Travel Insurance Add-ons: Are They Necessary for Your Trip?

Understanding Travel Insurance Add-ons What Are They And Why Do You Need Them

So, you're planning a trip! Exciting, right? But before you pack your bags and dream of sandy beaches or snowy slopes, there's that not-so-thrilling task of getting travel insurance. And then BAM! Add-ons. Suddenly, you're staring at a laundry list of options like "Adventure Sports Coverage," "Cancel For Any Reason," and "Baggage Delay." Are these just clever ways for insurance companies to squeeze more money out of you, or are they genuinely essential for a worry-free vacation? Let's dive in!

Think of travel insurance add-ons as extra layers of protection. Your basic policy might cover things like medical emergencies and trip cancellations due to unforeseen circumstances (like a sudden illness). But add-ons cover *specific* situations that might not be included in the standard plan. They’re designed to tailor your coverage to your individual needs and travel style.

For instance, if you’re planning a hiking trip in the Himalayas, a standard policy likely won't cover injuries sustained while trekking at high altitudes. That's where an "Adventure Sports Coverage" add-on comes in. Or, if you're worried about having to cancel your trip for a reason that isn't typically covered (like, say, you just changed your mind), a "Cancel For Any Reason" add-on could be a lifesaver.

Common Travel Insurance Add-ons and Their Use Cases Protect Yourself

Let's break down some of the most common travel insurance add-ons and when they might be worth considering:

- Cancel For Any Reason (CFAR): This is the holy grail of add-ons for the indecisive traveler. It allows you to cancel your trip for *any* reason and receive a partial refund (usually 50-75% of your trip cost). Perfect for those who are booking far in advance or are simply prone to last-minute changes of heart.

- Adventure Sports Coverage: If you're planning on engaging in any "risky" activities like skiing, snowboarding, scuba diving, rock climbing, or even zip-lining, this add-on is a must. It covers medical expenses and other losses resulting from injuries sustained during these activities.

- Baggage Delay/Loss Coverage: Lost luggage is a traveler's nightmare. This add-on provides reimbursement for essential items if your baggage is delayed or lost by the airline. It can cover the cost of toiletries, clothing, and other necessities you need to tide you over until your luggage is recovered.

- Rental Car Coverage: If you're renting a car, this add-on can provide coverage for damage or theft. It can save you from having to pay expensive deductibles or file a claim with your personal auto insurance policy. Be sure to check if your existing auto insurance or credit card already provides rental car coverage before purchasing this add-on.

- Pre-Existing Medical Condition Coverage: Standard travel insurance policies often exclude coverage for pre-existing medical conditions. This add-on can provide coverage for medical emergencies related to your existing health issues. It's crucial to disclose all pre-existing conditions when purchasing travel insurance to ensure you're adequately covered.

- Trip Interruption Coverage: This covers you if your trip is interrupted after it has already begun. For example, if a family emergency forces you to return home early, this coverage can reimburse you for the unused portion of your trip, as well as the cost of your return flight.

Comparing Travel Insurance Add-ons Providers A Deep Dive

Okay, so you know what add-ons are and which ones you might need. But with so many insurance providers out there, how do you choose the right one? Here's a comparison of some popular providers and their add-on offerings:

World Nomads: Known for its comprehensive coverage and adventure-focused add-ons. They offer coverage for a wide range of activities, including extreme sports. Their policies are flexible and can be purchased or extended while you're already traveling.

Allianz Global Assistance: A reputable provider with a variety of add-ons, including trip cancellation, baggage loss, and rental car coverage. They offer 24/7 assistance and have a strong track record of customer service.

Travel Guard: Offers a wide range of add-ons, including Cancel For Any Reason and pre-existing medical condition coverage. They also have a strong network of medical providers worldwide.

Seven Corners: Caters to international travelers and offers add-ons specifically designed for long-term trips and expatriates. They offer coverage for medical emergencies, trip interruptions, and baggage loss.

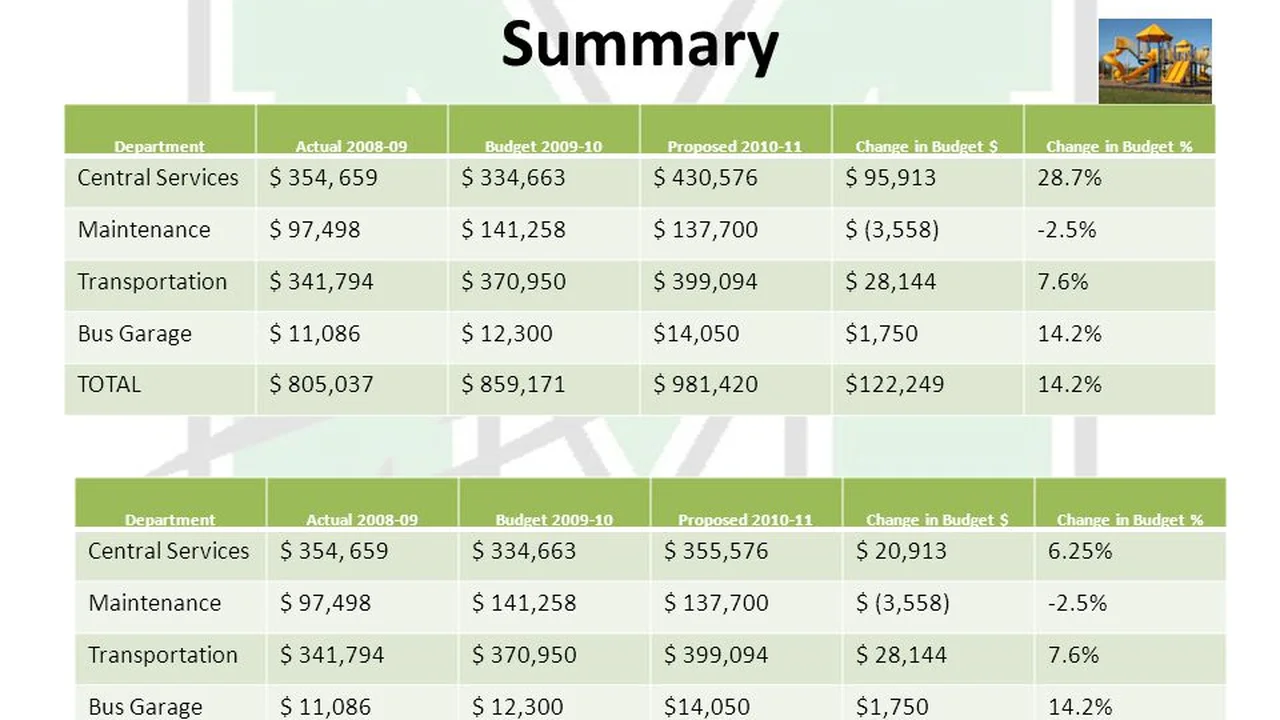

Here's a table summarizing some key differences:

| Provider | Cancel For Any Reason | Adventure Sports Coverage | Pre-Existing Condition Coverage | Price (Estimate for a 2-week trip) |

|---|---|---|---|---|

| World Nomads | No | Yes (Comprehensive) | Possible with rider | $150 - $250 |

| Allianz Global Assistance | Yes (Specific Plans) | Yes (Limited) | Yes (Specific Plans) | $120 - $200 |

| Travel Guard | Yes | Yes | Yes | $130 - $220 |

| Seven Corners | No | Yes | Yes | $140 - $230 |

Note: Prices are estimates and can vary depending on your age, destination, trip length, and coverage levels. Always get a quote from each provider to compare prices.

Real-World Scenarios When Add-ons Saved the Day Don't Get Caught Off Guard

Let's look at some real-life examples of how travel insurance add-ons can be a lifesaver:

- The Ski Trip Disaster: Sarah went on a ski trip to Colorado and broke her leg on the slopes. Luckily, she had purchased an Adventure Sports Coverage add-on with World Nomads. Her policy covered her medical expenses, including the cost of an ambulance ride, surgery, and physical therapy. Without the add-on, she would have been responsible for thousands of dollars in medical bills.

- The Cancelled Cruise: John booked a cruise to the Caribbean months in advance. A week before his trip, he got a bad case of the flu and was unable to travel. He had purchased a Cancel For Any Reason add-on with Allianz Global Assistance. He was able to cancel his trip and receive a 75% refund of his cruise fare.

- The Lost Luggage Nightmare: Maria's luggage was lost by the airline on her way to Italy. She had purchased a Baggage Delay/Loss Coverage add-on with Travel Guard. Her policy reimbursed her for the cost of essential items, such as clothing, toiletries, and medication. She was able to enjoy her trip without having to worry about replacing all of her belongings.

Product Recommendations Specific Travel Insurance Add-on Options

Here are a few specific add-on products from different providers that are worth considering:

- World Nomads Explorer Plan: This plan includes comprehensive adventure sports coverage, making it ideal for active travelers. It also offers coverage for gear and equipment, which is a bonus for those traveling with expensive sports equipment.

- Allianz Global Assistance Trip Protection Plan: This plan offers a variety of add-ons, including Cancel For Any Reason and pre-existing medical condition coverage. It also includes 24/7 assistance and a mobile app for easy access to policy information.

- Travel Guard Preferred Plan: This plan offers a high level of coverage for trip cancellation, interruption, and medical expenses. It also includes a concierge service that can help with travel arrangements and other needs.

- Seven Corners RoundTrip Choice Plan: This plan is designed for international travelers and offers coverage for medical emergencies, trip interruptions, and baggage loss. It also includes coverage for political unrest and natural disasters.

Cost Considerations Is It Worth the Investment

The cost of travel insurance add-ons can vary depending on the provider, the coverage levels, and your destination. Generally, add-ons can add anywhere from 10% to 50% to the cost of your base policy. So, is it worth the investment?

The answer depends on your individual circumstances and risk tolerance. If you're a budget traveler, you might be tempted to skip the add-ons to save money. However, consider the potential cost of an unexpected event. A medical emergency, a cancelled trip, or lost luggage could end up costing you far more than the price of an add-on.

Here's a simple way to think about it: Ask yourself, "What's the worst-case scenario?" If you can afford to cover the cost of that scenario yourself, then you might not need the add-on. But if the potential cost would be financially devastating, then the add-on is probably worth the investment.

For example, if you're planning a backpacking trip through Southeast Asia, you might want to consider an Adventure Sports Coverage add-on, even if you don't plan on doing anything particularly risky. Even a minor injury could require medical treatment, and the cost of healthcare in a foreign country can be surprisingly high.

Making the Right Choice Tailoring Coverage to Your Needs

Ultimately, the decision of whether or not to purchase travel insurance add-ons is a personal one. There's no one-size-fits-all answer.

The key is to carefully consider your individual needs and circumstances, and to shop around for the best coverage at the best price.

Here are a few tips to help you make the right choice:

- Read the fine print: Before purchasing any travel insurance policy, be sure to read the fine print carefully. Pay attention to the exclusions and limitations of the policy, and make sure you understand what is and isn't covered.

- Compare quotes from multiple providers: Don't just settle for the first policy you find. Get quotes from several different providers to compare prices and coverage levels.

- Consider your deductible: The deductible is the amount you have to pay out-of-pocket before your insurance coverage kicks in. A higher deductible will usually result in a lower premium, but you'll have to pay more if you file a claim.

- Think about your destination: The cost of healthcare and other services can vary significantly depending on your destination. If you're traveling to a country with high medical costs, you might want to consider purchasing higher coverage levels.

- Talk to a travel insurance agent: If you're unsure about which add-ons you need, consider talking to a travel insurance agent. They can help you assess your risks and find the right coverage for your trip.

Product Comparison Real World Scenarios and Costs Examples

Let's compare some specific products with concrete scenarios and cost examples:

Scenario 1: A family of four (two adults, two children) is planning a two-week trip to Disney World. They are concerned about potential trip cancellations due to illness and potential medical emergencies.

- Option A: Allianz Global Assistance Family Plan. This plan includes trip cancellation coverage, baggage loss, and medical expense coverage. The cost for a family of four for a two-week trip is approximately $250. The deductible for medical expenses is $250.

- Option B: Travel Guard Deluxe Plan. This plan includes trip cancellation coverage, baggage loss, medical expense coverage, and a concierge service. The cost for a family of four for a two-week trip is approximately $300. The deductible for medical expenses is $0.

- Analysis: While the Travel Guard plan is slightly more expensive, the $0 deductible for medical expenses might be worth the extra cost, especially with children.

Scenario 2: A solo traveler is planning a three-week backpacking trip through Southeast Asia, including hiking and exploring remote areas.

- Option A: World Nomads Explorer Plan. This plan includes comprehensive adventure sports coverage, medical expense coverage, and coverage for gear and equipment. The cost for a solo traveler for a three-week trip is approximately $200. The deductible for medical expenses is $100.

- Option B: Seven Corners RoundTrip Choice Plan. This plan includes medical expense coverage, trip interruption coverage, and baggage loss coverage. The cost for a solo traveler for a three-week trip is approximately $180. The deductible for medical expenses is $250.

- Analysis: The World Nomads plan is the better choice for this scenario due to its comprehensive adventure sports coverage, which is essential for a backpacking trip through Southeast Asia.

Final Thoughts Navigating the World of Travel Insurance Add-ons

Choosing the right travel insurance add-ons can seem daunting, but it doesn't have to be. By understanding your needs, comparing your options, and carefully reading the fine print, you can find the perfect coverage for your trip and enjoy a worry-free vacation. Remember to prioritize your health and safety, and don't be afraid to invest in the peace of mind that travel insurance provides.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)