Documenting Your Travel Insurance Claim: Tips for Success

Understanding the Importance of Thorough Documentation Travel Insurance Claim Success

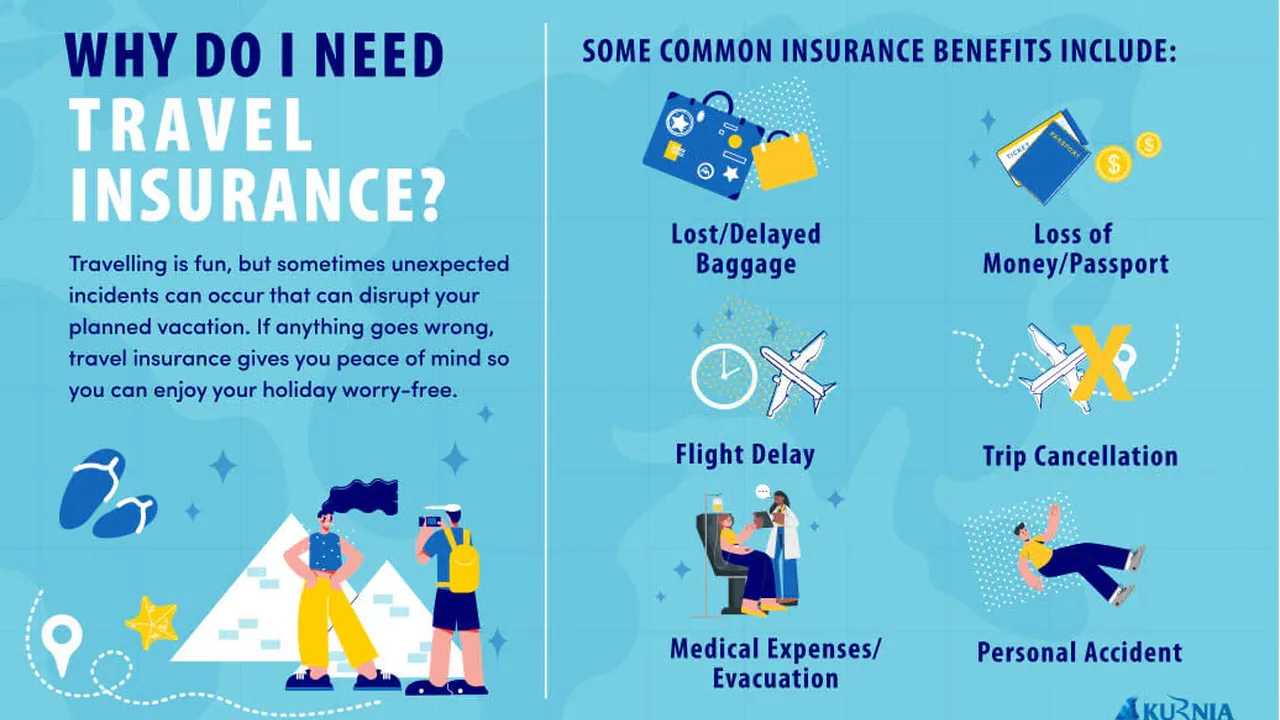

Hey there, fellow travelers! So, you've had a hiccup on your trip – a delayed flight, lost luggage, or maybe even a medical emergency. Travel insurance is your safety net, right? But filing a claim can feel like navigating a maze. The secret to a smooth claim process? Rock-solid documentation. Think of it as building your case – the stronger the evidence, the better your chances of a successful payout. This isn't just about throwing receipts at the insurance company; it's about painting a clear, compelling picture of what happened and why your claim is valid.

Gathering Essential Documents for Your Travel Insurance Claim The Ultimate Checklist

Okay, let's get down to brass tacks. What exactly should you be gathering? Here’s a comprehensive checklist to get you started:

- Your Insurance Policy: This is the holy grail. Know your coverage, limits, and exclusions inside and out.

- Travel Itinerary: Flight confirmations, hotel reservations, tour bookings – anything that proves your travel plans.

- Medical Records: If you required medical attention, gather all doctor's reports, hospital bills, prescriptions, and any other related documentation. Make sure they are translated to English if possible.

- Police Reports: For theft or loss, a police report is crucial. Get it filed as soon as possible after the incident.

- Proof of Purchase: Receipts for any items you're claiming for, whether it's lost luggage or necessary replacements.

- Photos and Videos: Visual evidence can be incredibly powerful. Take pictures of damaged luggage, medical conditions, or the scene of an incident.

- Correspondence: Keep copies of all emails, letters, and other communication with airlines, hotels, tour operators, and the insurance company.

- Witness Statements: If possible, get statements from anyone who witnessed the incident.

Detailed Receipts The Key to Validating Your Travel Insurance Claim

Receipts are your best friends when it comes to proving your losses. But not all receipts are created equal. Make sure your receipts are:

- Legible: Faded or blurry receipts are a no-go.

- Detailed: They should clearly state what you purchased, the date of purchase, and the amount paid.

- Original: Avoid submitting photocopies unless the original is unavailable.

If you're claiming for lost luggage, for example, you'll need receipts for the items that were in the suitcase. If you don't have the original receipts, try to get copies from the stores where you bought the items, or provide credit card statements as proof of purchase.

Writing a Compelling Claim Narrative For a Successful Travel Insurance Claim Submission

Don't just dump a pile of documents on the insurance company's desk and expect them to connect the dots. Write a clear and concise narrative that explains what happened, why you're making the claim, and how the supporting documents prove your case. Be sure to:

- Be Chronological: Tell the story in the order that it happened.

- Be Specific: Avoid vague language. Use precise details and dates.

- Be Honest: Never exaggerate or fabricate information.

- Be Concise: Get to the point quickly and avoid unnecessary details.

- Be Professional: Maintain a polite and respectful tone.

For example, instead of saying "My luggage was lost," say "On July 15, 2024, my checked luggage was lost by United Airlines on flight UA123 from New York to London. The baggage claim tag number was XYZ12345. The luggage contained the following items (list items with estimated value and proof of purchase when available)."

The Importance of Photos and Videos for Travel Insurance Claim Approval

A picture is worth a thousand words, right? Visual evidence can be incredibly helpful in supporting your claim. For example:

- Damaged Luggage: Take photos of the damage to your suitcase or its contents.

- Medical Conditions: If you suffered an injury or illness, take photos of the affected area.

- Theft or Vandalism: Take photos of the scene of the crime.

- Delayed Flights: A screenshot of the airport display board showing the delay can be useful.

Make sure your photos are clear, well-lit, and show the relevant details. Include a date and time stamp if possible. Videos can also be helpful, especially if they document the extent of the damage or the circumstances of the incident.

Navigating Pre-Existing Conditions in Your Travel Insurance Claim

Pre-existing conditions can be a tricky area when it comes to travel insurance. Most policies have exclusions or limitations on coverage for conditions that existed before you purchased the policy. It's crucial to:

- Disclose Everything: Be upfront about any pre-existing conditions when you purchase your policy.

- Understand the Policy: Carefully review the policy's terms and conditions regarding pre-existing conditions.

- Get Documentation: If you're claiming for a condition related to a pre-existing condition, provide detailed medical records from your doctor.

Some policies offer waivers for pre-existing conditions, but you may need to purchase additional coverage or meet certain requirements.

Lost or Stolen Items The Documentation You'll Need for a Travel Insurance Claim

Losing your belongings while traveling is stressful enough, but filing a claim for lost or stolen items can add to the frustration. To increase your chances of success:

- File a Police Report: This is essential. Get a copy of the report for your claim.

- Provide Proof of Ownership: Receipts, credit card statements, or photos can help prove that you owned the items.

- List the Items in Detail: Provide a detailed list of the lost or stolen items, including their estimated value and age.

Be aware that most policies have limits on the amount they will pay for certain types of items, such as jewelry or electronics.

Dealing with Flight Delays and Cancellations Documentation is Key for Travel Insurance Claims

Flight delays and cancellations are a common travel headache, and travel insurance can help cover some of the expenses you incur as a result. To file a claim:

- Get Documentation from the Airline: Obtain a written confirmation of the delay or cancellation, including the reason for the disruption.

- Keep Receipts for Expenses: Save receipts for any additional expenses you incur, such as meals, accommodation, or transportation.

- Understand the Policy's Coverage: Check your policy to see what types of expenses are covered and what the limits are.

Some policies may require you to first seek compensation from the airline before filing a claim with the insurance company.

Submitting Your Travel Insurance Claim A Step-by-Step Guide

Once you've gathered all the necessary documentation, it's time to submit your claim. Here's a step-by-step guide:

- Review the Claim Form: Carefully read the claim form and make sure you understand all the instructions.

- Complete the Form Accurately: Fill out all the required information completely and accurately.

- Attach Supporting Documents: Include all the necessary supporting documents, such as receipts, medical records, and police reports.

- Make Copies: Make copies of all the documents you're submitting for your records.

- Submit the Claim: Submit the claim form and supporting documents to the insurance company according to their instructions. This may be done online, by mail, or by email.

- Follow Up: Follow up with the insurance company to check on the status of your claim.

Travel Insurance Claim Denials Understanding Your Options and How to Appeal

Sometimes, despite your best efforts, your claim may be denied. If this happens, don't give up hope. You have the right to appeal the decision. To appeal a denial:

- Understand the Reason for Denial: Carefully review the denial letter to understand why your claim was rejected.

- Gather Additional Evidence: If possible, gather additional evidence to support your claim.

- Write a Letter of Appeal: Write a letter of appeal explaining why you believe the denial was incorrect and provide any additional information or documentation.

- Follow the Appeal Process: Follow the insurance company's appeal process carefully.

If you're still not satisfied with the outcome, you may be able to file a complaint with a consumer protection agency or seek legal advice.

Product Recommendations for Travel Documentation and Security

To make documenting your trip and protecting your belongings easier, here are a few product recommendations:

Waterproof Document Organizer

Product: YOMO Waterproof Document Organizer Bag

Description: This bag keeps all your important documents safe and dry, even in wet conditions. It's made from durable, waterproof material and has multiple compartments for organizing passports, tickets, receipts, and other essentials.

Use Case: Perfect for travelers who are going to destinations with unpredictable weather or who want to protect their documents from spills and accidents.

Comparison: While other organizers may offer similar features, the YOMO bag stands out for its superior waterproofing and durable construction. Cheaper options may not provide the same level of protection.

Price: Approximately $25

Portable Scanner

Product: Epson WorkForce ES-50 Portable Sheet-Fed Document Scanner

Description: This compact scanner allows you to quickly and easily scan receipts, documents, and photos while you're on the go. It's lightweight and portable, and it connects to your laptop or smartphone via USB.

Use Case: Ideal for travelers who need to digitize documents for insurance claims or other purposes. It eliminates the need to carry around bulky paper documents.

Comparison: Compared to other portable scanners, the Epson ES-50 offers fast scanning speeds and high-quality image resolution. Some cheaper options may be slower or produce lower-quality scans.

Price: Approximately $120

RFID Blocking Wallet

Product: Travelambo RFID Blocking Wallet

Description: This wallet protects your credit cards and passport from electronic theft by blocking RFID signals. It's slim and lightweight, and it has multiple slots for cards and cash.

Use Case: Essential for travelers who want to protect their personal information from identity theft while traveling in crowded areas or using public transportation.

Comparison: Many RFID blocking wallets are available, but the Travelambo wallet stands out for its stylish design and affordable price. Some more expensive options may offer additional features, such as a built-in money clip.

Price: Approximately $15

Luggage Tracker

Product: Apple AirTag

Description: Attach this small device to your luggage, backpack, or other belongings and track its location using your iPhone or iPad. It uses Apple's Find My network to provide location updates, even when the device is far away.

Use Case: Perfect for travelers who want to keep track of their luggage and prevent it from getting lost or stolen.

Comparison: While other luggage trackers are available, the Apple AirTag integrates seamlessly with Apple devices and offers a large network of users to help locate lost items. Tile trackers are a popular alternative, especially for Android users.

Price: Approximately $29

Final Thoughts on Documenting Your Travel Insurance Claim

Navigating the claims process might seem daunting, but remember: thorough documentation is your superpower. By following these tips and being proactive in gathering evidence, you'll significantly increase your chances of a successful claim. Happy travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)