Travel Insurance and Bankruptcy of Travel Suppliers: Claims

Understanding Travel Insurance Coverage for Supplier Bankruptcy

Okay, so you've booked your dream vacation, got your flights and hotels all sorted, and even purchased travel insurance. You're feeling good! But then, BAM! The travel supplier – the airline, the tour operator, the cruise line – files for bankruptcy. Panic sets in. What happens to your trip? And more importantly, what happens to your money?

This is where travel insurance can be a lifesaver. Many comprehensive travel insurance policies offer coverage for financial default, meaning the bankruptcy of a travel supplier. However, it's crucial to understand the specifics of your policy. Not all policies offer this coverage, and even those that do may have limitations.

First things first: Read your policy documents carefully! Look for sections about financial default, supplier insolvency, or similar terms. Pay attention to the definitions and exclusions. For example, some policies only cover bankruptcy if it occurs a certain number of days (e.g., 14, 21) before your scheduled departure. Others might only cover specific types of suppliers, like airlines or tour operators, and not hotels or car rental companies.

Key Considerations Before Filing a Claim for Supplier Bankruptcy

Before you jump into filing a claim, gather all your documentation. This includes your travel insurance policy, your booking confirmations, receipts for any payments made, and any official announcements about the bankruptcy. The more evidence you have, the smoother the claims process will be.

Contact your travel insurance provider as soon as possible. They can guide you through the claims process and answer any questions you have. Be prepared to provide them with all the documentation you've gathered. They'll likely ask for proof of payment, proof of the supplier's bankruptcy, and details about your original travel plans.

Keep in mind that there's usually a waiting period before you can file a claim. This is to allow the supplier time to potentially reorganize or find a buyer. Your insurance company will likely require you to wait a certain number of days (e.g., 30, 60) after the bankruptcy is announced before they'll process your claim. This is super important to know upfront.

Navigating the Claims Process: A Step-by-Step Guide to Travel Insurance

The claims process can seem daunting, but it's manageable if you take it one step at a time.

- Gather Your Documents: As mentioned earlier, collect all relevant documents, including your policy, booking confirmations, payment receipts, and bankruptcy announcements.

- Contact Your Insurer: Notify your insurance provider of the situation and ask about the claims process.

- File Your Claim: Complete the claims form accurately and honestly. Provide all the required information and attach copies of your supporting documents.

- Follow Up: Stay in touch with your insurance company and respond promptly to any requests for additional information.

- Be Patient: Claims can take time to process, so be patient and allow the insurance company sufficient time to review your claim.

Don't be afraid to ask questions! The claims process can be confusing, so don't hesitate to ask your insurance company for clarification on anything you don't understand. They're there to help you.

Choosing the Right Travel Insurance: Financial Default Coverage and Policy Comparison

When choosing travel insurance, pay close attention to the financial default coverage. Not all policies are created equal. Some policies may offer more comprehensive coverage than others. Look for policies that cover a wide range of suppliers and have minimal exclusions.

Here's a quick comparison of a few popular travel insurance providers and their financial default coverage:

- Allianz Global Assistance: Allianz offers comprehensive policies with financial default coverage. Check the specific policy details for limitations and exclusions.

- World Nomads: World Nomads offers adventure travel insurance with financial default coverage. Their policies are generally more expensive but offer broader coverage.

- Travel Guard: Travel Guard also provides policies with financial default coverage. Read the policy details carefully to understand the terms and conditions.

Remember to compare policies based on your specific needs and travel plans. Consider factors like the cost of your trip, the types of suppliers you're using, and your risk tolerance.

Recommended Travel Insurance Products: Features, Usage Scenarios, and Pricing

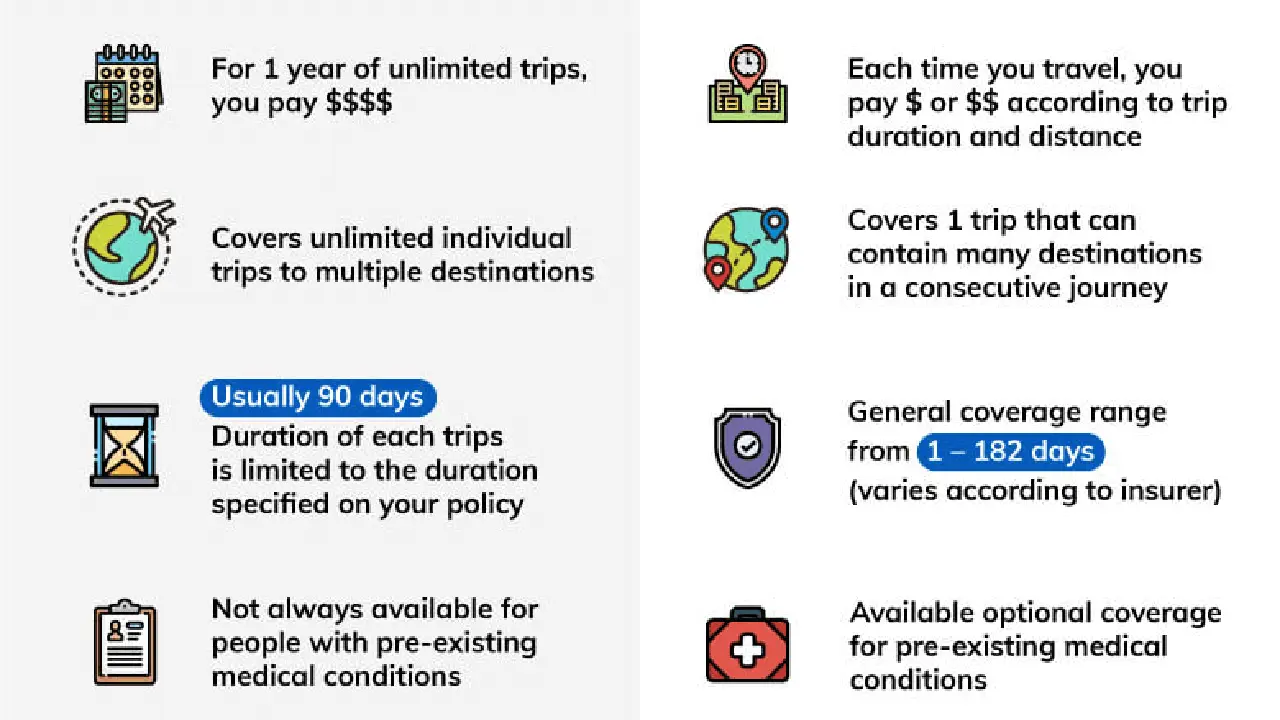

Let's dive into some specific travel insurance products and their features, usage scenarios, and pricing. Keep in mind that prices can vary depending on your age, destination, trip duration, and other factors. The prices listed below are approximate and should be verified with the insurance provider.

Allianz Global Assistance - AllTrips Premier Plan

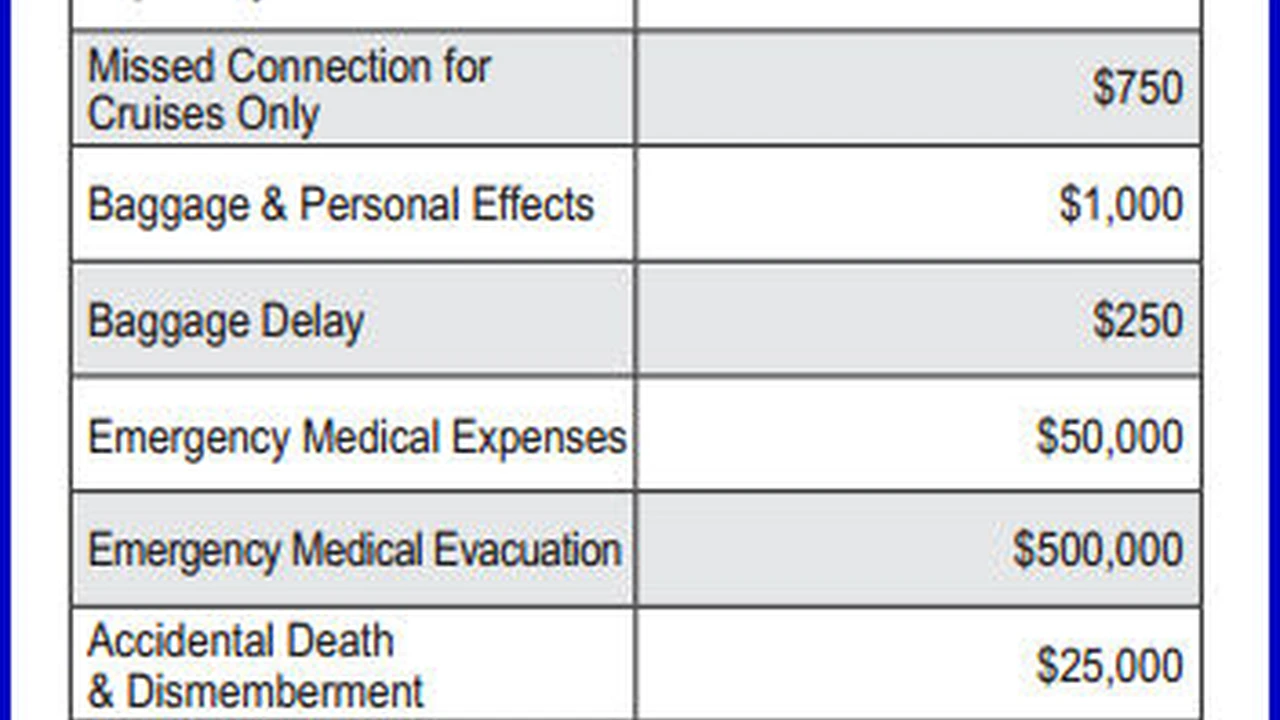

Features: This plan offers comprehensive coverage, including trip cancellation, trip interruption, baggage loss, medical expenses, and financial default coverage. It also includes 24/7 assistance.

Usage Scenario: This plan is ideal for travelers taking expensive trips or traveling to destinations with a higher risk of supplier bankruptcy. It provides peace of mind knowing that you're protected against a wide range of unforeseen events.

Approximate Price: $150 - $300 for a two-week trip, depending on the trip cost and traveler age.

World Nomads - Explorer Plan

Features: This plan is designed for adventurous travelers and offers coverage for activities like hiking, skiing, and scuba diving. It also includes financial default coverage, as well as coverage for medical emergencies and gear protection.

Usage Scenario: This plan is suitable for travelers who are planning adventurous activities and want comprehensive coverage, including protection against supplier bankruptcy.

Approximate Price: $200 - $400 for a two-week trip, depending on the destination and activities.

Travel Guard - Gold Plan

Features: This plan offers a balance of coverage and affordability. It includes trip cancellation, trip interruption, baggage loss, medical expenses, and financial default coverage. It also provides access to 24/7 assistance.

Usage Scenario: This plan is a good option for travelers who want comprehensive coverage at a reasonable price. It provides protection against a variety of travel-related risks, including supplier bankruptcy.

Approximate Price: $100 - $250 for a two-week trip, depending on the trip cost and traveler age.

Comparing Travel Insurance Products: Making the Right Choice

When comparing travel insurance products, consider the following factors:

- Coverage: What risks are covered by the policy? Does it include financial default coverage? What are the limitations and exclusions?

- Price: How much does the policy cost? Is it worth the price based on the coverage it provides?

- Deductible: How much will you have to pay out of pocket before the insurance company starts covering your losses?

- Customer Service: Does the insurance company have a good reputation for customer service? Are they responsive and helpful?

- Reviews: What are other travelers saying about the insurance company and their policies?

Reading online reviews and comparing policies side-by-side can help you make an informed decision and choose the right travel insurance for your needs.

Understanding Exclusions in Travel Insurance Policies: What's Not Covered

It's just as important to understand what's *not* covered by your travel insurance policy as it is to understand what *is* covered. Common exclusions in travel insurance policies include:

- Pre-existing medical conditions: Many policies exclude coverage for pre-existing medical conditions unless they are specifically covered by an endorsement.

- Acts of war or terrorism: Most policies exclude coverage for losses resulting from acts of war or terrorism.

- Participation in extreme sports: Some policies exclude coverage for injuries sustained while participating in extreme sports like bungee jumping or skydiving.

- Traveling against medical advice: If you travel against the advice of your doctor, your policy may not cover any medical expenses incurred during your trip.

- Illegal activities: Policies typically exclude coverage for losses resulting from illegal activities.

Always read the policy exclusions carefully to understand what's not covered. If you have any questions, contact your insurance provider for clarification.

Tips for Minimizing Your Risk of Supplier Bankruptcy

While travel insurance can protect you against financial losses due to supplier bankruptcy, there are also steps you can take to minimize your risk in the first place.

- Book with reputable suppliers: Choose established and financially stable travel suppliers with a good track record.

- Pay with a credit card: Credit cards offer consumer protection, which can help you recover your money if a supplier goes bankrupt.

- Monitor the supplier's financial health: Keep an eye on news and financial reports about the supplier you're using.

- Avoid booking too far in advance: The further out you book, the greater the risk that the supplier could go bankrupt before your trip.

- Consider purchasing travel insurance immediately after booking: This ensures that you're covered in case of supplier bankruptcy.

By taking these precautions, you can reduce your risk of being affected by supplier bankruptcy and enjoy a worry-free trip.

Alternative Solutions: Credit Card Chargebacks and Legal Recourse

If your travel insurance claim is denied, or if you don't have travel insurance, you may have other options for recovering your money. Two potential solutions are credit card chargebacks and legal recourse.

Credit Card Chargebacks

If you paid for your trip with a credit card, you may be able to file a chargeback with your credit card company. A chargeback is a dispute that you file with your credit card company to reverse a transaction. To file a chargeback, you'll need to provide evidence that the supplier failed to provide the services you paid for. This could include booking confirmations, payment receipts, and bankruptcy announcements.

Contact your credit card company as soon as possible to inquire about their chargeback policies and procedures. Be prepared to provide them with all the necessary documentation.

Legal Recourse

In some cases, you may be able to pursue legal action against the bankrupt supplier. This could involve filing a claim in bankruptcy court or pursuing a lawsuit. However, legal action can be expensive and time-consuming, and there's no guarantee of success.

Consult with an attorney to discuss your legal options and determine the best course of action.

Staying Informed: Resources for Tracking Travel Supplier Financial Health

Staying informed about the financial health of travel suppliers can help you avoid booking with companies that are at risk of bankruptcy. Here are some resources that can help you track travel supplier financial health:

- News articles: Follow news sources that cover the travel industry and report on supplier financial health.

- Financial reports: Review the financial reports of publicly traded travel suppliers.

- Travel forums: Participate in travel forums and discussions to learn about the experiences of other travelers.

- Travel advisories: Check for travel advisories issued by government agencies, which may warn about the financial instability of certain suppliers.

By staying informed, you can make more informed booking decisions and reduce your risk of being affected by supplier bankruptcy.

The Future of Travel Insurance: Adapting to Changing Industry Landscape

The travel industry is constantly evolving, and travel insurance is adapting to meet the changing needs of travelers. As the risk of supplier bankruptcy remains a concern, travel insurance providers are likely to offer more comprehensive coverage and develop new products to protect travelers against financial losses. The rise of online travel agencies and the sharing economy is also influencing the travel insurance landscape, with new policies emerging to cover risks associated with these platforms.

Staying informed about the latest trends in travel insurance can help you choose the right coverage for your trips and protect yourself against unforeseen events.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)