Travel Insurance for Luxury Travel: High-End Coverage

Why Luxury Travel Insurance is a Must Have Investment

So, you're planning that dream vacation, the one where you're sipping cocktails on a private beach in the Maldives, skiing down pristine slopes in the Swiss Alps, or maybe exploring ancient ruins with a personal guide. Sounds amazing, right? But what happens when things go a little… sideways? That's where luxury travel insurance comes in. We're not talking about the basic stuff; we're talking about comprehensive coverage that protects your investment and peace of mind when you're indulging in the finer things in life. Think of it as an essential part of your luxury travel experience, just like booking that first-class flight or reserving that penthouse suite. It's about safeguarding yourself against the unexpected so you can truly relax and enjoy every moment.

Understanding High End Travel Insurance Coverage Key Features

Luxury travel insurance isn’t just a fancier version of regular travel insurance. It’s designed to address the specific risks associated with high-end travel, which often involves significant financial investments and unique logistical challenges. Here's what you should expect:

- High Trip Cost Coverage: This is the big one. Luxury trips often involve substantial upfront costs for flights, accommodations, tours, and activities. High-end travel insurance policies offer coverage limits that reflect these higher expenses, ensuring you're adequately protected if you need to cancel or interrupt your trip. Imagine having to cancel a $50,000 safari due to a medical emergency. Without adequate coverage, you could be out a fortune.

- Trip Cancellation & Interruption: Life happens. Unexpected illnesses, family emergencies, or even natural disasters can force you to cancel or cut short your trip. Luxury travel insurance policies typically offer broader cancellation and interruption coverage, including reimbursement for non-refundable expenses. Some policies even cover cancellation due to "cancel for any reason" clauses (more on that later).

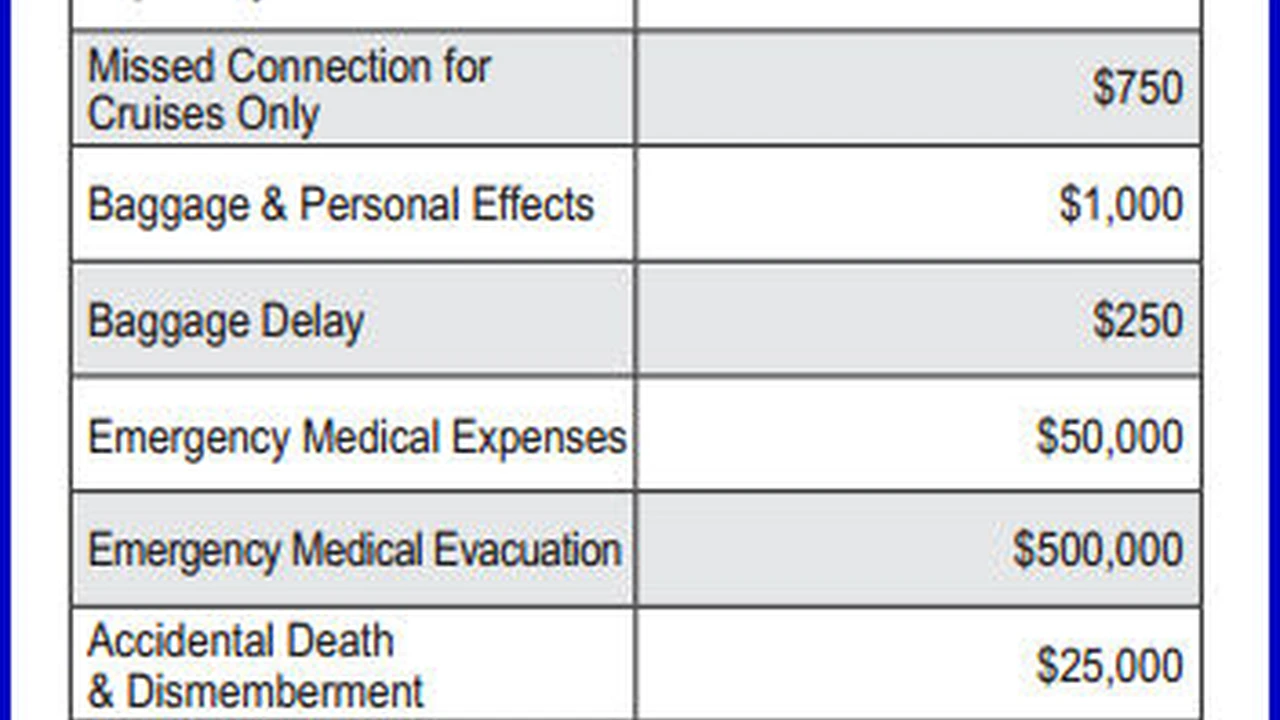

- Medical Coverage & Emergency Assistance: High-end policies provide robust medical coverage, including emergency medical evacuation, repatriation of remains, and access to a 24/7 assistance hotline. This is crucial if you're traveling to remote or unfamiliar destinations where quality medical care may be limited. Imagine falling ill while on a cruise in the Galapagos Islands. Having access to immediate medical assistance and potential evacuation could be life-saving.

- Baggage Loss & Delay: Losing your luggage is never fun, but it's especially frustrating when it contains expensive clothing, jewelry, or electronics. Luxury travel insurance policies offer higher baggage loss and delay coverage limits to compensate you for the value of your belongings. They also often include coverage for essential items if your luggage is delayed, ensuring you're not left stranded without necessities.

- Concierge Services: Many luxury travel insurance policies include concierge services, which can assist with everything from booking restaurant reservations to arranging transportation to providing translation services. This can be incredibly valuable when traveling in foreign countries or dealing with unexpected situations. Think of it as having a personal assistant at your fingertips.

- Rental Car Coverage: If you're renting a car, high-end travel insurance can offer comprehensive coverage that protects you against damage, theft, and liability.

- Coverage for Activities and Excursions: Luxury travel often involves adventurous activities like scuba diving, mountain climbing, or hot air ballooning. Ensure your policy covers these activities.

- Pre-existing Medical Conditions: Some policies offer waivers for pre-existing medical conditions, ensuring you're covered for any complications that may arise during your trip.

Specific Situations Where Luxury Travel Insurance Shines

Okay, so you know what it covers, but when does it really come in handy? Here are a few scenarios:

- Sudden Illness or Injury: Imagine you're on a ski trip in Aspen and break your leg. The medical bills can be astronomical, especially if you need emergency surgery and air ambulance transportation. Luxury travel insurance covers these costs, ensuring you receive the best possible care without bankrupting yourself.

- Lost or Stolen Valuables: You're enjoying a romantic dinner in Paris when your purse, containing your designer handbag and expensive jewelry, is stolen. Luxury travel insurance can reimburse you for the value of your lost items, up to the policy limits.

- Trip Cancellation Due to Unforeseen Events: A hurricane strikes your destination just days before your departure. Luxury travel insurance will reimburse you for your non-refundable travel expenses, allowing you to rebook your trip at a later date.

- Political Unrest or Natural Disasters: You're on a safari in Africa when political unrest breaks out. Luxury travel insurance can provide emergency evacuation services and cover the cost of alternative accommodations.

- Legal Assistance: If you find yourself in legal trouble while traveling, luxury travel insurance can provide access to legal assistance and cover legal fees.

Recommended Luxury Travel Insurance Products and Their Uses

Alright, let's get down to brass tacks. Here are a few specific luxury travel insurance products and how they might fit your needs:

- Allianz Global Assistance Executive Plan: This is a solid all-around option. It offers high trip cancellation/interruption coverage, excellent medical benefits, and 24/7 assistance. Best for: Travelers who want comprehensive coverage for a wide range of potential issues. Use Case: A family taking a multi-country European vacation with expensive flights and accommodations. Cost: Varies depending on trip cost and traveler age, but expect to pay several hundred dollars for a typical trip. You can get a quote directly from their website. Coverage highlights include up to $100,000 in trip cancellation coverage and $500,000 in emergency medical coverage.

- Travel Guard Platinum: Known for its excellent customer service and customizable options. You can tailor the policy to fit your specific needs and budget. Best for: Travelers who want flexibility and personalized coverage. Use Case: A solo traveler taking a luxury cruise to Antarctica with high upfront costs and potential for medical emergencies. Cost: Similar to Allianz, expect to pay several hundred dollars. Check their website for a customized quote. Key features include coverage for pre-existing medical conditions (with certain conditions) and rental car damage.

- Seven Corners RoundTrip Choice: This policy stands out for its high coverage limits for medical expenses and evacuation. It's a great option for travelers venturing to remote or high-risk destinations. Best for: Adventurous travelers who prioritize medical coverage. Use Case: A group of friends going on a climbing expedition in the Himalayas. Cost: Can be more expensive than other options, reflecting the higher coverage limits. Obtain a quote from their website. This plan offers up to $1,000,000 in emergency medical coverage and $1,000,000 in medical evacuation coverage.

- World Nomads Explorer Plan: While often associated with backpackers, the Explorer Plan actually offers surprisingly robust coverage for adventurous activities and higher-value trips. It's more affordable than some luxury-specific options but still provides good protection. Best for: Luxury travelers who are also adventure seekers on a budget. Use Case: A couple going on a luxury safari in Tanzania, which includes both high-end accommodations and adventurous game drives. Cost: More budget-friendly, ranging from $100-$300 depending on the trip duration and destination. Check their website for specifics. Key features include coverage for over 200 adventure activities and emergency dental coverage.

Comparing Luxury Travel Insurance Options What to Consider

Choosing the right luxury travel insurance policy can feel overwhelming. Here's a breakdown of key factors to consider:

- Coverage Limits: Make sure the policy's coverage limits are adequate to cover your trip costs and potential medical expenses. Don't skimp on this!

- Exclusions: Read the fine print! Understand what the policy doesn't cover. Common exclusions include pre-existing medical conditions (unless waived), participation in certain high-risk activities, and acts of war or terrorism (in some cases).

- "Cancel For Any Reason" (CFAR) Coverage: This is the holy grail of travel insurance. CFAR coverage allows you to cancel your trip for any reason whatsoever and receive a partial reimbursement (typically 50-75% of your trip cost). It's more expensive but provides ultimate peace of mind.

- Deductibles: Understand the deductible you'll have to pay before the insurance kicks in. Lower deductibles typically mean higher premiums.

- Customer Service: Read reviews and check the insurer's reputation for customer service. You want to be able to easily reach them in case of an emergency.

- Pre-existing Conditions: If you have any pre-existing medical conditions, make sure the policy offers a waiver or covers related complications.

- Activity Coverage: Ensure that the policy covers all activities you plan to participate in, such as skiing, scuba diving, or hiking.

Luxury Travel Insurance Costs Factors Influencing Premiums

The cost of luxury travel insurance varies depending on several factors:

- Trip Cost: The higher your trip cost, the higher your premium will be.

- Traveler Age: Older travelers typically pay higher premiums due to increased risk of medical issues.

- Destination: Travel to high-risk destinations or countries with expensive medical care will result in higher premiums.

- Coverage Limits: Higher coverage limits mean higher premiums.

- Deductible: Lower deductibles mean higher premiums.

- Pre-existing Conditions: Coverage for pre-existing conditions will increase the cost.

- Additional Coverage Options: Adding options like "Cancel For Any Reason" will also increase the premium.

Real Life Luxury Travel Insurance Claim Scenarios

Let's look at some real-life examples of how luxury travel insurance can save the day:

- Scenario 1: The Unexpected Illness. A couple booked a $30,000 luxury cruise to the Mediterranean. A week before departure, one of them developed a severe case of pneumonia and was unable to travel. Thanks to their luxury travel insurance policy, they were able to recoup the full cost of the cruise, including non-refundable deposits.

- Scenario 2: The Lost Luggage Debacle. A business executive was traveling to a high-profile conference in Tokyo. His luggage, containing expensive suits and presentation materials, was lost in transit. His luxury travel insurance policy reimbursed him for the cost of replacing his clothing and allowed him to purchase necessary supplies, ensuring he could attend the conference without a hitch.

- Scenario 3: The Emergency Evacuation. A family was on a safari in Tanzania when one of their children suffered a severe allergic reaction to an insect bite. Their luxury travel insurance policy provided emergency medical evacuation to a hospital in Nairobi, saving the child's life.

- Scenario 4: The Trip Interruption Nightmare. A couple was on their honeymoon in the Maldives when a family emergency forced them to cut their trip short. Their luxury travel insurance policy covered the cost of their return flights and reimbursed them for the unused portion of their hotel stay.

Tips for Finding the Best Luxury Travel Insurance Policy

Ready to find the perfect policy? Here are a few tips:

- Shop Around: Don't settle for the first policy you find. Compare quotes from multiple insurers.

- Read the Fine Print: Carefully review the policy's terms and conditions, including coverage limits, exclusions, and deductibles.

- Consider Your Specific Needs: Choose a policy that meets your specific travel needs and budget.

- Check Customer Reviews: Read online reviews to get a sense of the insurer's reputation for customer service.

- Talk to a Travel Insurance Expert: Consider consulting with a travel insurance broker who can help you find the best policy for your needs.

Understanding Policy Limits and Deductibles

Policy limits are the maximum amount the insurance company will pay for a covered loss. Deductibles are the amount you pay out of pocket before the insurance company starts paying. It's crucial to understand these terms to avoid surprises later.

The Importance of Reading the Fine Print Policy Exclusions

Policy exclusions are specific situations or events that are not covered by the insurance policy. Common exclusions include pre-existing medical conditions (unless waived), participation in certain high-risk activities, and acts of war or terrorism (in some cases). Always read the fine print to understand what's not covered.

Luxury Travel Insurance and COVID-19 Considerations

The COVID-19 pandemic has changed the landscape of travel insurance. When choosing a policy, look for coverage that includes trip cancellation or interruption due to COVID-19, as well as medical expenses related to COVID-19 treatment.

Making a Claim What to Expect

If you need to make a claim, contact the insurance company as soon as possible. Gather all relevant documentation, such as receipts, medical records, and police reports. Be prepared to provide detailed information about the incident. The claims process can take time, so be patient and persistent.

Luxury Travel Insurance for Different Types of Trips

The best luxury travel insurance policy for you will depend on the type of trip you're taking. Consider these factors when choosing a policy:

- Cruises: Look for policies that cover medical emergencies at sea, trip interruption due to mechanical issues, and lost or damaged luggage.

- Adventure Travel: Ensure the policy covers the specific activities you plan to participate in, such as skiing, scuba diving, or hiking.

- International Travel: Choose a policy with high coverage limits for medical expenses and emergency medical evacuation.

- Domestic Travel: Even for domestic trips, travel insurance can protect you against unexpected events, such as flight delays, lost luggage, and medical emergencies.

The Future of Luxury Travel Insurance Trends to Watch

The luxury travel insurance industry is constantly evolving. Here are a few trends to watch:

- Increased Customization: Insurers are offering more customizable policies to meet the specific needs of luxury travelers.

- AI-Powered Assistance: AI-powered chatbots and virtual assistants are providing travelers with instant support and guidance.

- Blockchain Technology: Blockchain is being used to streamline the claims process and reduce fraud.

- Sustainability Focus: Insurers are incorporating sustainability considerations into their policies and operations.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)