Travel Insurance for RV Trips: Extended Protection

Understanding the Need for Specialized RV Travel Insurance

So, you're hitting the open road in your RV? Awesome! RVing is a fantastic way to see the country, experience nature, and create lasting memories. But before you crank up the engine, let's talk about something crucial: travel insurance. Standard travel insurance often falls short when it comes to RV trips. Why? Because RVs are more than just cars; they're rolling homes. They come with unique risks and liabilities that a regular policy simply won't cover.

Think about it: your RV has appliances, plumbing, electrical systems, and potentially expensive modifications. If your RV breaks down in the middle of nowhere, a standard policy might only cover basic roadside assistance. It probably won't cover the cost of specialized RV repairs, towing to a qualified RV mechanic, or temporary lodging if you're stranded for days. That's where specialized RV travel insurance comes in. It's designed to address the specific needs and challenges of RV travel, providing comprehensive protection and peace of mind.

Key Coverage Areas in RV Travel Insurance Policies

Let's break down the essential coverage areas you should look for in an RV travel insurance policy:

- Trip Interruption/Cancellation: Imagine your RV breaks down the day before your big trip, or a family emergency forces you to cancel. RV travel insurance can reimburse you for non-refundable trip expenses, like campground reservations and pre-paid activities.

- Medical Coverage: Accidents happen. Whether you're hiking, biking, or just relaxing at your campsite, medical expenses can quickly add up. RV travel insurance can cover medical bills, emergency transportation, and even repatriation if you need to return home for treatment.

- Roadside Assistance: This is a must-have for any RV trip. Look for policies that offer 24/7 roadside assistance, including towing, jump-starts, tire changes, fuel delivery, and lockout service. Crucially, make sure the towing covers large vehicles like RVs, and isn't just limited to standard cars.

- RV Repair Coverage: This is where specialized RV insurance shines. It can cover the cost of repairs to your RV's systems and appliances, such as the refrigerator, air conditioner, water heater, and plumbing. Some policies even cover wear and tear.

- Personal Belongings Coverage: Your RV is your home on wheels, and it's filled with your belongings. RV travel insurance can protect your personal items from theft, damage, or loss.

- Liability Coverage: This is crucial in case you're responsible for an accident that causes damage to another person or their property. Liability coverage can help pay for legal fees and settlements.

- Pet Coverage: If you're traveling with your furry friends, look for policies that offer coverage for pet medical expenses or boarding fees if you're hospitalized.

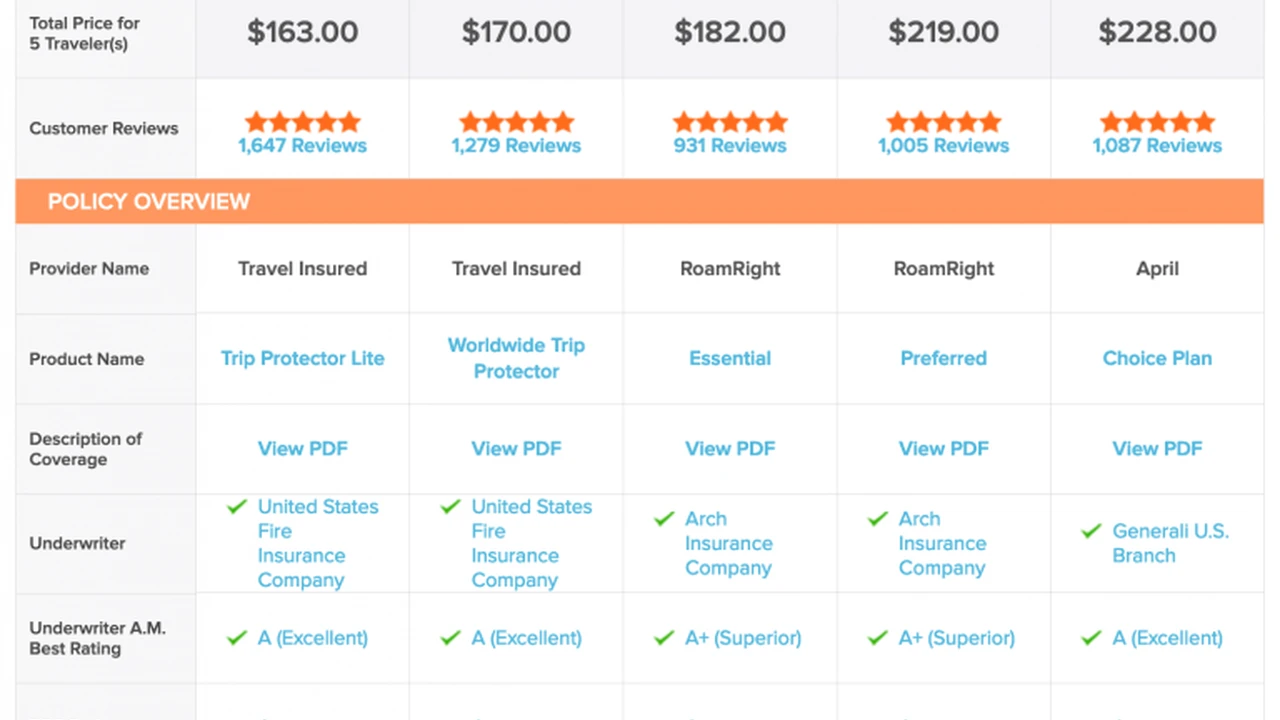

Recommended RV Travel Insurance Products and Their Features

Now, let's take a look at some specific RV travel insurance products and their key features:

- Good Sam TravelAssist: This is a popular choice for RVers, offering comprehensive coverage including trip interruption, medical coverage, roadside assistance, and RV repair coverage. They also offer a "Concierge" service to help you plan your trips and find RV-friendly campgrounds and services. Good Sam is a well-known name in the RV community, adding a layer of trust.

- Allianz Travel Insurance: Allianz offers a variety of travel insurance plans that can be customized to fit your specific needs. Their "AllTrips Premier" plan is a good option for RVers, offering trip cancellation/interruption, medical coverage, and baggage protection. While not exclusively focused on RVs, they offer high coverage limits and a reputation for solid customer service.

- World Nomads Explorer Plan: Primarily known for backpacker and adventure travel insurance, World Nomads can be a viable option for RVers who are also engaging in outdoor activities like hiking, kayaking, or rock climbing. Their Explorer Plan offers comprehensive medical coverage, including coverage for adventure sports. However, their RV-specific coverage might be less extensive than Good Sam.

- Roamly RV Insurance: Roamly specializes in RV insurance and offers comprehensive coverage including roadside assistance, RV repair coverage, and liability coverage. They offer flexible policies with customizable coverage options. Roamly is a newer player, but their focus on RVs makes them a worthwhile consideration.

Comparing RV Travel Insurance Products: Features, Benefits, and Costs

Choosing the right RV travel insurance policy can be overwhelming. Here's a comparison table to help you make an informed decision:

| Feature | Good Sam TravelAssist | Allianz AllTrips Premier | World Nomads Explorer | Roamly RV Insurance |

|---|---|---|---|---|

| Trip Interruption/Cancellation | Yes | Yes | Yes | Yes |

| Medical Coverage | Yes | Yes | Yes (including adventure sports) | Yes |

| Roadside Assistance | Yes (RV-specific) | Yes (standard) | Yes (standard) | Yes (RV-specific) |

| RV Repair Coverage | Yes | No (limited) | No | Yes |

| Personal Belongings Coverage | Yes | Yes | Yes | Yes |

| Liability Coverage | Yes | Yes | Yes | Yes |

| Pet Coverage | Yes (optional) | No | No | Yes (optional) |

| Price (Estimate for 2-week trip) | $150 - $300 | $100 - $250 | $80 - $200 | $180 - $350 |

Important Note: Prices are estimates and can vary based on your age, health, trip length, RV type, and coverage options. Always get a personalized quote from each insurance provider.

Real-World Scenarios and How RV Travel Insurance Can Help

Let's look at some real-world scenarios where RV travel insurance can save the day:

- Scenario 1: You're driving through the mountains and your RV's transmission fails. Roadside assistance covers the cost of towing your RV to the nearest repair shop, which is 200 miles away. RV repair coverage pays for the cost of the transmission repair, which is $4,000. Without insurance, you'd be stuck with a hefty towing bill and a massive repair expense.

- Scenario 2: A severe storm damages your RV's awning and roof. Your insurance policy covers the cost of repairs, preventing you from having to pay out of pocket. This can be particularly important if you're on a fixed income.

- Scenario 3: You accidentally cause an accident while backing up your RV, damaging another vehicle. Your liability coverage helps pay for the damages to the other vehicle and any medical expenses incurred by the other driver. This protects your assets and prevents you from facing a lawsuit.

- Scenario 4: You fall ill during your trip and need to be hospitalized. Your medical coverage pays for your medical bills and emergency transportation back home. This is especially important if you're traveling internationally.

Tips for Choosing the Right RV Travel Insurance Policy

Here are some tips to help you choose the right RV travel insurance policy:

- Assess your needs: Consider your RV type, trip length, travel destinations, and activities you'll be participating in.

- Compare quotes: Get quotes from multiple insurance providers and compare their coverage options and prices.

- Read the fine print: Carefully review the policy terms and conditions to understand what is covered and what is excluded.

- Check the deductible: Understand how much you'll have to pay out of pocket before your insurance coverage kicks in.

- Look for endorsements: Consider adding endorsements to your policy to cover specific risks, such as pet coverage or increased liability coverage.

- Consider customer service: Choose an insurance provider with a reputation for excellent customer service and claims handling.

Understanding Exclusions in RV Travel Insurance Policies

While RV travel insurance offers comprehensive protection, it's important to understand the common exclusions. Here are some things that are typically not covered:

- Pre-existing medical conditions: Some policies may exclude coverage for pre-existing medical conditions unless you purchase a waiver.

- Intentional acts: Damage caused by intentional acts, such as vandalism or arson, is typically not covered.

- Illegal activities: Losses resulting from illegal activities, such as drug use or drunk driving, are not covered.

- Normal wear and tear: Coverage for normal wear and tear is often limited or excluded.

- Acts of war or terrorism: Losses resulting from acts of war or terrorism are typically excluded.

Specific Scenarios: Travel Insurance for Full-Time RVers

Living in your RV full-time requires a different approach to insurance. Instead of travel insurance, you'll likely need a full-fledged RV insurance policy that provides year-round coverage, similar to homeowners insurance. This type of policy typically includes:

- Comprehensive and Collision Coverage: Covers damage to your RV from accidents, theft, vandalism, and natural disasters.

- Personal Liability Coverage: Protects you if you're responsible for an accident that causes injury or property damage.

- Uninsured/Underinsured Motorist Coverage: Covers your expenses if you're hit by an uninsured or underinsured driver.

- Full Replacement Cost Coverage: Pays for the full replacement cost of your RV if it's totaled, regardless of depreciation.

For full-time RVers, consider working with an insurance agent who specializes in RV insurance to ensure you have adequate coverage.

RV Travel Insurance and COVID-19: What You Need to Know

The COVID-19 pandemic has changed the landscape of travel insurance. Here's what you need to know about RV travel insurance and COVID-19:

- Trip Cancellation/Interruption: Some policies may cover trip cancellation or interruption due to COVID-19 if you test positive for the virus or are subject to a travel ban. However, coverage may vary depending on the policy and the circumstances.

- Medical Coverage: Many policies offer medical coverage for COVID-19 if you contract the virus while traveling. However, coverage may be subject to limitations and exclusions.

- Review the Policy Carefully: Before purchasing RV travel insurance, carefully review the policy terms and conditions to understand the coverage for COVID-19 related events.

- Consider "Cancel for Any Reason" Coverage: If you're concerned about the possibility of canceling your trip due to COVID-19, consider purchasing a "Cancel for Any Reason" (CFAR) policy. CFAR coverage allows you to cancel your trip for any reason and receive a partial refund (typically 50-75%). However, CFAR coverage is typically more expensive than standard travel insurance.

Making a Claim: A Step-by-Step Guide

If you need to make a claim on your RV travel insurance policy, here's a step-by-step guide:

- Report the incident: Contact your insurance provider as soon as possible after the incident occurs.

- Gather documentation: Collect all relevant documentation, such as police reports, medical records, repair bills, and receipts.

- Complete the claim form: Fill out the claim form accurately and completely.

- Submit the claim: Submit the claim form and supporting documentation to your insurance provider.

- Follow up: Follow up with your insurance provider to check on the status of your claim.

- Be patient: The claims process can take time, so be patient and persistent.

Staying Safe on the Road: Beyond Insurance

While RV travel insurance is essential, it's just one piece of the puzzle. Here are some additional tips for staying safe on the road:

- Pre-Trip Inspection: Before each trip, thoroughly inspect your RV to ensure that all systems are functioning properly.

- Safe Driving Practices: Practice safe driving habits, such as maintaining a safe following distance, avoiding distractions, and driving at a safe speed.

- Weather Awareness: Be aware of the weather conditions and avoid driving in hazardous weather.

- Emergency Preparedness: Carry a well-stocked emergency kit with supplies such as a first-aid kit, flashlight, jumper cables, and extra food and water.

- RV Maintenance: Regularly maintain your RV to prevent breakdowns and ensure its safety.

Final Thoughts: Protecting Your RV Adventure

RVing is an incredible way to explore the world and create unforgettable memories. By investing in the right RV travel insurance policy and practicing safe travel habits, you can protect yourself, your RV, and your loved ones from unexpected events and enjoy your RV adventures with peace of mind. So, get insured, get prepared, and get ready to hit the open road!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)