Travel Insurance for Group Travel: Simplifying Coverage

Understanding the Need for Group Travel Insurance Group Travel Benefits

Planning a trip with friends, family, or colleagues? Awesome! But before you pack your bags, let's talk about something crucial: travel insurance. Especially when you're traveling as a group, things can get a little… complicated. That's where group travel insurance comes in. It's like having a safety net for your entire crew, ensuring everyone is protected from unexpected hiccups along the way.

Think about it. Imagine one of your friends gets sick before the trip and has to cancel. Or, worse, someone gets injured while you're exploring a new city. Without insurance, these situations can quickly turn into financial nightmares. Group travel insurance can cover cancellation fees, medical expenses, lost luggage, and a whole lot more. It's peace of mind for everyone involved.

Key Benefits of Group Travel Insurance Comprehensive Coverage

So, what exactly does group travel insurance cover? Well, it depends on the policy, but generally, you can expect coverage for:

- Trip Cancellation/Interruption: If someone gets sick, injured, or has a family emergency, the policy can reimburse non-refundable trip costs.

- Medical Expenses: Covers medical bills if someone gets injured or becomes ill during the trip. This is especially important when traveling internationally.

- Lost or Stolen Luggage: Reimburses you for lost, stolen, or damaged luggage and personal belongings.

- Emergency Evacuation: Covers the cost of emergency medical transportation to a hospital or back home.

- 24/7 Assistance: Provides access to a helpline for assistance with medical emergencies, travel arrangements, and other issues.

Choosing the Right Group Travel Insurance Policy Factors to Consider

Not all group travel insurance policies are created equal. Here's what you need to consider when choosing the right one for your group:

- Coverage Limits: Make sure the policy provides adequate coverage limits for medical expenses, trip cancellation, and other potential losses.

- Deductibles: Understand the deductible amount and how it applies to different types of claims.

- Pre-existing Conditions: Check if the policy covers pre-existing medical conditions. Some policies exclude coverage for these conditions altogether.

- Activities Covered: If your group plans to participate in adventure activities like skiing, scuba diving, or rock climbing, make sure the policy covers these activities.

- Destination: Some policies may not cover certain destinations due to political instability or other risks.

Top Group Travel Insurance Providers Recommended Providers and Features

Here are a few reputable group travel insurance providers to consider:

- Allianz Global Assistance: Offers a wide range of group travel insurance plans with comprehensive coverage options. Known for their excellent customer service and 24/7 assistance.

- World Nomads: Popular among adventurous travelers, World Nomads offers flexible and affordable group travel insurance plans that cover a wide range of activities.

- Travel Guard: Provides customizable group travel insurance plans with options for trip cancellation, medical expenses, and lost luggage.

- Seven Corners: Specializes in international travel insurance, offering comprehensive plans suitable for groups traveling abroad. They have good options for both short and long-term trips.

Comparing Group Travel Insurance Plans Price Coverage and Benefits

Let's take a closer look at a few specific plans and compare their features and prices (prices are approximate and may vary):

| Provider | Plan Name | Price (per person, per week) | Key Features |

|---|---|---|---|

| Allianz Global Assistance | Trip Cancellation Plan | $50 | Trip cancellation/interruption, baggage loss, travel delay. |

| World Nomads | Explorer Plan | $75 | Trip cancellation/interruption, medical expenses, adventure activities. |

| Travel Guard | Gold Plan | $60 | Trip cancellation/interruption, medical expenses, emergency evacuation. |

| Seven Corners | Liaison Complete | $80 | Comprehensive medical coverage, trip interruption, and 24/7 assistance. Great for international trips. |

Allianz Global Assistance Trip Cancellation Plan: This is a solid choice if your primary concern is trip cancellation and interruption coverage. It's reasonably priced and offers good basic protection. Imagine your group is planning a ski trip, and one of your members breaks a leg before the trip. This plan would help reimburse the non-refundable costs of the ski passes and accommodation.

World Nomads Explorer Plan: If your group is planning an adventurous trip with activities like hiking, kayaking, or even volunteering abroad, the World Nomads Explorer Plan is a great option. It covers a broader range of activities and offers higher medical expense limits. Picture your group going on a backpacking trip in Southeast Asia. This plan would cover medical expenses if someone gets sick or injured while trekking.

Travel Guard Gold Plan: The Travel Guard Gold Plan is a comprehensive option that includes trip cancellation, medical expenses, and emergency evacuation coverage. It's a good choice if you want peace of mind knowing that you're protected from a wide range of potential problems. Think about your group going on a cruise. This plan would cover medical expenses if someone gets sick on board and needs medical attention.

Seven Corners Liaison Complete: For groups traveling internationally, especially for extended periods, the Seven Corners Liaison Complete plan offers excellent medical coverage and is designed for travelers staying outside their home country. It includes coverage for pre-existing conditions (with certain limitations) and 24/7 multilingual assistance. Imagine a group of students participating in a study abroad program. This plan would be ideal for covering their medical needs while they're away from home.

Real-Life Scenarios When Group Travel Insurance Comes in Handy Practical Examples

Let's look at some specific scenarios where group travel insurance can be a lifesaver:

- Scenario 1: The Pre-Trip Sickness. One of your group members comes down with a severe flu a week before the trip. They're unable to travel, and the entire group has to cancel their non-refundable hotel bookings. Group travel insurance can reimburse the cancellation fees.

- Scenario 2: The Lost Luggage. Your group arrives at your destination, but one person's luggage is lost. The insurance can provide reimbursement for essential items and, eventually, the lost luggage itself.

- Scenario 3: The Unexpected Injury. Someone in your group breaks their leg while hiking. The insurance covers the cost of medical treatment, including hospitalization and emergency transportation.

- Scenario 4: The Political Unrest. Your group is traveling to a country that experiences sudden political unrest. The insurance covers the cost of emergency evacuation to a safe location.

Tips for Buying Group Travel Insurance Streamlining the Process

Here are a few tips to make the process of buying group travel insurance easier:

- Start Early: Don't wait until the last minute to purchase insurance. The earlier you buy it, the more time you have to compare options and get the best deal.

- Shop Around: Get quotes from multiple providers to compare prices and coverage options.

- Read the Fine Print: Carefully review the policy terms and conditions to understand what is and isn't covered.

- Consider a Group Policy: Some providers offer group discounts for purchasing multiple policies together.

- Keep Documents Handy: Make sure each group member has a copy of the insurance policy and knows how to file a claim.

Making a Claim Tips and Best Practices

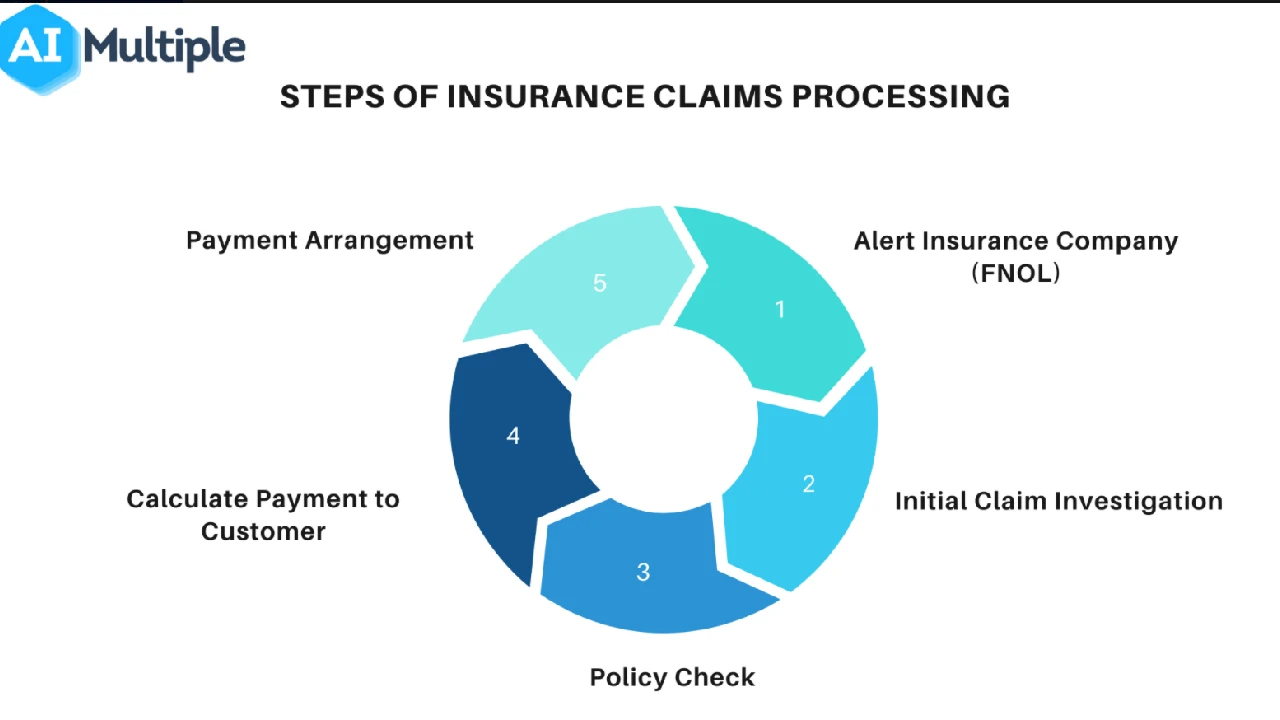

So, you need to make a claim. Here's how to do it right:

- Report the Incident Promptly: Contact the insurance provider as soon as possible after the incident occurs.

- Gather Documentation: Collect all relevant documentation, such as medical bills, police reports, and receipts.

- Fill Out the Claim Form Accurately: Provide all the required information on the claim form.

- Keep Copies of Everything: Make copies of all documents you submit to the insurance provider.

- Follow Up Regularly: Check the status of your claim and follow up with the insurance provider if you haven't heard back within a reasonable timeframe.

Group Travel Insurance vs Individual Travel Insurance Which is Better

While individual travel insurance can work, group travel insurance often offers better deals and simplified management for larger groups. It allows for a single point of contact and can sometimes result in lower per-person costs. However, consider the individual needs of your group members to ensure the chosen plan adequately covers everyone. For example, if one member has significantly higher medical needs, an individual policy might be more appropriate for them.

Future of Group Travel Insurance Trends and Innovations

The future of group travel insurance is likely to include more personalized and flexible options, driven by technology. Expect to see more AI-powered claim processing, real-time risk assessments, and customized plans that cater to the specific needs of different types of groups. Additionally, the integration of travel insurance with other travel booking platforms will become more seamless, making it easier for groups to purchase insurance alongside their flights and accommodations.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)