Do You Really Need Travel Insurance? Assessing Your Risk

Sample meta description.

Understanding the Basics of Travel Insurance and Why It Matters

So, you're planning a trip! That's awesome. But before you pack your bags and dream of sipping cocktails on a beach, let's talk about something not quite as glamorous but super important: travel insurance. A lot of people skip it, thinking "it won't happen to me," but trust me, a little planning can save you a *lot* of headaches (and money) down the road. Essentially, travel insurance is like a safety net for your trip. It can help cover unexpected medical expenses, trip cancellations or interruptions, lost or stolen luggage, and even emergency evacuations. Think of it as peace of mind in a policy.

Assessing Your Personal Risk Factors for Travel Insurance Needs

Now, the big question: do *you* really need it? Well, that depends on a few things. First, consider your destination. Are you heading to a country with expensive healthcare? The US, for example, can bankrupt you with a single emergency room visit. Even in countries with socialized medicine, you might not be covered as a tourist. Also, think about the type of trip you're taking. Are you planning on doing any risky activities like skiing, scuba diving, or mountain climbing? If so, you'll definitely want coverage. Your age and health are also factors. Older travelers or those with pre-existing conditions are more likely to need medical coverage. Finally, consider the cost of your trip. If you've invested a lot of money in non-refundable flights and hotels, it makes sense to protect that investment.

Medical Emergencies Abroad Travel Insurance Coverage

Let's dive deeper into medical emergencies. Imagine you're trekking in Nepal and break your leg. Getting you to a hospital, let alone back home, could cost tens of thousands of dollars. Travel insurance can cover these costs, including emergency medical transportation, hospital stays, and doctor's fees. Make sure your policy covers pre-existing conditions if you have any. Read the fine print carefully to understand what's covered and what's not. Some policies exclude certain activities or have limits on coverage amounts.

Trip Cancellation and Interruption Coverage in Travel Insurance

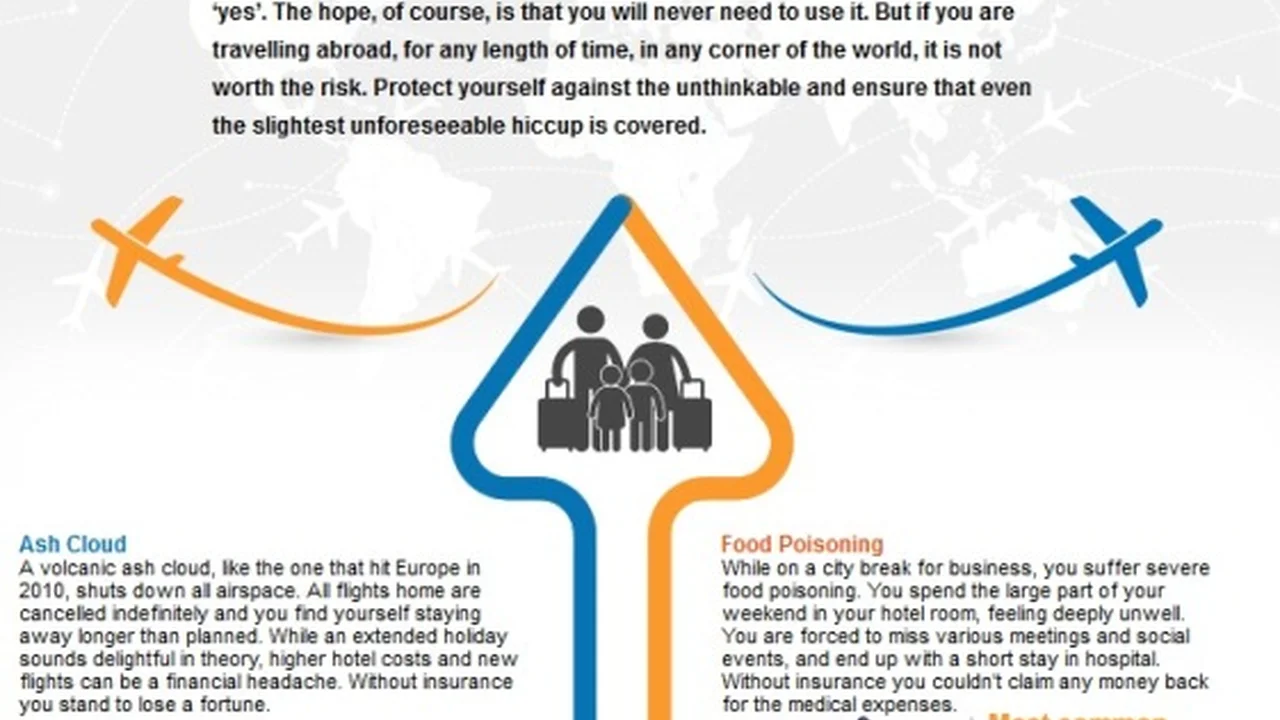

Life happens. Your flight gets canceled due to a snowstorm. A family emergency forces you to cut your trip short. Trip cancellation and interruption coverage can reimburse you for non-refundable expenses like flights, hotels, and tours. Most policies cover a range of reasons for cancellation, but again, read the fine print. Some policies exclude cancellations due to fear of travel or pre-existing conditions that flare up.

Lost or Stolen Luggage Protection with Travel Insurance Policies

Losing your luggage is a traveler's nightmare. But it happens. Travel insurance can help you replace your lost or stolen belongings. Make sure you keep receipts for expensive items and take photos of your luggage and its contents before you travel. Most policies have limits on the amount they'll pay out, so if you're traveling with valuable items, you might want to consider additional coverage.

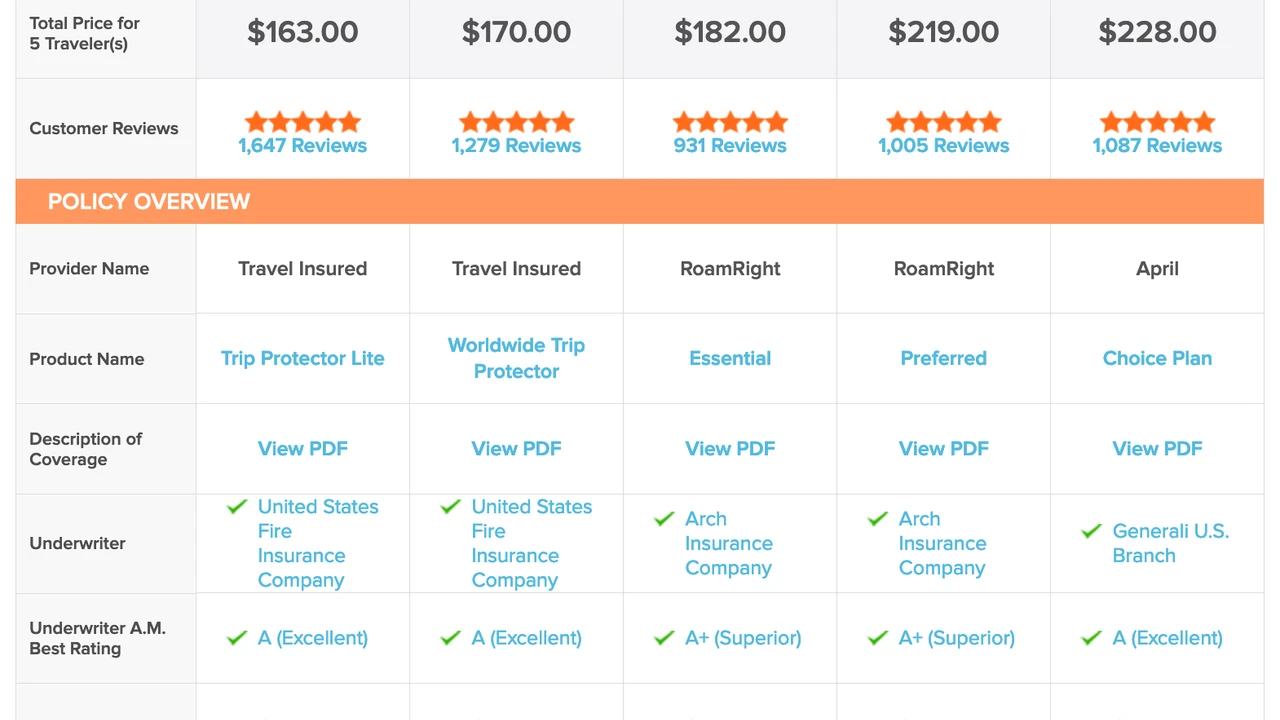

Specific Travel Insurance Product Recommendations and Comparisons

Okay, let's get down to brass tacks. Here are a few travel insurance companies and policies that are worth checking out:

- World Nomads: Great for adventurous travelers. They offer comprehensive coverage for a wide range of activities, including extreme sports. Their policies are flexible and can be purchased or extended while you're already traveling. Pricing varies depending on your destination, trip length, and age, but expect to pay around $50-$150 for a two-week trip. They excel in covering adventure activities, something many standard policies exclude. Imagine you're rock climbing in Thailand and require helicopter evacuation; World Nomads is likely to cover that.

- Allianz Global Assistance: A solid all-around option. They offer a variety of policies to suit different needs and budgets. Their plans often include trip cancellation, interruption, medical coverage, and lost luggage protection. Prices are competitive, typically ranging from $40-$120 for a two-week trip. Allianz is particularly good for families, offering options to cover kids at no extra cost. If your family trip to Disney World gets cut short due to illness, Allianz can help recoup those non-refundable park tickets and hotel costs.

- Travelex Insurance Services: Good for travelers looking for budget-friendly options. They offer basic coverage at affordable prices. Their plans might not be as comprehensive as World Nomads or Allianz, but they can still provide valuable protection. Expect to pay around $30-$100 for a two-week trip. Travelex shines when budget is the primary concern. If you're backpacking through Europe on a shoestring budget, Travelex can provide essential coverage without breaking the bank.

- IMG (International Medical Group): Primarily focuses on medical coverage. This is a great option for those who are more concerned about health related emergencies and less about trip interruption. Pricing can vary greatly depending on the level of medical coverage required, but generally aligns with the other options. IMG is a good choice for individuals with pre-existing medical conditions who require robust international health coverage.

Travel Insurance Use Cases and Real-World Scenarios

Let's paint some pictures:

- The Ski Trip Disaster: You're shredding the slopes in Aspen and take a nasty fall, breaking your leg. Without insurance, the medical bills and helicopter transport could easily exceed $50,000. With insurance, you're covered.

- The Cruise Catastrophe: You're on a dream cruise in the Caribbean when a hurricane hits, forcing the ship to return to port. Your trip is cut short, and you've lost several days of vacation. Trip interruption coverage can reimburse you for the unused portion of your cruise and any additional expenses.

- The Lost Laptop Lament: You're on a business trip to London, and your laptop is stolen from your hotel room. Travel insurance can help you replace your laptop, allowing you to continue working.

- The Emergency Evacuation: While hiking in a remote area, you experience a serious medical emergency. Travel insurance can cover the high costs of helicopter evacuation to the nearest medical facility, a crucial and potentially life-saving benefit.

Comparing Different Types of Travel Insurance Policies

Not all travel insurance policies are created equal. Here's a quick rundown of the different types:

- Single-Trip Policies: Cover one specific trip. Ideal for infrequent travelers.

- Multi-Trip Policies (Annual Policies): Cover multiple trips within a year. A good option for frequent travelers.

- Medical-Only Policies: Focus solely on medical coverage. Suitable for travelers who already have coverage for other aspects of their trip.

- Comprehensive Policies: Offer the most comprehensive coverage, including trip cancellation, interruption, medical coverage, and lost luggage protection.

Understanding Travel Insurance Costs and Pricing Factors

The cost of travel insurance depends on several factors, including:

- Your Age: Older travelers typically pay more.

- Your Destination: Traveling to countries with expensive healthcare will increase the cost.

- Trip Length: Longer trips cost more.

- Coverage Amount: Higher coverage limits will increase the cost.

- Pre-Existing Conditions: Covering pre-existing conditions will usually increase the cost.

You can get quotes from multiple insurance companies to compare prices and coverage options.

Travel Insurance for Specific Travel Scenarios (e.g., Cruises, Adventure Travel)

Certain types of travel require specialized insurance. For example:

- Cruises: Cruise insurance often includes coverage for missed port days, shipboard medical care, and emergency evacuation from the ship.

- Adventure Travel: Adventure travel insurance covers activities like skiing, scuba diving, and mountain climbing. Make sure the policy specifically covers the activities you're planning on doing.

- Backpacking: Backpacking insurance often includes coverage for lost or stolen gear, as well as medical coverage for remote areas.

Tips for Choosing the Right Travel Insurance Policy

Here are a few tips to help you choose the right travel insurance policy:

- Read the Fine Print: Understand what's covered and what's not.

- Compare Quotes: Get quotes from multiple insurance companies.

- Consider Your Needs: Choose a policy that meets your specific needs and budget.

- Look for 24/7 Assistance: Make sure the insurance company offers 24/7 assistance in case of an emergency.

- Check Reviews: See what other travelers have to say about the insurance company.

Travel Insurance Alternatives and Considerations

Are there alternatives to traditional travel insurance? Well, sometimes. Your existing health insurance might offer some coverage abroad, but it's usually limited. Credit cards often offer travel insurance benefits, but these are typically basic and might not cover everything you need. Self-insuring is another option, but it's risky. You'd need to have enough savings to cover any potential expenses. For most travelers, travel insurance is the best way to protect themselves financially.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)