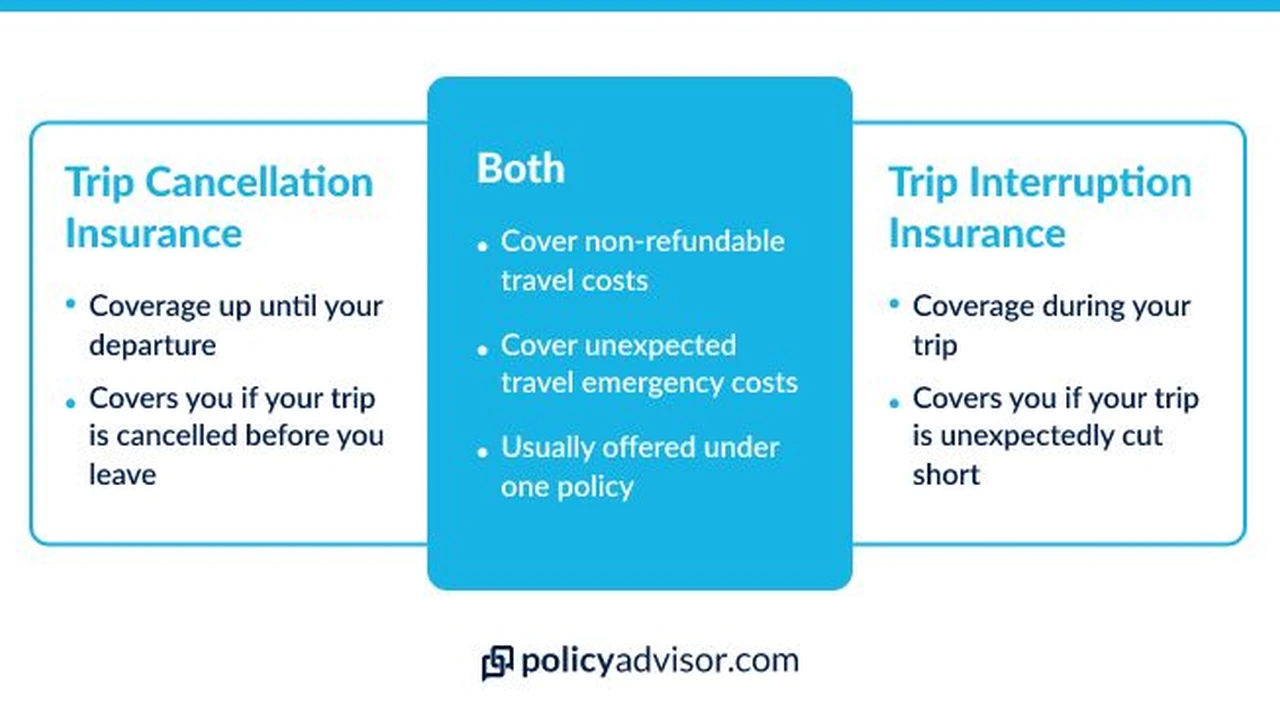

Comparing Travel Insurance: Trip Cancellation vs. Trip Interruption

Understanding Travel Insurance Trip Cancellation Coverage

Okay, let's dive into the nitty-gritty of travel insurance, specifically trip cancellation coverage. Think of trip cancellation as your safety net before you even leave for your amazing adventure. It's designed to reimburse you for prepaid, non-refundable trip costs if you have to cancel your trip for a covered reason. What qualifies as a "covered reason"? Well, that's where things get interesting. Typically, covered reasons include things like:

- Unexpected illness or injury: This is a big one. If you get sick or injured and your doctor says you can't travel, you're usually covered. Make sure you have documentation from your doctor.

- Death of a family member: This is a terrible reason to cancel a trip, but travel insurance can help ease the financial burden.

- Adverse weather: Hurricanes, blizzards, and other severe weather events that make it impossible or dangerous to travel are often covered.

- Unforeseen natural disasters: Earthquakes, floods, wildfires – these can all disrupt travel plans.

- Jury duty or military duty: If you get called for jury duty or military duty, and it conflicts with your trip, you're generally covered.

- Job loss: Some policies cover job loss, but there are usually specific requirements (e.g., you have to have been employed for a certain amount of time).

- Terrorist incident: If a terrorist incident occurs in your destination and makes travel unsafe, you may be covered.

It's super important to read the fine print of your policy to understand exactly what's covered and what's not. For example, pre-existing medical conditions might not be covered unless you purchase a waiver. Also, "cancel for any reason" coverage is a thing, but it's usually more expensive and only reimburses a percentage of your trip costs (typically 50-75%).

Example Scenario: Imagine you've booked a non-refundable cruise to the Caribbean. A week before you're scheduled to leave, you break your leg. Your doctor advises you not to travel. With trip cancellation coverage, you can file a claim to get reimbursed for the cost of the cruise (minus any deductible). Without it, you're likely out of pocket thousands of dollars.

Understanding Travel Insurance Trip Interruption Coverage

Trip interruption, on the other hand, kicks in after your trip has already started. It's designed to reimburse you for expenses incurred if your trip is interrupted due to a covered reason. These expenses can include things like:

- Additional transportation costs: If you need to return home early due to a covered reason, trip interruption can cover the cost of a one-way flight home.

- Accommodation costs: If you're stranded somewhere due to a covered reason, trip interruption can cover the cost of hotel stays.

- Lost prepaid expenses: If you have to cut your trip short and miss out on prepaid tours or activities, trip interruption can help reimburse you for those costs.

Covered reasons for trip interruption are generally similar to those for trip cancellation: illness, injury, death of a family member, adverse weather, natural disasters, etc. Again, read the fine print to understand the specifics of your policy.

Example Scenario: You're backpacking through Europe when your mother suddenly falls ill back home. You need to return home immediately. Trip interruption coverage can cover the cost of your last-minute flight home and any unused portions of your prepaid accommodations.

Key Differences Between Trip Cancellation and Trip Interruption

The main difference is the timing. Trip cancellation covers you before your trip, while trip interruption covers you during your trip. Think of it this way: trip cancellation is your pre-departure safety net, and trip interruption is your on-the-road safety net.

Here's a quick table to summarize the key differences:

| Feature | Trip Cancellation | Trip Interruption |

|---|---|---|

| Timing | Before your trip | During your trip |

| Coverage | Reimburses prepaid, non-refundable trip costs if you cancel for a covered reason. | Reimburses expenses incurred if your trip is interrupted for a covered reason (e.g., additional transportation, accommodation, lost prepaid expenses). |

| Example | Canceling a cruise due to a broken leg. | Returning home early from a backpacking trip due to a family emergency. |

Choosing the Right Travel Insurance Policy Considering Trip Cancellation and Trip Interruption Needs

When choosing a travel insurance policy, consider the following factors:

- Trip cost: The more expensive your trip, the more coverage you'll need. Make sure your policy covers the full cost of your prepaid, non-refundable expenses.

- Destination: Some destinations are riskier than others. If you're traveling to a place prone to hurricanes or other natural disasters, you'll want to make sure your policy covers those events.

- Your health: If you have any pre-existing medical conditions, you'll need to make sure your policy covers them (or purchase a waiver).

- Your travel style: If you're an adventurous traveler who engages in risky activities (e.g., rock climbing, scuba diving), you'll need to make sure your policy covers those activities.

- Policy limits and exclusions: Read the fine print carefully to understand the policy limits and exclusions. Make sure you're comfortable with them.

Comparing Specific Travel Insurance Products with Comprehensive Trip Cancellation and Trip Interruption Coverage

Let's look at a few popular travel insurance providers and their plans. Remember, prices and coverage can change, so always check the provider's website for the most up-to-date information.

World Nomads Explorer Plan: A Comprehensive Option for Adventurous Travelers

World Nomads is a popular choice for backpackers and adventurous travelers. Their Explorer Plan offers comprehensive coverage, including trip cancellation, trip interruption, medical expenses, and baggage loss. It's a bit pricier than some other options, but it offers excellent coverage for a wide range of activities.

- Pros: Covers a wide range of activities, good for longer trips, 24/7 emergency assistance.

- Cons: Can be more expensive than other options, may have exclusions for certain pre-existing conditions.

- Typical Scenarios: Ideal for backpacking trips, adventure travel, and longer-term travel.

- Price: Varies depending on trip length, destination, and age, but expect to pay around $100-$300 for a two-week trip.

Allianz Travel Insurance OneTrip Prime Plan: A Solid Choice for Leisure Travelers

Allianz is a well-known travel insurance provider with a variety of plans. Their OneTrip Prime Plan offers good coverage for trip cancellation, trip interruption, and medical expenses. It's a good option for leisure travelers who want comprehensive coverage at a reasonable price.

- Pros: Good value for money, covers a wide range of common travel scenarios, offers 24/7 assistance.

- Cons: May not cover as many adventure activities as World Nomads, may have lower coverage limits for certain benefits.

- Typical Scenarios: Good for family vacations, cruises, and other leisure trips.

- Price: Typically ranges from $50-$150 for a two-week trip.

Travel Guard Essential Plan: A Budget-Friendly Travel Insurance Option

Travel Guard offers a range of plans, including the Essential Plan, which is a more budget-friendly option. It provides basic coverage for trip cancellation, trip interruption, and medical expenses. It's a good choice if you're looking for basic coverage and don't need all the bells and whistles.

- Pros: Affordable, covers basic trip cancellation and trip interruption needs.

- Cons: Lower coverage limits, may not cover pre-existing conditions without a waiver, fewer included benefits.

- Typical Scenarios: Suitable for shorter trips, domestic travel, and travelers on a budget.

- Price: Can be as low as $30-$80 for a two-week trip.

Generali Global Assistance Preferred Plan: A Plan with "Cancel for Any Reason" Upgrade

Generali Global Assistance provides a range of plans with options for upgrades like "Cancel for Any Reason" coverage. Their Preferred Plan offers a good balance of coverage and price, making it a worthwhile option to consider.

- Pros: Good balance of coverage and price, "Cancel for Any Reason" upgrade available, 24/7 travel assistance.

- Cons: "Cancel for Any Reason" upgrade increases the overall price, potential exclusions on pre-existing conditions.

- Typical Scenarios: Suitable for travelers who want flexibility and peace of mind, especially regarding potential cancellations.

- Price: Around $60-$180 for a two-week trip, depending on the upgrades selected.

Real-World Scenarios and Choosing the Right Insurance for Your Trip

Let’s consider a few scenarios to illustrate when to choose which type of coverage.

Scenario 1: Family Vacation to Disney World

Details: A family books a non-refundable Disney World vacation package. One week before the trip, the child develops chickenpox. Insurance Needed: Trip Cancellation Insurance. This would cover the cost of canceling the trip due to the child's illness.

Scenario 2: Backpacking Trip Through Southeast Asia

Details: A backpacker is traveling through Southeast Asia. A typhoon hits, causing flight cancellations and forcing them to stay in a hotel for several extra days. Insurance Needed: Trip Interruption Insurance. This would cover the cost of the extra hotel nights and any rebooking fees for flights.

Scenario 3: Cruise to Alaska

Details: A couple takes a cruise to Alaska. During the cruise, one of them has a medical emergency and needs to be airlifted to a hospital. Insurance Needed: Both Trip Interruption (for the interrupted cruise) and Medical Coverage (to cover the cost of medical treatment and the airlift). While trip interruption might cover the unused portion of the cruise, the medical emergency falls under a different part of the policy.

Scenario 4: Business Trip to Europe

Details: An executive is on a business trip to Europe. Their connecting flight is canceled, causing them to miss an important meeting. Insurance Needed: Trip Interruption Insurance. This would cover the cost of rebooking flights and potentially any lost business opportunities (depending on the policy's coverage).

Tips for Filing a Travel Insurance Claim Smoothly

Filing a travel insurance claim can sometimes feel daunting. Here are some tips to make the process smoother:

- Document Everything: Keep copies of all your travel documents (tickets, itineraries, hotel confirmations, etc.), medical records, and any other relevant documentation.

- Notify the Insurance Company Promptly: Contact your insurance company as soon as possible after the event that caused the cancellation or interruption.

- Be Honest and Accurate: Provide accurate information and be honest about the circumstances surrounding your claim.

- Follow the Instructions: Follow the insurance company's instructions carefully when filing your claim.

- Be Patient: Claims can take time to process, so be patient and follow up with the insurance company if you haven't heard back within a reasonable timeframe.

The Impact of COVID-19 on Travel Insurance and Coverage

The COVID-19 pandemic has significantly impacted the travel insurance landscape. Many policies now have specific exclusions or limitations related to COVID-19. It’s crucial to check if a policy covers:

- Cancellation due to contracting COVID-19: Does the policy cover cancellation if you test positive for COVID-19 before your trip?

- Interruption due to contracting COVID-19: Does the policy cover interruption if you test positive for COVID-19 during your trip and need to quarantine?

- Medical expenses related to COVID-19: Does the policy cover medical expenses if you contract COVID-19 while traveling?

- Quarantine costs: Does the policy cover the cost of quarantine if you are required to quarantine due to COVID-19 exposure?

Some policies offer "Cancel for Any Reason" upgrades that can provide more flexibility in case of COVID-related concerns. However, these upgrades usually come at a higher cost.

Navigating the Fine Print Understanding Exclusions and Limitations

Travel insurance policies are complex documents, and it's essential to understand the exclusions and limitations. Common exclusions include:

- Pre-existing medical conditions (unless waived): Many policies exclude coverage for pre-existing medical conditions unless you purchase a waiver.

- Participation in extreme sports: Some policies exclude coverage for injuries sustained while participating in extreme sports (e.g., skydiving, bungee jumping).

- Traveling against medical advice: If you travel against the advice of your doctor, your policy may not cover any related medical expenses.

- Intoxication: Injuries or losses sustained while intoxicated may not be covered.

- War or acts of terrorism (in certain regions): Some policies may exclude coverage for events related to war or acts of terrorism in specific regions.

Pay close attention to the policy limits. For example, a policy might have a limit of $10,000 for medical expenses or $2,000 for baggage loss. Make sure these limits are sufficient for your needs.

Future of Travel Insurance Trends and Innovations

The travel insurance industry is constantly evolving. Some emerging trends include:

- Personalized insurance: Policies tailored to individual needs and travel styles.

- Embedded insurance: Insurance offered directly through travel booking platforms.

- AI-powered claims processing: Faster and more efficient claims processing using artificial intelligence.

- Real-time risk assessment: Insurance companies using data to assess risks in real-time and adjust coverage accordingly.

- Blockchain technology: Using blockchain to improve transparency and security in travel insurance transactions.

These innovations are aimed at making travel insurance more accessible, affordable, and relevant to travelers' needs.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)