Understanding Travel Insurance Claim Deadlines: Don't Miss Out

Why Travel Insurance Claim Deadlines Matter Understanding the Basics

Hey there, fellow traveler! Let's talk about something that's not exactly the most exciting part of planning a trip, but it's super important: travel insurance claim deadlines. I know, I know, insurance isn't exactly a beach read, but trust me, understanding these deadlines can save you a whole lot of headache (and money!) down the road.

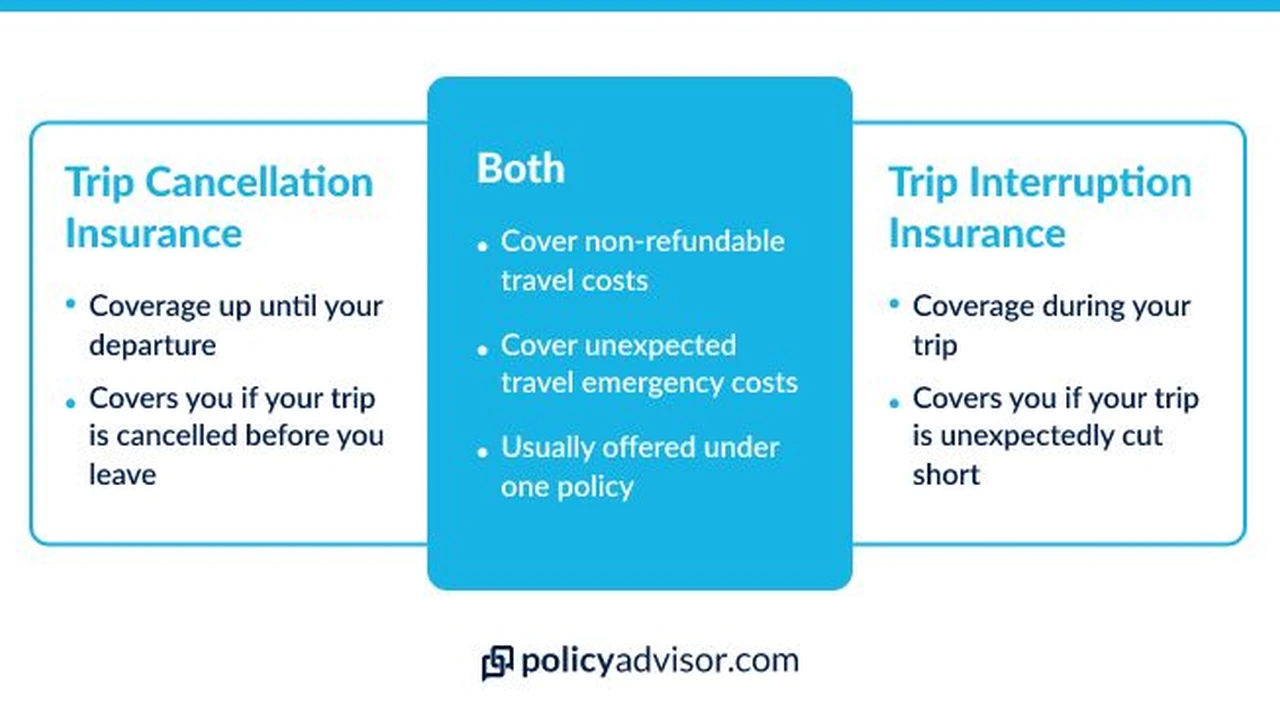

So, what exactly are we talking about? Basically, when you buy travel insurance, you're agreeing to a contract with the insurance company. Part of that contract outlines how long you have to file a claim after something goes wrong on your trip. Miss that deadline, and you might be out of luck, even if your claim is totally legitimate. Think of it like this: you wouldn't wait a year to report a car accident to your car insurance company, right? Same principle applies here.

Different insurance companies have different rules, so there's no one-size-fits-all answer. Some might give you 30 days, others 60, and some even longer. It's crucial to read your policy carefully and understand the specific deadlines that apply to *your* particular plan. Don't just skim over it – actually read it! You'll thank yourself later.

Why do these deadlines exist? Well, insurance companies need to be able to investigate claims in a timely manner. The longer you wait, the harder it becomes to gather evidence and verify what happened. Imagine trying to track down a lost bag six months after your trip – it's gonna be tough! Deadlines help ensure that the claims process is fair and efficient for everyone.

Common Reasons for Missing Travel Insurance Claim Deadlines and How to Avoid Them

Okay, so we know deadlines are important. But why do people miss them? Here are a few common reasons, and more importantly, how to avoid making the same mistakes:

- Procrastination: Let's be honest, dealing with insurance claims isn't exactly fun. It's easy to put it off until "later." The problem is, "later" often turns into "never." Solution: As soon as you have a problem, start the claims process. Even if you don't have all the information you need, at least get the ball rolling. Set a reminder on your phone or calendar to follow up.

- Lack of Awareness: Many people simply don't realize there's a deadline in the first place. They buy the insurance, stick the policy in a drawer, and forget about it until something goes wrong. Solution: Read your policy! Seriously, take the time to understand the terms and conditions, including the claim deadlines. Highlight the important parts and keep the policy in an easily accessible place. Even better, save a digital copy on your phone or computer.

- Lost or Damaged Documents: Sometimes, you need to provide specific documents to support your claim, like medical bills, police reports, or receipts. If those documents get lost or damaged, it can delay the claims process and potentially cause you to miss the deadline. Solution: Make copies of all important documents before you leave on your trip. Store the originals in a safe place and carry the copies with you. You can also scan the documents and save them to a cloud storage service like Google Drive or Dropbox.

- Difficulty Understanding the Claims Process: Navigating the claims process can be confusing, especially if you're dealing with a stressful situation. You might not know what documents you need, how to fill out the forms, or who to contact for help. Solution: Don't be afraid to ask for help! Contact the insurance company's customer service department. They can walk you through the process and answer any questions you have. Many companies also have online resources and FAQs that can be helpful.

- Assuming It's Not Covered: Sometimes people experience a loss and assume it's not covered by their insurance policy, so they don't even bother filing a claim. Solution: Always file a claim, even if you're not sure if it's covered. Let the insurance company decide. You might be surprised at what's covered.

Documentation and Evidence Gathering for Successful Travel Insurance Claims Before the Deadline

Okay, you've had a mishap, you know there's a deadline, now what? The key to a successful claim (before the deadline hits!) is gathering the right documentation and evidence. Think of yourself as a detective, piecing together the puzzle of your trip gone wrong.

Here's a breakdown of the types of documentation you might need, depending on the situation:

- Medical Expenses: If you had to see a doctor or go to the hospital, you'll need copies of your medical bills, receipts for any medications you purchased, and a doctor's note explaining your condition and the treatment you received. Make sure the bills are itemized, showing the specific charges for each service.

- Lost or Stolen Items: If your luggage was lost or stolen, you'll need a copy of the police report (if you filed one), a list of the items that were lost or stolen, and receipts or other proof of purchase for those items. Photos of the items can also be helpful. Don't forget to report the loss to the airline or hotel as well, and get a written confirmation of the report.

- Trip Cancellation or Interruption: If you had to cancel or interrupt your trip due to illness, injury, or other covered reason, you'll need a doctor's note, a copy of your original itinerary, and documentation of any non-refundable expenses you incurred. This could include airline tickets, hotel reservations, tour bookings, and other pre-paid activities.

- Travel Delays: If your flight was delayed, you'll need documentation from the airline confirming the delay, the reason for the delay, and the length of the delay. You'll also need receipts for any additional expenses you incurred as a result of the delay, such as meals, accommodation, or transportation.

Pro Tip: Take photos of everything! Before you leave on your trip, take photos of your luggage and its contents. If something gets lost or stolen, you'll have visual proof of what was inside. Also, take photos of any damage to your belongings, or any injuries you sustained.

Another Pro Tip: Keep a travel journal. Jot down the details of your trip, including dates, times, locations, and any incidents that occur. This can be helpful in refreshing your memory when you're filling out the claim form.

Navigating the Travel Insurance Claim Form A Step by Step Guide Before the Deadline

Alright, you've got your documentation, you know the deadline is looming, now it's time to tackle the claim form. These forms can seem daunting, but don't worry, we'll break it down step by step.

- Read the Instructions Carefully: This might seem obvious, but it's important to read the instructions on the claim form before you start filling it out. The instructions will tell you what information you need to provide, what documents you need to include, and where to send the form.

- Complete All Sections: Make sure you fill out all sections of the claim form completely and accurately. If you leave out any information, it could delay the processing of your claim.

- Be Honest and Accurate: Don't exaggerate or misrepresent any information on the claim form. This could be considered fraud and could result in your claim being denied.

- Attach All Required Documentation: Make sure you attach all the required documentation to the claim form. This could include medical bills, receipts, police reports, and other supporting documents.

- Keep a Copy for Your Records: Before you submit the claim form, make a copy for your records. This will help you track the progress of your claim and provide proof that you submitted the form.

- Submit the Claim Form Before the Deadline: This is the most important step! Make sure you submit the claim form before the deadline. If you submit the form after the deadline, your claim could be denied. Consider sending it via certified mail so you have proof of the date you sent it.

Understanding Exclusions in Your Travel Insurance Policy and How They Impact Claim Deadlines

Travel insurance isn't a magic wand that covers absolutely everything. There are exclusions – specific situations or events that aren't covered by the policy. Knowing these exclusions is just as important as understanding the coverage itself because they can indirectly affect how you approach claim deadlines.

Here are some common exclusions to be aware of:

- Pre-existing Medical Conditions: Many policies have limitations or exclusions for pre-existing medical conditions. If you have a chronic illness, make sure you understand the policy's stance on it. If your condition flares up during your trip, and it's excluded, filing a claim might be pointless. However, if you're unsure, it's still worth checking with the insurance company and submitting documentation.

- High-Risk Activities: Activities like skydiving, bungee jumping, or extreme sports are often excluded. If you get injured participating in one of these, your medical claim might be denied. Again, understand the policy's definition of "high-risk" before your trip.

- Illegal Activities: If you get into trouble with the law or engage in illegal activities, your insurance won't cover any related expenses, such as legal fees or medical bills.

- Acts of War or Terrorism: While some policies offer limited coverage for terrorism, acts of war are generally excluded.

- Unattended Belongings: If you leave your belongings unattended and they get stolen, your claim might be denied. You have a responsibility to take reasonable care of your possessions.

- Traveling Against Medical Advice: If your doctor advises you not to travel, and you go anyway, any medical expenses related to your condition during the trip might not be covered.

How Exclusions Impact Claim Deadlines:

Knowing the exclusions helps you make informed decisions about whether to file a claim in the first place. If you know your situation falls under an exclusion, you might decide not to file a claim, saving you time and effort. However, *always* double-check with the insurance company if you're unsure. It's better to be safe than sorry. Even if you suspect an exclusion applies, there might be nuances or exceptions in your policy that could provide coverage.

Specific Travel Insurance Products Recommendations Use Cases Comparisons and Pricing

Okay, let's get down to brass tacks and talk about some actual travel insurance products. Remember, the "best" insurance depends entirely on your individual needs, trip details, and budget. But here are a few examples with different strengths, use cases, and price points:

Disclaimer: Prices are estimates and can vary depending on your age, destination, trip duration, and other factors. Always get a quote from the insurance provider for the most accurate pricing.

- World Nomads:

- Use Case: Adventure travelers, backpackers, long-term trips.

- Strengths: Wide range of activities covered, flexible policy options, can extend coverage while traveling.

- Weaknesses: Can be more expensive than other options, especially for shorter trips.

- Products: Standard Plan, Explorer Plan (more comprehensive coverage).

- Pricing: Estimated $50-$150 per week, depending on coverage and destination.

- Allianz Global Assistance:

- Use Case: Families, cruises, shorter trips, pre-existing medical conditions (depending on the plan).

- Strengths: Wide range of plans, good customer service, options for pre-existing condition waivers.

- Weaknesses: Can be more restrictive in terms of covered activities compared to World Nomads.

- Products: OneTrip Prime, OneTrip Basic, AllTrips Premier.

- Pricing: Estimated $30-$100 per week, depending on coverage and destination.

- Travel Guard (AIG):

- Use Case: Trip cancellation coverage, business travelers, higher coverage limits.

- Strengths: Strong trip cancellation and interruption benefits, options for rental car coverage.

- Weaknesses: Can be more expensive than other options, may have stricter requirements for claims.

- Products: Essential, Preferred, Deluxe.

- Pricing: Estimated $40-$120 per week, depending on coverage and destination.

- Seven Corners:

- Use Case: International students, group travel, medical coverage focused plans.

- Strengths: Good options for medical coverage outside of your home country, affordable plans.

- Weaknesses: May not have as extensive coverage for trip cancellation or lost luggage.

- Products: RoundTrip Choice, Liaison Travel Plus.

- Pricing: Estimated $20-$80 per week, depending on coverage and destination.

Product Comparison:

Let's say you're going on a two-week backpacking trip through Southeast Asia, planning to do some hiking and maybe even try rock climbing. In this case, World Nomads might be a good fit because they cover a wider range of adventure activities. However, if you're primarily concerned about medical coverage and are on a tight budget, Seven Corners could be a more affordable option. If you're going on a cruise with your family and want comprehensive trip cancellation coverage, Allianz Global Assistance or Travel Guard would be worth considering.

Remember to:

- Get quotes from multiple providers. Don't just settle for the first quote you get.

- Read the fine print. Understand the policy's terms and conditions, including exclusions and limitations.

- Consider your specific needs. Choose a policy that covers the activities you plan to do and the risks you're most concerned about.

Extending Your Claim Deadline What Are Your Options

So, the worst has happened: you're nearing your claim deadline, and you're not ready. Maybe you're still gathering documents, dealing with a medical issue, or simply overwhelmed. Is there any hope of extending the deadline?

The short answer is: it depends. There's no guarantee, but it's always worth asking. Here's what you can do:

- Contact the Insurance Company Immediately: Don't wait until the last minute. As soon as you realize you might miss the deadline, contact the insurance company's customer service department. Explain your situation honestly and clearly.

- Provide a Valid Reason for the Delay: You'll need to provide a good reason why you haven't been able to file the claim on time. "I forgot" isn't going to cut it. Legitimate reasons might include:

- Serious illness or injury

- Hospitalization

- Dealing with a family emergency

- Difficulty obtaining necessary documentation

- Language barrier

- Document Everything: Keep a record of all your communications with the insurance company, including the dates, times, and names of the people you spoke with. Also, document any evidence that supports your reason for needing an extension, such as medical records or correspondence with other parties.

- Ask for a Written Extension: If the insurance company agrees to extend the deadline, get it in writing. This will protect you in case there's any confusion later on.

- Submit a Partial Claim: If you can't gather all the necessary documentation before the deadline, consider submitting a partial claim with the information you have. You can then supplement the claim with additional documentation later on. This shows the insurance company that you're taking the claim seriously and are actively working to resolve the issue.

Important Considerations:

- The insurance company is not obligated to grant an extension. It's up to their discretion.

- The sooner you contact them, the better your chances are. Don't wait until the last day to ask for an extension.

- Be polite and professional in your communications. This will increase your chances of getting a positive response.

Final Thoughts and Key Takeaways for Timely Travel Insurance Claims

Navigating travel insurance claims can seem daunting, but with a little preparation and understanding, you can significantly increase your chances of a successful outcome – and avoid missing those crucial deadlines. Remember, travel insurance is there to protect you when things go wrong, but it's up to you to understand the rules of the game.

Here are some key takeaways to keep in mind:

- Read your policy carefully. This is the most important step. Understand the coverage, exclusions, and claim deadlines.

- Gather documentation promptly. As soon as something goes wrong, start collecting the necessary documents, such as medical bills, receipts, and police reports.

- File your claim as soon as possible. Don't wait until the last minute. The sooner you file your claim, the better.

- Be honest and accurate. Don't exaggerate or misrepresent any information on the claim form.

- Keep a copy of everything. Make copies of all documents and communications for your records.

- Don't be afraid to ask for help. Contact the insurance company's customer service department if you have any questions or need assistance.

By following these tips, you can navigate the travel insurance claims process with confidence and protect your investment in your trip. Safe travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)