Travel Insurance for Students Studying Abroad: A Guide

Why Travel Insurance is Essential for International Students

Studying abroad is an amazing experience, but let's face it, things can go wrong. Think about it: lost luggage, a sudden illness, or even needing to cut your trip short due to a family emergency. That's where travel insurance comes in. It's not just a nice-to-have; it's a must-have for peace of mind. Imagine getting sick in a foreign country and being hit with a massive medical bill you can't afford. Or losing your laptop right before a big presentation. Travel insurance can help cover these unexpected costs, allowing you to focus on your studies and enjoy your time abroad.

Understanding Different Types of Travel Insurance for Students

Not all travel insurance is created equal. There are several types, and it's important to pick the one that best suits your needs. Here's a breakdown:

- Trip Cancellation Insurance: This covers you if you have to cancel your trip before you even leave, usually due to unforeseen circumstances like illness or a family emergency.

- Trip Interruption Insurance: Similar to cancellation insurance, but it kicks in *during* your trip. If you have to cut your study abroad program short, this can help reimburse you for unused expenses.

- Medical Insurance: This is arguably the most important, especially when studying in a country with expensive healthcare. It covers doctor's visits, hospital stays, and even emergency medical evacuation.

- Baggage Insurance: Covers lost, stolen, or damaged luggage.

- Personal Liability Insurance: Protects you if you accidentally cause damage to someone else's property or injure someone.

Key Considerations When Choosing Student Travel Insurance

Okay, so you know you need travel insurance, but how do you choose the right one? Here are some key factors to consider:

- Coverage Limits: Make sure the policy has adequate coverage for medical expenses, baggage loss, and other potential issues. Don't just go for the cheapest option; consider the risks involved.

- Deductibles: The deductible is the amount you'll have to pay out-of-pocket before the insurance kicks in. A lower deductible usually means a higher premium.

- Exclusions: Read the fine print! Many policies have exclusions, such as pre-existing medical conditions, extreme sports, or travel to certain countries.

- 24/7 Assistance: Look for a policy that offers 24/7 assistance in case of emergencies. You want to be able to reach someone who can help you, no matter the time of day.

- Reputation: Check online reviews and ratings to see what other students have to say about the insurance provider.

Specific Situations and How Travel Insurance Can Help

Let's dive into some specific scenarios where travel insurance can be a lifesaver:

Medical Emergencies and Student Travel Insurance

Imagine you're hiking in the mountains and twist your ankle. You need to see a doctor and maybe even get an X-ray. Without travel insurance, you could be facing a hefty medical bill. Travel insurance can cover these costs, ensuring you get the medical care you need without breaking the bank.

Lost or Stolen Belongings and Student Travel Insurance

Losing your passport or having your laptop stolen can be a nightmare. Travel insurance can help cover the cost of replacing these essential items. Some policies also offer assistance with reporting the loss to the authorities.

Trip Cancellation or Interruption and Student Travel Insurance

Life happens. If you have to cancel your trip due to illness or a family emergency, travel insurance can reimburse you for non-refundable expenses like flights and accommodation. Similarly, if you have to cut your trip short, it can help cover the cost of getting home.

Political Unrest or Natural Disasters and Student Travel Insurance

Unfortunately, these things can happen. If there's political unrest or a natural disaster in your study abroad location, travel insurance can help you evacuate safely and cover the cost of alternative accommodation.

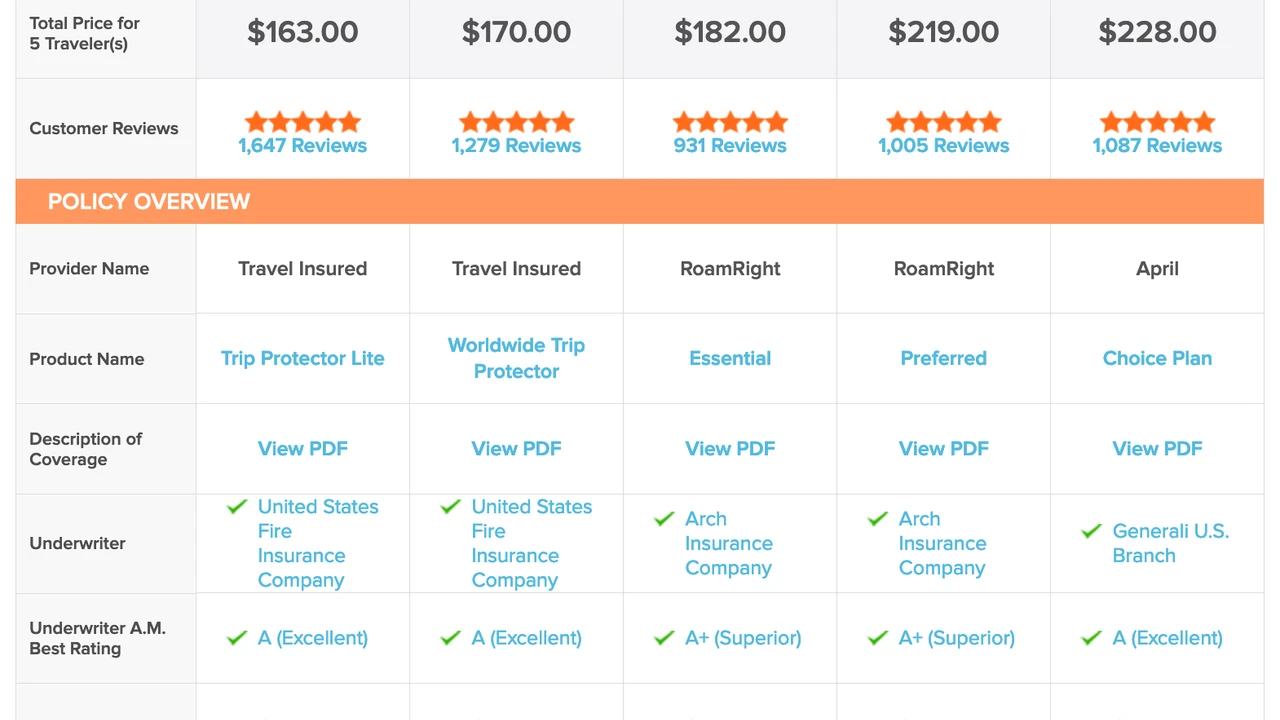

Recommended Travel Insurance Providers and Products for Students Studying Abroad

Here are a few reputable travel insurance providers that offer plans specifically designed for students studying abroad:

International Student Insurance (ISI)

ISI offers a range of plans with different levels of coverage. They are known for their comprehensive medical coverage and 24/7 assistance. They offer plans tailored for different study abroad durations and destinations. A basic plan might cost around $50 per month, while a more comprehensive plan could be closer to $100 per month. They are a good option if you prioritize medical coverage and want a reliable provider.

World Nomads Travel Insurance

World Nomads is a popular choice among travelers, including students. They offer flexible plans that can be customized to your specific needs. They also cover a wide range of activities, including adventure sports. They are known for their easy-to-use website and responsive customer service. A basic plan covering a 6-month study abroad program could range from $300-$500, depending on the destination and coverage options. World Nomads is a great choice if you plan on doing a lot of traveling during your study abroad program.

Allianz Travel Insurance

Allianz is a well-established insurance company that offers a variety of travel insurance plans. They have plans specifically designed for students studying abroad, with coverage for medical expenses, trip cancellation, and lost baggage. Allianz offers a variety of add-ons, such as coverage for pre-existing medical conditions. Prices vary greatly depending on the plan and coverage options, but you can expect to pay anywhere from $60-$120 per month for a decent student plan. Allianz is a good option if you want a reputable and reliable insurance provider with a wide range of coverage options.

Comparing Travel Insurance Products: Features, Coverage, and Price

Let's compare the three providers mentioned above based on key factors:

| Provider | Key Features | Medical Coverage | Trip Cancellation Coverage | Baggage Loss Coverage | Price (Approx. per month) |

|---|---|---|---|---|---|

| International Student Insurance (ISI) | Comprehensive medical coverage, 24/7 assistance | Excellent | Good | Good | $50 - $100 |

| World Nomads | Flexible plans, covers adventure sports | Good | Excellent | Good | $50 - $83 (based on a 6-month plan averaging $400) |

| Allianz Travel Insurance | Reputable company, wide range of options | Good | Good | Good | $60 - $120 |

Important Note: Prices are approximate and can vary depending on your destination, duration of stay, and specific coverage needs. Always get a quote from each provider to compare prices and coverage options.

Understanding Insurance Jargon: Deductibles, Co-pays, and Coverage Limits

Insurance policies can be confusing, with all their jargon. Let's break down some common terms:

- Deductible: The amount you pay out-of-pocket before the insurance kicks in.

- Co-pay: A fixed amount you pay for each medical visit or service.

- Coverage Limit: The maximum amount the insurance will pay for a particular type of claim.

- Pre-existing Condition: A medical condition you had before you purchased the insurance policy. Some policies may exclude coverage for pre-existing conditions.

Tips for Filing a Travel Insurance Claim Successfully

If you need to file a claim, here are some tips to increase your chances of success:

- Document Everything: Keep copies of all your travel documents, medical records, and receipts.

- File the Claim Promptly: Don't wait until you get home to file your claim. The sooner you file, the better.

- Provide Accurate Information: Be honest and accurate when filling out the claim form.

- Follow Up: Don't be afraid to follow up with the insurance company to check on the status of your claim.

The Importance of Reading the Fine Print: Exclusions and Limitations

We can't stress this enough: read the fine print! Pay attention to the exclusions and limitations of the policy. This will help you avoid any surprises later on.

How to Get the Best Deal on Student Travel Insurance

Here are some tips for saving money on student travel insurance:

- Shop Around: Compare quotes from multiple providers.

- Consider a Higher Deductible: A higher deductible will lower your premium.

- Look for Discounts: Some providers offer discounts for students or members of certain organizations.

- Bundle Your Insurance: If you need multiple types of insurance, consider bundling them together for a discount.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)