Travel Insurance for Road Trips: Staying Safe on the Road

Road Trip Travel Insurance Why You Need It

So, you're hitting the open road! Awesome! Road trips are all about freedom, adventure, and making memories. But let's be real – things can happen. A flat tire, a fender bender, or even a sudden illness can throw a wrench into your carefully planned itinerary. That's where travel insurance for road trips comes in. It's not just an extra expense; it's peace of mind knowing you're covered if things go sideways. It's like having a safety net for your adventure.

Understanding Travel Insurance Coverage for Road Trips Key Benefits

Okay, let's break down what travel insurance actually covers on a road trip. Think of it as a combination of different safety nets:

- Trip Interruption: Imagine your car breaks down halfway through your trip, and you have to cut it short. Trip interruption coverage can reimburse you for prepaid, non-refundable expenses like hotels and activities you miss out on.

- Medical Expenses: If you get sick or injured on the road, travel insurance can help cover medical bills, hospital stays, and even emergency transportation. This is especially important if you're traveling to a different state or country where your health insurance might not fully cover you.

- Emergency Evacuation: In a serious situation, like a major accident or a medical emergency in a remote location, emergency evacuation coverage can get you to the nearest appropriate medical facility. This can be incredibly expensive without insurance.

- Baggage Loss or Delay: While less critical than medical or trip interruption, baggage coverage can help if your luggage is lost, stolen, or delayed. It can cover the cost of replacing essential items like clothing and toiletries.

- Rental Car Coverage: Many travel insurance policies include coverage for rental cars, supplementing or replacing the Collision Damage Waiver (CDW) offered by rental companies. This can save you money and provide more comprehensive protection.

Road Trip Travel Insurance Choosing the Right Policy Key Considerations

Not all travel insurance policies are created equal. Here's what to look for when choosing a policy for your road trip:

- Coverage Limits: Make sure the policy has adequate coverage limits for medical expenses, trip interruption, and emergency evacuation. Consider the potential costs of these scenarios and choose a policy that will provide sufficient financial protection.

- Deductibles: Understand the deductible you'll have to pay before the insurance kicks in. A lower deductible usually means a higher premium, and vice versa. Choose a deductible that you're comfortable with.

- Exclusions: Read the fine print and understand what the policy doesn't cover. Common exclusions include pre-existing medical conditions, extreme sports, and acts of war. If you have any concerns, contact the insurance provider for clarification.

- Policy Duration: Make sure the policy covers the entire duration of your road trip. Some policies are only valid for a specific number of days.

- 24/7 Assistance: Choose a policy that offers 24/7 assistance in case of an emergency. This can be invaluable if you need help in the middle of the night or in a foreign country.

Specific Situations Covered By Travel Insurance on Road Trips

Let's dive into some specific scenarios where travel insurance can be a lifesaver on a road trip:

- Car Accidents: If you're involved in a car accident, travel insurance can help cover medical expenses, rental car costs, and even legal fees. It can also provide assistance with filing a claim and navigating the insurance process.

- Mechanical Breakdowns: While travel insurance typically doesn't cover the cost of repairing your car, it can cover trip interruption expenses if your car breaks down and you have to cancel or shorten your trip.

- Severe Weather: If severe weather forces you to cancel or delay your trip, travel insurance can reimburse you for prepaid, non-refundable expenses.

- Illness or Injury: If you get sick or injured on the road, travel insurance can cover medical expenses, hospital stays, and even emergency transportation.

- Lost or Stolen Belongings: If your belongings are lost or stolen, travel insurance can help cover the cost of replacing them.

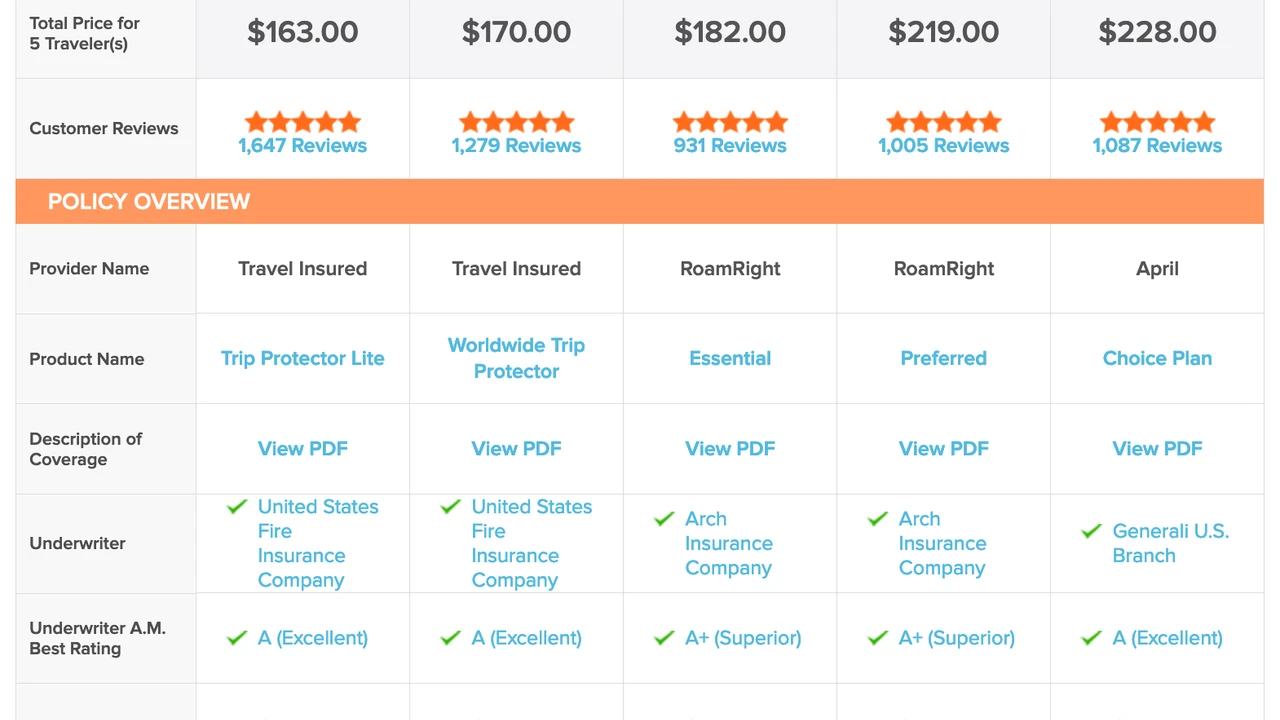

Recommended Travel Insurance Products for Road Trips Product Comparisons and Pricing

Alright, let's get down to brass tacks. Here are a few travel insurance companies and specific product recommendations suitable for road trips, along with some comparisons and pricing estimates (prices are approximate and can vary based on your specific trip details, age, and coverage levels. Always get a personalized quote):

- World Nomads: A popular choice for adventure travelers, World Nomads offers comprehensive coverage, including medical expenses, trip interruption, and emergency evacuation. They have two main plans: Standard and Explorer. The Explorer plan offers higher coverage limits and includes coverage for more adventurous activities.

- Pros: Comprehensive coverage, good for adventure activities, 24/7 assistance.

- Cons: Can be more expensive than other options.

- Typical Scenario: Ideal for a cross-country road trip with hiking and outdoor activities.

- Estimated Price: $75 - $150 per week, depending on the plan and your age.

- Allianz Travel Insurance: Allianz offers a variety of plans to suit different budgets and needs. Their "AllTrips Basic" plan is a good option for budget-conscious travelers, while their "AllTrips Prime" and "AllTrips Premier" plans offer more comprehensive coverage.

- Pros: Variety of plans to choose from, competitive pricing, good customer service.

- Cons: Coverage limits may be lower than World Nomads.

- Typical Scenario: Suitable for a family road trip with a focus on sightseeing and relaxation.

- Estimated Price: $50 - $120 per week, depending on the plan and your age.

- Travel Guard: Travel Guard is another well-known travel insurance provider with a range of plans to choose from. Their "Essential" plan is a basic option, while their "Preferred" and "Deluxe" plans offer more comprehensive coverage.

- Pros: Wide range of plans, good reputation, optional add-ons like rental car coverage.

- Cons: Can be more expensive than Allianz.

- Typical Scenario: A good choice for a road trip involving specific concerns like rental car damage or needing trip cancellation for any reason.

- Estimated Price: $60 - $130 per week, depending on the plan and your age.

- Seven Corners: Seven Corners specializes in international travel insurance, but they also offer plans suitable for domestic road trips. Their "RoundTrip Choice" plan is a popular option for travelers seeking comprehensive coverage.

- Pros: Excellent medical coverage, good for international travelers, 24/7 assistance.

- Cons: May be more expensive than other options for domestic travel.

- Typical Scenario: Perfect for a road trip that crosses into Canada or Mexico.

- Estimated Price: $80 - $160 per week, depending on the plan and your age.

Rental Car Insurance on Road Trips CDW vs Travel Insurance

When renting a car for your road trip, you'll likely be offered Collision Damage Waiver (CDW) from the rental company. But is it necessary if you have travel insurance? Here's the breakdown:

- CDW (Collision Damage Waiver): This waives your responsibility for damage to the rental car in case of an accident or theft. It's expensive, often costing $10-$30 per day.

- Travel Insurance with Rental Car Coverage: Some travel insurance policies include coverage for rental cars, supplementing or replacing the CDW. This can save you money and provide more comprehensive protection.

Should you get CDW or rely on travel insurance?

If your travel insurance policy offers adequate rental car coverage, you can likely skip the CDW. However, make sure to check the policy details and understand the coverage limits, deductibles, and exclusions. Also, be aware that filing a claim with your travel insurance company may require more paperwork than simply accepting the CDW. Consider your risk tolerance and budget when making your decision.

Emergency Roadside Assistance and Travel Insurance Combining Coverage

Roadside assistance programs like AAA can be incredibly helpful on a road trip, but they don't cover everything. Travel insurance can complement roadside assistance by providing coverage for medical expenses, trip interruption, and other unexpected events.

Consider this scenario: You get a flat tire in the middle of nowhere. Your AAA membership covers the cost of towing your car to the nearest repair shop. However, you also develop a fever and need to see a doctor. Your travel insurance can cover the cost of the medical visit and any necessary medication.

By combining roadside assistance with travel insurance, you can have comprehensive protection against a wide range of potential problems on your road trip.

Tips for a Safe and Insured Road Trip Road Trip Planning Essentials

Before you hit the road, here are a few tips to ensure a safe and insured road trip:

- Plan your route: Research your route and identify potential hazards, such as construction zones, mountain passes, and areas prone to severe weather.

- Get your car serviced: Make sure your car is in good working condition before you leave. Check the tires, brakes, fluids, and lights.

- Pack an emergency kit: Include items like a first-aid kit, flashlight, jumper cables, tire inflator, and extra food and water.

- Share your itinerary: Let someone know your route and estimated arrival times.

- Drive safely: Obey traffic laws, avoid distractions, and take breaks when you're tired.

- Keep your travel insurance information handy: Have your policy number and contact information readily available in case of an emergency.

Travel Insurance Claims Process for Road Trips What to Do in Case of an Emergency

Knowing what to do in an emergency and how to file a claim is crucial. Here's a quick guide:

- Document Everything: Keep receipts, police reports (if applicable), and medical records. Photos of damage or incidents are invaluable.

- Contact Your Insurance Provider Immediately: Most policies require you to notify them as soon as possible after an incident.

- Follow Their Instructions: They will guide you through the claims process and let you know what documents are needed.

- Be Honest and Accurate: Provide all the information truthfully and completely.

- Keep Copies: Keep copies of all documents you submit for your records.

Remember, travel insurance is there to help you when things go wrong. By understanding your coverage and following these tips, you can have a safer and more enjoyable road trip.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)