Travel Insurance for Digital Nomads: Staying Protected on the Road

Why Digital Nomads Need Specialized Travel Insurance Nomad Insurance Considerations

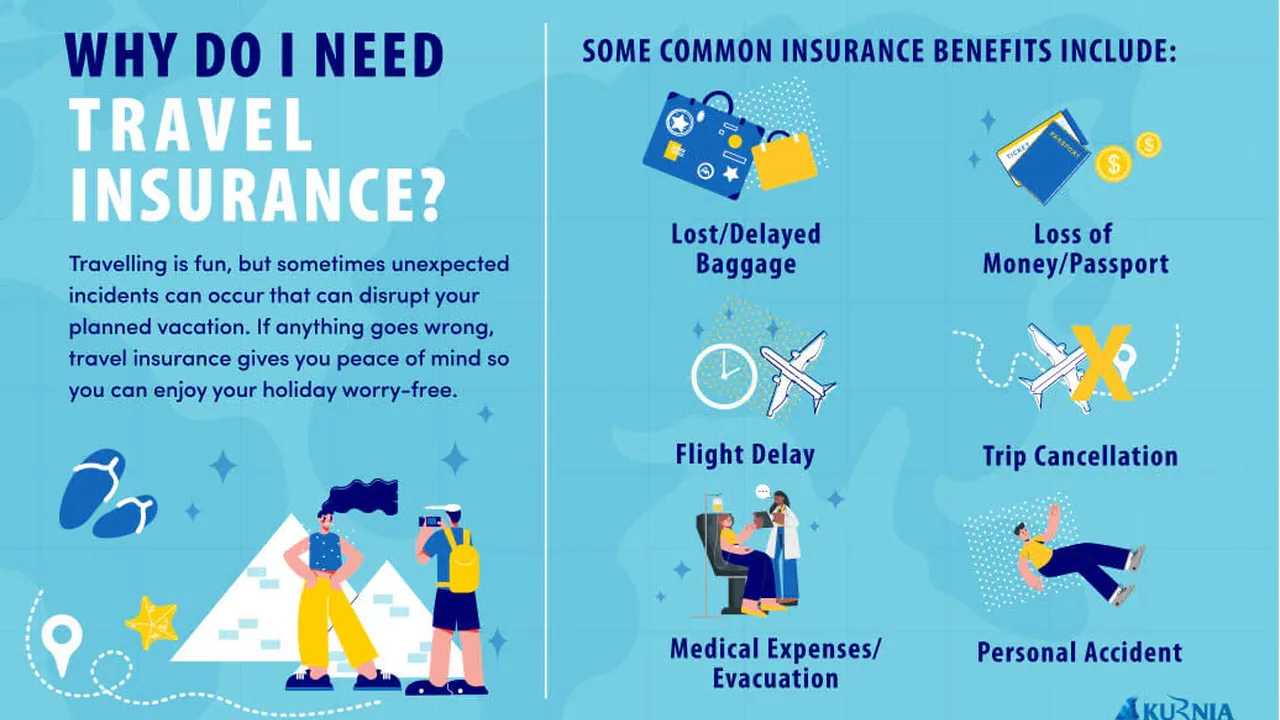

So, you're a digital nomad, living the dream – working remotely from exotic locales, exploring new cultures, and basically living life on your own terms. Awesome! But let's be real, that freedom comes with its own set of responsibilities, especially when it comes to staying safe and healthy. Regular travel insurance just doesn't cut it for us long-term travelers. We need something more robust, something designed for the unique challenges of the digital nomad lifestyle. Think about it: you're not just going on a two-week vacation; you're living abroad, possibly moving between countries frequently, and engaging in activities that might be considered "risky" by traditional insurers (think hiking, scuba diving, or even just renting a scooter in Southeast Asia).

That's where specialized travel insurance for digital nomads comes in. It's not just about covering medical emergencies; it's about peace of mind. Knowing you're covered if your laptop gets stolen, if you need to be evacuated from a remote location, or if you have to cancel your trip due to unforeseen circumstances. It’s an investment in your wellbeing and your ability to continue living this incredible lifestyle.

Key Coverage Areas For Digital Nomad Travel Insurance Coverage Details

When choosing travel insurance, make sure it covers these crucial areas:

- Medical Expenses: This is the big one. You need coverage for doctor visits, hospital stays, emergency surgeries, and prescription medications. Look for policies that offer high coverage limits (think $100,000 or more) and that cover pre-existing conditions (though this might come with a higher premium). Also, check if the policy has a deductible and how that deductible works.

- Emergency Evacuation: Imagine needing to be airlifted from a remote mountain village after an accident. This coverage pays for that. It's incredibly important, especially if you plan on traveling to off-the-beaten-path destinations. Make sure it includes repatriation of remains in the worst-case scenario.

- Trip Interruption/Cancellation: Life happens. You might need to cancel or interrupt your trip due to illness, injury, or a family emergency. This coverage reimburses you for non-refundable travel expenses.

- Lost or Stolen Belongings: Your laptop, camera, phone – these are essential tools for your work and your connection to the world. This coverage helps replace them if they're lost or stolen. Pay attention to the coverage limits and any exclusions (e.g., unattended belongings). Consider getting a separate policy for high-value items if necessary.

- Personal Liability: If you accidentally injure someone or damage their property, this coverage protects you from financial liability.

- Adventure Activities: Planning on going bungee jumping in New Zealand or scuba diving in Thailand? Make sure your policy covers these activities. Some policies exclude certain "high-risk" activities.

Top Travel Insurance Providers for Digital Nomads Recommended Insurance Companies

Okay, let's get down to specifics. Here are a few of the top travel insurance providers that cater to digital nomads:

- SafetyWing: This is a popular choice among digital nomads because it's affordable and flexible. They offer a subscription-based model, so you can pay monthly and cancel anytime. They cover medical expenses, emergency evacuation, and lost luggage. They don't cover pre-existing conditions or high-risk activities as standard, but these can be added.

Example Use Case: Sarah, a freelance writer, uses SafetyWing because she likes the flexibility of the monthly subscription and the fact that it covers her medical expenses while she's working remotely in Southeast Asia. Pricing: Starts around $45 per month. - World Nomads: World Nomads is another well-known provider that offers comprehensive coverage for a wide range of activities. They have different plans to choose from, depending on your needs. They cover medical expenses, emergency evacuation, trip interruption, and lost or stolen belongings. They also cover a wide range of adventure activities.

Example Use Case: Mark, a travel photographer, uses World Nomads because it covers his expensive camera equipment and his adventurous activities, like hiking and rock climbing. Pricing: Varies depending on the plan and your destination, but expect to pay around $80-$150 per month. - IMG Global Medical Insurance: IMG offers a more comprehensive and customizable option, particularly suited for long-term expats and digital nomads who want a higher level of coverage. They have plans that cover pre-existing conditions (with underwriting) and offer higher coverage limits than SafetyWing or World Nomads.

Example Use Case: Maria, a software developer who plans to live abroad for several years, chose IMG because she wanted comprehensive medical coverage, including coverage for pre-existing conditions and access to a global network of doctors and hospitals. Pricing: Significantly higher than SafetyWing or World Nomads, often starting around $200-$500 per month, depending on the level of coverage and your age and health. - Allianz Travel Insurance: Allianz offers a variety of travel insurance plans, including annual plans that can be a good option for frequent travelers. They cover trip cancellation, trip interruption, medical expenses, and lost or stolen belongings.

Example Use Case: David, a consultant who travels frequently for work, uses an Allianz annual travel insurance plan because it covers all of his trips throughout the year. Pricing: Varies depending on the plan and your destination, but annual plans can range from $300 to $1000 or more.

Comparing Travel Insurance Plans for Digital Nomads Features and Benefits Comparison

Choosing the right travel insurance plan can be overwhelming. Here's a quick comparison of the plans mentioned above:

| Provider | Key Features | Pros | Cons | Typical Price (Monthly) |

|---|---|---|---|---|

| SafetyWing | Subscription-based, medical expenses, emergency evacuation, lost luggage | Affordable, flexible, easy to use | Limited coverage for pre-existing conditions and high-risk activities | $45 |

| World Nomads | Comprehensive coverage, covers adventure activities | Wide range of coverage, good for adventurous travelers | More expensive than SafetyWing | $80-$150 |

| IMG Global Medical Insurance | Comprehensive medical coverage, covers pre-existing conditions (with underwriting) | High coverage limits, good for long-term expats | Most expensive option | $200-$500 |

| Allianz Travel Insurance | Variety of plans, annual plans available | Good for frequent travelers, convenient annual option | Coverage can vary significantly depending on the plan | Varies significantly |

Important Considerations:

- Destination: Some policies are more expensive in certain regions due to higher medical costs or increased risk.

- Age and Health: Your age and health can affect your premium. Older travelers and those with pre-existing conditions will typically pay more.

- Activities: If you plan on participating in high-risk activities, make sure your policy covers them.

- Coverage Limits: Make sure the coverage limits are adequate for your needs. Don't skimp on medical coverage or emergency evacuation.

- Deductible: Understand how the deductible works and how much you'll have to pay out-of-pocket before your coverage kicks in.

Real-World Scenarios Using Travel Insurance For Digital Nomads Case Studies

Let's look at a few real-world scenarios to illustrate the importance of travel insurance:

- Scenario 1: You're hiking in the Andes Mountains and break your leg. You need to be evacuated by helicopter to a hospital in a nearby city. Emergency evacuation coverage can save you tens of thousands of dollars.

- Scenario 2: Your laptop is stolen from your hostel in Barcelona. Lost or stolen belongings coverage can help you replace it quickly so you can get back to work.

- Scenario 3: You develop a severe allergic reaction to something you ate in Thailand and need to be hospitalized. Medical expense coverage can cover the cost of your treatment.

- Scenario 4: You need to cancel your trip due to a family emergency. Trip cancellation coverage can reimburse you for non-refundable flights and accommodations.

Affordable Travel Insurance Options For Digital Nomads Budget-Friendly Choices

Being a digital nomad often means being budget-conscious. Here are a few tips for finding affordable travel insurance:

- Compare quotes from multiple providers. Don't just settle for the first quote you get.

- Choose a higher deductible. This will lower your premium, but you'll have to pay more out-of-pocket if you need to file a claim.

- Consider a shorter coverage period. If you only need coverage for a specific trip, don't buy an annual plan.

- Look for discounts. Some providers offer discounts for students, seniors, or members of certain organizations.

- Read the fine print carefully. Make sure you understand what's covered and what's not.

Travel Insurance Claims Process For Digital Nomads Making a Claim Explained

Okay, so you've got your insurance, and unfortunately, you need to make a claim. Here's generally how it works:

- Document Everything: Keep records of everything related to your incident. This includes medical reports, police reports (if it's a theft), receipts for expenses, and any communication with doctors or authorities.

- Contact Your Insurer ASAP: Don't delay! Most insurance companies have a timeframe within which you need to report an incident. Call them or visit their website to start the claims process.

- Fill Out the Claim Form: You'll likely need to fill out a claim form, providing details about the incident and your policy information. Be accurate and thorough.

- Provide Supporting Documentation: This is where all that documentation you collected comes in handy. Submit copies of your medical reports, police reports, receipts, and any other relevant documents.

- Follow Up: Keep in touch with the insurance company and follow up on the status of your claim. Don't be afraid to ask questions.

- Appeal if Necessary: If your claim is denied, you have the right to appeal. Find out the reason for the denial and provide any additional information that might support your claim.

Staying Healthy and Safe While Traveling Tips and Resources

Travel insurance is crucial, but prevention is even better! Here are some tips for staying healthy and safe on the road:

- Get Vaccinated: Talk to your doctor about recommended vaccinations for your destination.

- Practice Food and Water Safety: Be careful about what you eat and drink. Drink bottled or purified water and avoid street food that looks questionable.

- Protect Yourself from Mosquitoes: Use insect repellent and sleep under a mosquito net.

- Be Aware of Your Surroundings: Avoid walking alone at night in unfamiliar areas.

- Learn Basic First Aid: Knowing basic first aid can be a lifesaver in an emergency.

- Stay Connected: Keep in touch with family and friends and let them know your itinerary.

- Register with Your Embassy: Register with your embassy so they can contact you in case of an emergency.

The Future of Travel Insurance For Digital Nomads Trends and Innovations

The world of travel insurance is constantly evolving. Here are a few trends and innovations to watch out for:

- More Personalized Coverage: Insurance companies are using data and technology to offer more personalized coverage options.

- Real-Time Assistance: Some providers offer real-time assistance through mobile apps, allowing you to get help quickly in an emergency.

- Integration with Travel Platforms: Travel insurance is becoming increasingly integrated with travel booking platforms, making it easier to purchase coverage when you book your flights and accommodations.

- Blockchain Technology: Blockchain technology could be used to streamline the claims process and reduce fraud.

Travel Insurance Jargon Demystified Understanding Insurance Terms

Insurance policies can be confusing, filled with jargon and technical terms. Here are a few common terms you should understand:

- Premium: The amount you pay for your insurance policy.

- Deductible: The amount you have to pay out-of-pocket before your coverage kicks in.

- Coverage Limit: The maximum amount your insurance policy will pay for a covered claim.

- Exclusion: A specific situation or event that is not covered by your insurance policy.

- Pre-existing Condition: A medical condition that you had before you purchased your insurance policy.

- Waiting Period: A period of time after you purchase your insurance policy before certain coverages become effective.

- Policy Wording: The legal document that outlines the terms and conditions of your insurance policy. Read it carefully!

Resources for Digital Nomads Travel Insurance and Health Information

Here are some useful resources for digital nomads:

- Travel Insurance Review Websites: Sites like InsureMyTrip and Squaremouth allow you to compare quotes from multiple providers.

- CDC (Centers for Disease Control and Prevention): The CDC website provides information on travel health advisories and recommended vaccinations.

- World Health Organization (WHO): The WHO website provides global health information and resources.

- Digital Nomad Forums and Communities: Online forums and communities like Nomad List and Reddit's r/digitalnomad are great places to ask questions and get advice from other digital nomads.

Making Informed Decisions About Your Health While Traveling

Being a digital nomad is an amazing experience, but it's important to prioritize your health and safety. By choosing the right travel insurance and taking precautions to stay healthy, you can enjoy your adventures with peace of mind.

Final Thoughts On Digital Nomad Insurance

Don’t leave home without it! Seriously, travel insurance for digital nomads is a non-negotiable expense. It’s the safety net that allows you to explore the world with confidence, knowing you’re protected from unexpected challenges. Do your research, compare your options, and choose a plan that fits your needs and your budget. Happy travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)