personal auto insurance company, your credit card company (if you're relying on their rental car insurance), and your travel insurance provider. 6. **Document everything:** Take photos of the damage to the car, the accident scene, and any relevant documents. Keep copies of all paperwork. 7. **File a claim:** Follow the instructions provided by each insurance company to file a claim. Be prepared to provide documentation and answer questions.Avoiding Common Rental Car Insurance Mistakes Staying Informed

Here are some common mistakes to avoid when it comes to rental car insurance:

* **Assuming you're covered:** Don't assume you have adequate coverage. Always check your policies and understand the limitations. * **Buying unnecessary insurance:** Don't buy insurance you don't need. If you already have adequate coverage, decline the rental company's CDW/LDW. * **Not reading the fine print:** Always read the fine print of any insurance policy before you buy it. Understand the coverage details, exclusions, and limitations. * **Not knowing what to do in case of an accident:** Be prepared. Know the steps to take if you have an accident.Future Trends in Travel Insurance and Rental Car Coverage What's on the Horizon

The travel insurance and rental car industries are constantly evolving. Here are some trends to watch for:

* **More personalized insurance:** Insurance companies are increasingly using data and technology to offer more personalized insurance products. * **Embedded insurance:** Insurance is becoming more integrated into the travel booking process. You might be offered rental car insurance when you book your flight or hotel. * **Increased focus on sustainability:** Travelers are increasingly concerned about the environmental impact of their trips. Insurance companies are starting to offer products that offset carbon emissions. * **Greater use of technology:** Technology is playing an increasingly important role in the insurance industry, from online claims processing to mobile apps.Rental Car Insurance Coverage for Specific Vehicle Types A Comprehensive Guide

The type of vehicle you rent can affect your insurance coverage. For example:

* **Luxury cars:** Some credit card rental car insurance policies exclude luxury cars. * **SUVs and trucks:** Some policies have different coverage limits for SUVs and trucks. * **Vans:** Renting a van might require additional insurance coverage. * **RVs:** RVs typically require specialized insurance policies.State-by-State Guide to Rental Car Insurance Laws and Regulations Navigating the Legal Landscape

Rental car insurance laws and regulations vary from state to state. It's important to understand the laws in the state where you're renting a car. Consult resources like the Department of Motor Vehicles (DMV) website for the state you are visiting.

Case Studies Real-Life Examples of Rental Car Insurance Claims

Let's look at some real-life examples of rental car insurance claims:

* **Case Study 1:** A traveler rented a car and had a minor accident. They used their credit card rental car insurance to cover the damage. * **Case Study 2:** A family rented a car and had their belongings stolen from the vehicle. They used their travel insurance to cover the losses. * **Case Study 3:** A business traveler rented a car and was injured in an accident. They used their travel insurance to cover medical expenses and lost wages.Resources for Further Research and Information Staying Informed

Here are some resources for further research and information:

* **Your personal auto insurance policy:** Read your policy carefully to understand your coverage. * **Your credit card agreement:** Review the rental car insurance benefits offered by your credit card. * **Travel insurance websites:** Compare quotes and coverage details from multiple providers. * **Rental car company websites:** Read the terms and conditions of your rental agreement. * **Consumer Reports:** Consumer Reports provides reviews and ratings of travel insurance companies.:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)