Trip Cancellation Claims: What You Need to Know

Understanding Trip Cancellation Insurance and When to Use It

Okay, so you've booked that dream vacation. Flights, hotels, excursions – the whole shebang. You're practically already sipping Mai Tais on the beach, right? But then… life happens. A sudden illness, a family emergency, a hurricane decides to crash your party. That's where trip cancellation insurance swoops in like a travel-saving superhero.

Trip cancellation insurance is basically a safety net for your travel investment. It reimburses you for prepaid, non-refundable travel expenses if you have to cancel your trip for a covered reason. Think of it as a "get out of jail free" card for unexpected travel disruptions.

But here's the thing: it's not a magic wand. You can't just decide you'd rather binge-watch Netflix and expect a refund. Covered reasons typically include:

- Illness or Injury: Yours, a traveling companion's, or a close family member's. (Doctor's note required, naturally.)

- Death: Sadly, this happens.

- Natural Disasters: Hurricanes, earthquakes, floods – Mother Nature's tantrums.

- Job Loss: If you're unexpectedly laid off.

- Jury Duty: Because civic duty sometimes trumps vacation dreams.

- Terrorist Acts: Unfortunately, a reality we have to consider.

Read the fine print! Each policy has its own list of covered reasons and exclusions. For example, most policies won't cover pre-existing medical conditions unless you purchase a waiver. And "buyer's remorse" is definitely not a covered reason.

Navigating the Trip Cancellation Claims Process A Step-by-Step Guide

Alright, so you had to cancel your trip. Bummer. But don't despair! Here's how to file a claim and (hopefully) get your money back:

- Notify the Travel Providers ASAP: Airlines, hotels, tour operators – let them know you're canceling. This is crucial, as some providers may offer partial refunds or credits even without insurance.

- Gather Your Documentation: This is where organization is key. You'll need:

- Your insurance policy details (policy number, coverage dates, etc.)

- Your original travel itinerary (flights, hotels, tours)

- Proof of payment (receipts, credit card statements)

- Documentation supporting your reason for cancellation (doctor's note, police report, layoff notice, etc.)

- File Your Claim: Contact your insurance provider and follow their instructions for filing a claim. Most providers have online claim forms, but some may require you to mail in your documentation.

- Be Patient: Claims processing can take time. Don't expect a check to magically appear overnight. The insurance company will investigate your claim and may request additional information.

- Follow Up: If you haven't heard back from the insurance company within a reasonable timeframe (usually a few weeks), follow up to check on the status of your claim.

- Appeal If Necessary: If your claim is denied, don't give up immediately. Review the reason for the denial and see if you can provide additional documentation or clarification to support your claim. You have the right to appeal the decision.

Essential Documents for a Successful Trip Cancellation Claim

Let's break down those essential documents a bit more. Having these ready will significantly speed up your claim processing and increase your chances of a successful outcome.

- Your Insurance Policy: This is the foundation. Know your coverage limits, deductible (the amount you pay out-of-pocket), and covered reasons.

- Detailed Travel Itinerary: Every flight number, hotel confirmation, tour booking – everything. Make sure it matches your receipts.

- Proof of Payment: Credit card statements, bank statements, receipts. These need to clearly show the amounts you paid and to whom.

- Medical Documentation (If Applicable): A doctor's note specifically stating you (or your traveling companion/family member) were unable to travel due to a medical condition. It needs to be dated and signed by a licensed physician. HIPAA compliance is crucial here; make sure the doctor understands what information the insurance company needs.

- Police Report (If Applicable): If your trip was cancelled due to theft or a crime, a police report is essential.

- Layoff Notice (If Applicable): Official documentation from your employer stating you were laid off.

- Death Certificate (If Applicable): A copy of the death certificate if the cancellation was due to the death of a family member.

Common Reasons for Trip Cancellation Claim Denials and How to Avoid Them

Unfortunately, trip cancellation claims aren't always approved. Here are some common reasons for denials and how to avoid them:

- Pre-Existing Medical Conditions: As mentioned earlier, most policies exclude pre-existing conditions unless you purchase a waiver. Avoidance: Disclose any pre-existing conditions when purchasing your policy and consider a waiver.

- Insufficient Documentation: Missing receipts, incomplete medical notes, lack of proof of payment. Avoidance: Keep meticulous records of all travel-related expenses and documentation.

- Cancellation Not Due to a Covered Reason: "I changed my mind" or "I didn't feel like going" are not covered reasons. Avoidance: Understand your policy's covered reasons before purchasing.

- Failure to Notify Travel Providers Promptly: Failing to cancel your reservations with airlines, hotels, etc., can limit your reimbursement. Avoidance: Cancel your reservations as soon as you know you can't travel.

- Claim Exceeds Coverage Limits: Your policy may have limits on the amount it will reimburse for certain expenses. Avoidance: Choose a policy with sufficient coverage for your travel investment.

- Misrepresentation of Facts: Lying or providing false information on your claim form. Avoidance: Be honest and accurate in your claim submission.

Maximizing Your Trip Cancellation Insurance Claim The Expert Tips

Want to increase your chances of a successful claim? Here are some insider tips:

- Purchase Your Policy Early: The sooner you buy your policy after booking your trip, the better. Some policies have waiting periods before certain coverages take effect.

- Read the Fine Print (Seriously!): Don't just skim the policy. Understand the covered reasons, exclusions, and claim procedures.

- Keep Copies of Everything: Make digital and physical copies of all your travel documents, receipts, and insurance policy.

- Communicate Clearly and Concisely: When filing your claim, be clear, concise, and provide all the necessary information.

- Be Polite and Professional: Dealing with insurance companies can be frustrating, but staying polite and professional will help you get better results.

- Consider a "Cancel For Any Reason" Policy: These policies are more expensive, but they allow you to cancel your trip for any reason and receive a partial reimbursement (usually 50-75%).

Understanding "Cancel For Any Reason" (CFAR) Trip Insurance and its Benefits

Okay, let's dive deeper into Cancel For Any Reason (CFAR) insurance. This is the gold standard of trip cancellation coverage, but it comes at a premium. The big advantage? You can cancel your trip... well, for *any* reason. Didn't like the weather forecast? Your cat got a cold? Suddenly decided you'd rather remodel your bathroom? CFAR *might* cover it (though the cat thing is pushing it).

However, there are crucial caveats:

- Partial Reimbursement: CFAR policies typically only reimburse 50-75% of your non-refundable trip costs. You're still losing some money.

- Time Restrictions: You usually have to purchase CFAR within a short window after booking your trip (often 14-21 days).

- Cancellation Deadline: You must cancel your trip at least 48 hours (sometimes more) before your scheduled departure.

- Higher Premium: CFAR policies are significantly more expensive than standard trip cancellation insurance. Expect to pay 40-60% more.

When is CFAR worth it?

- Expensive Trips: If you're investing a significant amount of money in your trip, the peace of mind CFAR offers might be worth the extra cost.

- Uncertain Travel Plans: If you anticipate a higher-than-normal chance of needing to cancel (e.g., you're waiting for a medical diagnosis), CFAR can provide a safety net.

- High-Demand Travel: If you're traveling during peak season and know it will be difficult to rebook your trip, CFAR can help you recoup some of your losses.

Comparing Different Types of Trip Cancellation Insurance Policies Finding the Right Fit

Choosing the right trip cancellation insurance can feel overwhelming. Here's a breakdown of the different types and what they offer:

- Standard Trip Cancellation Insurance: Covers cancellation for specific covered reasons (illness, injury, death, natural disasters, etc.). Most affordable option.

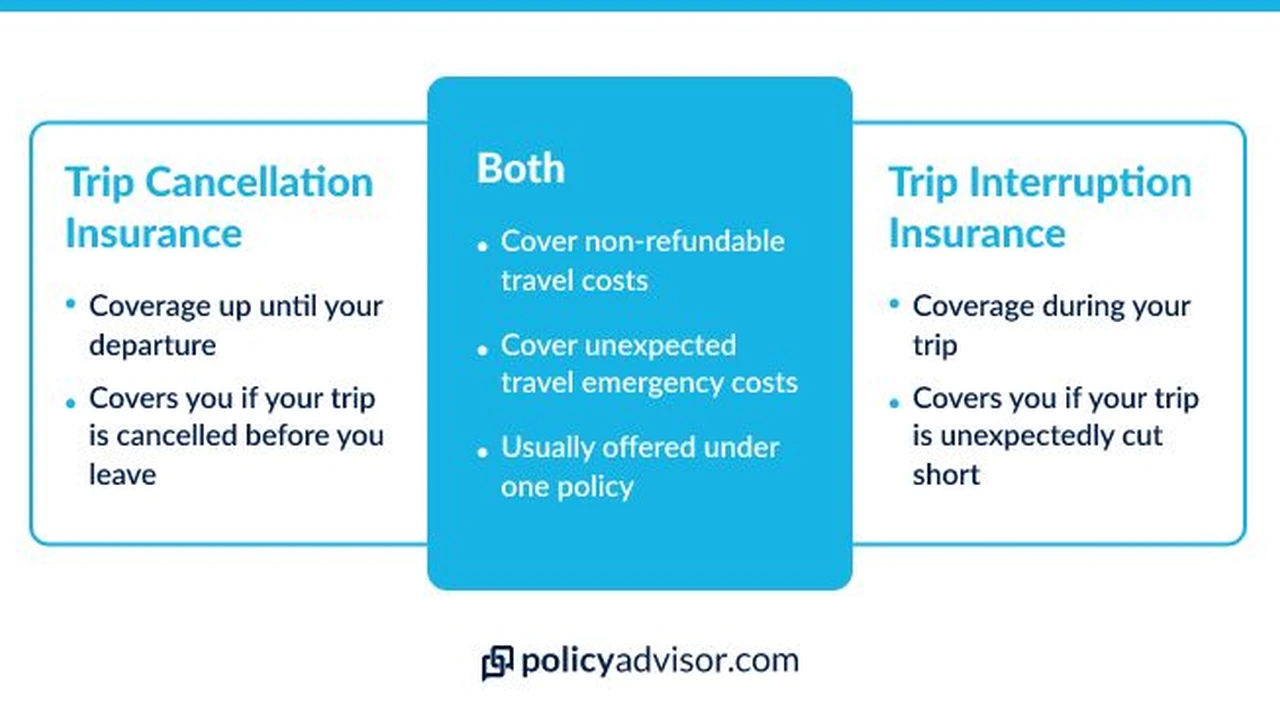

- Trip Interruption Insurance: Covers expenses if your trip is interrupted *after* it has begun (e.g., you get sick while on vacation and need to return home early). Often included with standard trip cancellation insurance.

- Cancel For Any Reason (CFAR) Insurance: Allows you to cancel your trip for any reason and receive a partial reimbursement. Most expensive option.

- Travel Medical Insurance: Covers medical expenses incurred while traveling. Important if your health insurance doesn't provide adequate coverage abroad.

- Baggage Insurance: Covers lost, stolen, or damaged luggage.

Factors to consider when choosing a policy:

- Trip Cost: Choose a policy with sufficient coverage to protect your entire travel investment.

- Destination: Some policies offer better coverage for certain destinations (e.g., areas prone to natural disasters).

- Travel Style: Consider your travel style (adventure travel, luxury travel, etc.) and choose a policy that meets your specific needs.

- Medical History: Disclose any pre-existing medical conditions and consider a waiver if necessary.

- Budget: Balance the cost of the policy with the level of coverage you need.

Recommended Trip Cancellation Insurance Providers and Products

Alright, let's get down to brass tacks. Here are a few reputable trip cancellation insurance providers and some of their popular products, along with pricing examples (note: prices can vary based on your trip details):

- Allianz Global Assistance: A well-known and respected provider with a variety of plans.

- Allianz TravelSmart: A comprehensive plan that includes trip cancellation, trip interruption, baggage loss, and medical coverage. Price Estimate: $150-$300 for a $5,000 trip.

- Allianz Prime: A more basic plan with lower coverage limits, but still offers essential trip cancellation protection. Price Estimate: $80-$150 for a $5,000 trip.

- World Nomads: Popular with adventure travelers, offering coverage for a wide range of activities.

- Standard Plan: Covers trip cancellation, trip interruption, medical expenses, and adventure activities. Price Estimate: $200-$400 for a $5,000 trip, depending on activities covered.

- Explorer Plan: Offers higher coverage limits and includes additional benefits, such as rental car damage coverage. Price Estimate: $300-$500 for a $5,000 trip, depending on activities covered.

- Travel Guard: Another reputable provider with a variety of customizable plans.

- Deluxe Plan: A comprehensive plan that includes trip cancellation, trip interruption, baggage loss, medical coverage, and rental car collision coverage. Price Estimate: $180-$350 for a $5,000 trip.

- Essential Plan: A more affordable option with lower coverage limits, but still offers essential trip cancellation protection. Price Estimate: $100-$200 for a $5,000 trip.

- Seven Corners: Specializes in travel medical insurance, but also offers trip cancellation options.

- RoundTrip Choice: A plan offering comprehensive trip cancellation, interruption, and medical coverage, with options to customize coverage levels. Price Estimate: $220-$450 for a $5,000 trip.

- RoundTrip Basic: A more economical option that still provides essential trip cancellation and interruption coverage. Price Estimate: $120-$250 for a $5,000 trip.

Product Comparison Table (Example):

| Provider | Plan | Trip Cancellation Coverage (Example) | Trip Interruption Coverage (Example) | Medical Coverage (Example) | CFAR Option? | Estimated Price (for $5,000 trip) |

|---|---|---|---|---|---|---|

| Allianz | TravelSmart | $5,000 | 150% of trip cost | $50,000 | No | $200 |

| World Nomads | Standard | $2,500 | $2,500 | $100,000 | No | $300 |

| Travel Guard | Deluxe | $5,000 | 150% of trip cost | $50,000 | Yes (additional cost) | $250 |

| Seven Corners | RoundTrip Choice | $5,000 | 150% of trip cost | $100,000 | No | $350 |

Disclaimer: Prices are estimates only and may vary based on your individual circumstances. Always get a quote from the insurance provider before purchasing a policy. Coverage details and policy terms are subject to change. It is crucial to read the full policy documents before making a purchase decision.

Real-Life Scenarios How Trip Cancellation Insurance Saved the Day

Let's look at some concrete examples of how trip cancellation insurance can be a lifesaver:

- Scenario 1: The Unexpected Illness. John and Mary booked a cruise to the Caribbean. A week before their departure, John developed a severe case of pneumonia and was unable to travel. Their standard trip cancellation insurance covered the non-refundable cost of their cruise, saving them thousands of dollars.

- Scenario 2: The Hurricane Strikes. Sarah planned a beach vacation in Florida during hurricane season (rookie mistake!). A hurricane hit the area a few days before her trip, forcing her to cancel. Her trip cancellation insurance covered her flight and hotel expenses.

- Scenario 3: The Job Loss. David was unexpectedly laid off from his job a month before his family vacation to Disney World. He had purchased trip cancellation insurance that covered job loss, allowing him to recoup the costs of his flights, hotel, and park tickets.

- Scenario 4: The Family Emergency. Emily's mother was hospitalized with a serious illness a few days before Emily's planned trip to Europe. Her trip cancellation insurance covered the cost of her flights and tours, allowing her to be with her family during a difficult time.

- Scenario 5: The Cancel For Any Reason Win. Tom and Lisa booked a trip to Italy, but as the departure date approached, they started feeling uneasy about traveling due to rising COVID-19 cases. They had purchased a CFAR policy and decided to cancel their trip. They received a 70% reimbursement of their non-refundable expenses.

Choosing the Right Deductible for Your Trip Cancellation Policy

The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing the right deductible is a balancing act between affordability and risk. Here's a breakdown:

- High Deductible: Lower premium, higher out-of-pocket expense if you need to file a claim. Good if you're generally healthy, have a low-risk trip, and are comfortable absorbing a small loss.

- Low Deductible: Higher premium, lower out-of-pocket expense if you need to file a claim. Good if you're concerned about potential health issues, have an expensive trip, or prefer the peace of mind of knowing you'll have minimal out-of-pocket costs.

- Zero Deductible: Highest premium, no out-of-pocket expense if you need to file a claim. Rare and expensive, but provides the most comprehensive coverage.

Example:

Let's say you have a $5,000 trip and are comparing two policies:

- Policy A: $100 deductible, $200 premium.

- Policy B: $500 deductible, $150 premium.

If you need to cancel your trip and file a claim:

- With Policy A, you'll pay $100 and your insurance will cover the remaining $4,900.

- With Policy B, you'll pay $500 and your insurance will cover the remaining $4,500.

However, if you *don't* need to cancel your trip, you'll save $50 on the premium with Policy B.

The best deductible for you depends on your individual circumstances and risk tolerance.

The Future of Trip Cancellation Insurance Emerging Trends and Technologies

The world of travel insurance is constantly evolving. Here are some emerging trends and technologies to watch out for:

- AI-Powered Claims Processing: Artificial intelligence is being used to automate and speed up claims processing, making it easier and faster for travelers to get reimbursed.

- Personalized Insurance Products: Insurance companies are using data analytics to create more personalized insurance products that are tailored to individual travelers' needs and preferences.

- Embedded Insurance: Travel insurance is increasingly being embedded into other travel products, such as flights, hotels, and rental cars, making it easier for travelers to purchase coverage.

- Blockchain Technology: Blockchain is being explored as a way to create more transparent and secure travel insurance policies.

- Pandemic Coverage: In the wake of the COVID-19 pandemic, many insurance companies are now offering policies that specifically cover cancellations due to pandemics or epidemics. This is becoming a crucial factor for travelers.

- Increased Flexibility: Consumers are demanding more flexible policies that allow them to change their coverage or cancel their policy without penalty. Insurance companies are responding by offering more flexible options.

Staying informed about these trends can help you make the best decisions about your travel insurance coverage.

Trip Cancellation Insurance for Specific Travel Types Cruises, Tours, and More

Trip cancellation insurance needs can vary depending on the type of travel you're planning. Let's look at specific considerations for cruises, tours, and other travel styles:

- Cruises: Cruise lines often have strict cancellation policies, so trip cancellation insurance is particularly important. Look for policies that cover pre-existing medical conditions, trip delays, and missed port calls. Consider coverage for onboard medical expenses.

- Tours: Tour operators may also have strict cancellation policies. Make sure your policy covers cancellation due to illness, injury, or other unforeseen circumstances. Look for coverage for tour interruptions and missed connections.

- Adventure Travel: If you're planning an adventure trip, make sure your policy covers the specific activities you'll be participating in (e.g., hiking, skiing, scuba diving). Look for coverage for emergency medical evacuation. World Nomads is a good option for adventure travelers.

- Group Travel: If you're traveling with a group, make sure your policy covers cancellation if one member of the group gets sick or injured. Consider a policy that allows you to cancel your trip if a certain number of group members cancel.

- International Travel: Make sure your policy provides adequate medical coverage for international travel. Look for coverage for emergency medical evacuation and repatriation of remains. Seven Corners specializes in international travel medical insurance.

Understanding Exclusions in Trip Cancellation Insurance What's Not Covered?

It's just as important to know what's *not* covered by your trip cancellation insurance as it is to know what *is* covered. Common exclusions include:

- Pre-Existing Medical Conditions (Without a Waiver): As mentioned before, most policies exclude pre-existing conditions unless you purchase a waiver.

- Mental Health Conditions: Some policies may exclude cancellations due to mental health conditions.

- War or Terrorism (in Certain Regions): Policies may exclude coverage for travel to regions with active war or terrorism.

- Participation in Illegal Activities: Cancellations due to participation in illegal activities are not covered.

- Cosmetic Surgery: Cancellations due to elective cosmetic surgery are not covered.

- Professional Sports: Cancellation to participate in professional sports is often excluded.

- Financial Default of a Travel Supplier (Sometimes): While some policies cover this, others may not. Carefully review the policy terms.

- Known Events: If a hurricane is already approaching when you purchase your policy, cancellation due to that hurricane may not be covered.

Carefully review the exclusions section of your policy to understand what's not covered. If you have concerns about specific exclusions, consider purchasing a policy with broader coverage or a "Cancel For Any Reason" option.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)