Comparing Travel Insurance: Price vs. Coverage - What Matters?

Understanding Travel Insurance Basics Key Coverage Types

Okay, let's dive into travel insurance. It's basically a safety net for your trip. Think of it as that friend who always has your back, just in case things go sideways. But what exactly does it cover? Well, that’s the million-dollar question, isn’t it? Different policies cover different things, and it's crucial to know what you're getting into before you even think about comparing prices. The core types of coverage you'll find in most comprehensive travel insurance plans include:

- Trip Cancellation/Interruption: Imagine you've booked your dream vacation to Bali, but a week before you're supposed to leave, you break your leg. Trip cancellation coverage can reimburse you for non-refundable trip costs, like flights and hotels. Trip interruption works similarly, but it covers situations that force you to cut your trip short – maybe a family emergency back home. This is a biggie!

- Medical Expenses: Falling ill or getting injured while traveling can be incredibly expensive, especially in countries with high healthcare costs. Medical expense coverage can help pay for doctor visits, hospital stays, medication, and even emergency medical evacuation. Seriously, don’t skimp on this one. Think about the cost of a helicopter ride off a mountain in Switzerland!

- Lost or Stolen Baggage: Losing your luggage is a traveler's nightmare. This coverage can reimburse you for the value of your lost or stolen belongings. There are usually limits, so it’s good to keep receipts for expensive items and consider a separate personal articles policy for very valuable things.

- Emergency Assistance: This is the catch-all for things like 24/7 hotline support, help with replacing lost passports, and arranging emergency travel changes. It’s like having a personal concierge for your travel emergencies.

- Accidental Death and Dismemberment (AD&D): This is the one nobody wants to think about, but it provides a payout in the event of a serious accident resulting in death or permanent disability.

So, those are the basics. But here's the thing: every policy is different. Some might have exclusions for pre-existing conditions, adventure activities (like skydiving or scuba diving), or even certain destinations. Read the fine print! It's boring, I know, but it's essential. Think of it like reading the terms and conditions before you click "I agree" – only this time, it could save you thousands of dollars.

Deciphering the Price Tag What Drives Travel Insurance Costs

Alright, let's talk money. Why does travel insurance cost what it costs? It's not magic (though sometimes it feels like it!), it's based on a whole bunch of factors. Understanding these factors will help you figure out why one policy is cheaper than another and whether the price difference is worth it.

- Age: Yep, just like with car insurance, your age plays a role. Older travelers generally pay more because they're statistically more likely to have health issues.

- Destination: Traveling to a country with high medical costs (like the US) or a higher risk of political instability will usually increase your premium. Think about it: a trip to Disneyland is probably less risky than a trek through the Amazon rainforest.

- Trip Length: The longer you're traveling, the more likely something could go wrong, so longer trips usually mean higher premiums. A weekend getaway is going to be cheaper to insure than a six-month backpacking adventure.

- Coverage Amount: The more coverage you want (e.g., higher medical expense limits, higher baggage loss limits), the more you'll pay. It's like buying a car: you can get the basic model, or you can load it up with all the bells and whistles.

- Deductible: This is the amount you have to pay out-of-pocket before your insurance kicks in. A higher deductible usually means a lower premium, but it also means you'll have to pay more if something goes wrong. Think of it like co-pay for your regular health insurance.

- Pre-existing Conditions: This is a tricky one. Many policies exclude coverage for pre-existing conditions, or they require you to purchase a special rider to cover them. Be honest about your medical history, or you could risk having your claim denied.

So, how do you find the sweet spot between price and coverage? Well, that's where the real comparison comes in! Don't just automatically go for the cheapest policy. Think about your specific needs and risks. Are you planning on doing any adventure activities? Do you have any pre-existing conditions? How much can you afford to pay out-of-pocket if something goes wrong? Answer these questions, and you'll be in a much better position to choose the right policy.

Coverage vs Cost Finding the Right Balance for Your Needs

This is the crux of the matter, isn't it? How do you balance getting enough coverage with not breaking the bank? It’s a delicate dance, but here are some things to keep in mind:

- Assess Your Risk Tolerance: Are you a risk-averse traveler who wants maximum protection, or are you comfortable taking on a bit more risk to save money? Be honest with yourself. If the thought of a medical emergency abroad keeps you up at night, then spend a little more for peace of mind.

- Consider Your Destination: As mentioned before, some destinations are riskier than others. If you're traveling to a developing country with limited healthcare infrastructure, you'll want more comprehensive medical coverage.

- Think About Your Activities: If you're planning on doing any adventurous activities, make sure your policy covers them. Some policies exclude high-risk activities, so read the fine print carefully.

- Don't Overpay for Unnecessary Coverage: Do you really need coverage for rental car damage if you're not planning on renting a car? Probably not. Tailor your policy to your specific needs.

- Compare Apples to Apples: When comparing policies, make sure you're looking at the same coverage limits and deductibles. It's easy to be swayed by a lower price, but make sure you're not sacrificing essential coverage.

Here's a little secret: sometimes, the cheapest policy isn't the best deal. It might have hidden exclusions or limitations that you don't realize until it's too late. Read reviews, compare policies side-by-side, and don't be afraid to ask questions. The more informed you are, the better decision you'll make.

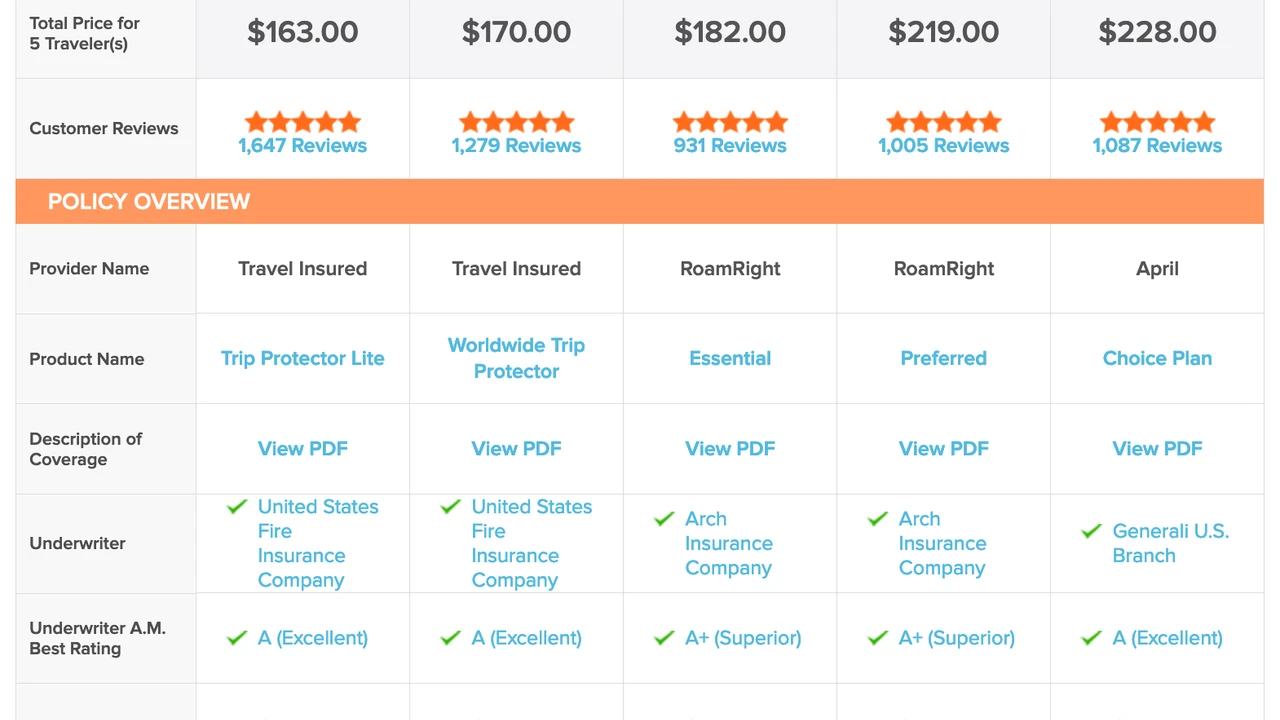

Product Recommendations and Comparisons Specific Travel Insurance Plans

Alright, let's get down to brass tacks. Here are a few travel insurance plans that are popular and generally well-regarded. Keep in mind that this is not exhaustive, and the best plan for you will depend on your individual needs and circumstances. Always get quotes and compare policies yourself!

World Nomads Explorer Plan Adventure Travel Focus

Best For: Adventure travelers, backpackers, and those participating in high-risk activities.

Coverage Highlights:

- Covers a wide range of adventure activities, including scuba diving, rock climbing, and skiing.

- Offers higher medical expense limits than some other plans.

- Includes coverage for lost or stolen gear.

- 24/7 emergency assistance.

Things to Consider:

- Can be more expensive than basic plans.

- May have exclusions for certain pre-existing conditions.

Price: Expect to pay around $80-$200 per month, depending on your age, destination, and coverage limits.

Sample Scenario: Sarah, a 28-year-old avid hiker, is planning a month-long backpacking trip through Patagonia. She chooses the World Nomads Explorer Plan because it covers hiking at high altitudes and provides ample medical coverage in case of an emergency. The peace of mind is worth the extra cost for her.

Allianz Global Assistance OneTrip Prime Plan Family Travel and Comprehensive Coverage

Best For: Families, cruises, and travelers seeking comprehensive coverage.

Coverage Highlights:

- Trip cancellation/interruption coverage.

- Medical expense coverage.

- Lost/delayed baggage coverage.

- Rental car damage coverage.

- 24/7 emergency assistance.

Things to Consider:

- Can be more expensive than basic plans.

- Pre-existing conditions may not be covered (check policy details).

Price: Expect to pay around $60-$150 per trip, depending on your trip cost and coverage limits.

Sample Scenario: The Johnson family is taking a week-long cruise to the Caribbean. They choose the Allianz Global Assistance OneTrip Prime Plan to protect their investment in case of cancellation or interruption. They also appreciate the medical expense coverage and the rental car damage protection.

Travel Guard Essential Plan Budget-Friendly Option

Best For: Budget-conscious travelers and those seeking basic coverage.

Coverage Highlights:

- Trip cancellation/interruption coverage.

- Medical expense coverage.

- Lost/delayed baggage coverage.

- 24/7 emergency assistance.

Things to Consider:

- Lower coverage limits than more comprehensive plans.

- May have more exclusions.

Price: Expect to pay around $40-$100 per trip, depending on your trip cost and coverage limits.

Sample Scenario: Mark, a 25-year-old student, is taking a short weekend trip to visit friends. He chooses the Travel Guard Essential Plan because it's affordable and provides basic coverage for trip cancellation and medical expenses. He's willing to accept lower coverage limits to save money.

Comparing the Plans A Side-by-Side View

Okay, let's put these plans head-to-head. This table gives you a quick overview of the key differences:

| Feature | World Nomads Explorer | Allianz OneTrip Prime | Travel Guard Essential |

|---|---|---|---|

| Focus | Adventure Travel | Comprehensive | Budget |

| Trip Cancellation/Interruption | Yes | Yes | Yes |

| Medical Expense Coverage | High | Moderate | Low |

| Adventure Activities Coverage | Extensive | Limited | Limited |

| Price | Higher | Moderate | Lower |

Remember, this is just a general comparison. Always get personalized quotes and read the policy details carefully before making a decision.

Travel Insurance Claim Scenarios Real-Life Examples

Let's look at some real-life scenarios to illustrate how travel insurance can help:

- Scenario 1: The Ski Injury. John is skiing in Colorado and breaks his leg. His World Nomads Explorer Plan covers his medical expenses, including the cost of an ambulance, hospital stay, and surgery. Without insurance, he would have been facing tens of thousands of dollars in medical bills.

- Scenario 2: The Missed Flight. Maria is traveling to Europe for a conference. Her connecting flight is delayed due to bad weather, causing her to miss the conference. Her Allianz OneTrip Prime Plan reimburses her for the non-refundable conference fees and the cost of a new flight.

- Scenario 3: The Lost Luggage. David's luggage is lost on his flight to Thailand. His Travel Guard Essential Plan reimburses him for the cost of essential items, such as toiletries and clothing, while he waits for his luggage to be found.

- Scenario 4: The Family Emergency. Lisa is on vacation in Italy when she receives news that her mother has been hospitalized. Her Allianz OneTrip Prime Plan covers the cost of her emergency flight home and provides assistance with rearranging her travel plans.

These are just a few examples of how travel insurance can protect you from unexpected events. While you can't predict the future, you can take steps to mitigate your risk and ensure that you're prepared for anything that comes your way.

Tips for Filing a Travel Insurance Claim Smooth Process

So, you've had a mishap and need to file a claim. Here's how to make the process as smooth as possible:

- Document Everything: Keep copies of all your travel documents, including your policy, tickets, receipts, and medical records.

- Notify Your Insurance Company Promptly: Don't wait until you get home to file a claim. Contact your insurance company as soon as possible after the incident occurs.

- Provide Accurate Information: Be honest and accurate when filling out the claim form. Any misrepresentation could result in your claim being denied.

- Gather Supporting Documentation: Provide all the necessary documentation to support your claim, such as police reports, medical bills, and proof of purchase.

- Follow Up: Don't be afraid to follow up with your insurance company to check on the status of your claim.

Filing a claim can be a bit of a hassle, but it's worth it if you're facing significant expenses. Be patient, organized, and persistent, and you'll increase your chances of a successful outcome.

The Future of Travel Insurance Emerging Trends

The travel insurance industry is constantly evolving to meet the changing needs of travelers. Here are a few emerging trends to watch:

- Personalized Policies: Insurers are increasingly using data and technology to create personalized policies that are tailored to individual travelers' needs and risk profiles.

- Embedded Insurance: Travel insurance is increasingly being embedded into other travel products, such as flights, hotels, and rental cars.

- Parametric Insurance: This type of insurance pays out automatically when a specific event occurs, such as a flight delay or cancellation.

- Increased Focus on Sustainability: Some insurers are starting to offer policies that cover the costs of carbon offsetting or that support sustainable tourism initiatives.

As technology advances and travel patterns change, travel insurance will continue to evolve to provide travelers with the protection they need.

Frequently Asked Questions about Travel Insurance

Let's tackle some common questions about travel insurance:

- Q: Do I really need travel insurance? A: It depends on your individual circumstances, but it's generally a good idea to have travel insurance, especially if you're traveling abroad or participating in high-risk activities.

- Q: What's the difference between trip cancellation and trip interruption coverage? A: Trip cancellation covers you if you have to cancel your trip before it starts, while trip interruption covers you if you have to cut your trip short.

- Q: Does travel insurance cover pre-existing conditions? A: Some policies cover pre-existing conditions, but others exclude them. Be sure to read the policy details carefully.

- Q: How much travel insurance do I need? A: The amount of coverage you need depends on your individual needs and risk tolerance. Consider your destination, activities, and medical history when determining how much coverage to purchase.

- Q: How do I find the best travel insurance plan? A: Compare policies from different providers, read reviews, and don't be afraid to ask questions.

Hopefully, this has cleared up some of your questions about travel insurance. Remember to do your research and choose a policy that meets your specific needs.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)