Travel Policy for Meals and Entertainment Expenses

Defining clear limits and rules for meal and entertainment expenses within your corporate travel policy.

Travel Policy for Meals and Entertainment Expenses A Comprehensive Guide

Business travel often comes with a significant chunk of spending on meals and entertainment. Without a clear, well-defined travel policy, these expenses can quickly spiral out of control, impacting your company's bottom line. This article dives deep into how to establish robust guidelines for meal and entertainment expenses, ensuring both cost efficiency and employee satisfaction. We'll explore best practices, common pitfalls, and even recommend some tools to help you manage these costs effectively.

Understanding Meal Expense Policies What to Include

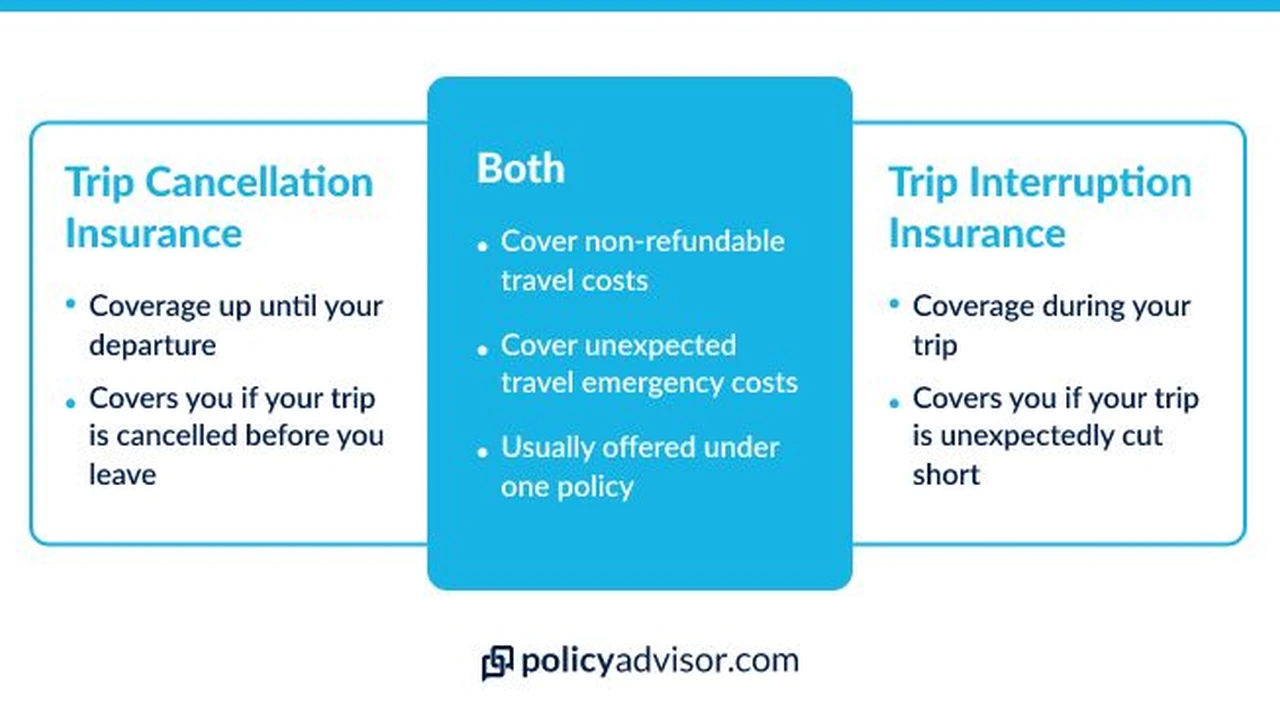

When it comes to meals, your travel policy needs to be precise. Are you setting per diems, or will you reimburse actual expenses? Each approach has its pros and cons. Per diems offer simplicity and predictability, reducing administrative burden. However, they might not always reflect the actual cost of meals in different locations. Actual expense reimbursement, while more accurate, requires detailed receipt tracking and can be more time-consuming to process.

Per Diem vs Actual Expense Reimbursement Choosing Your Approach

Many companies opt for a hybrid model, using per diems for most meals but allowing for actual expense reimbursement in specific, high-cost cities or for special circumstances. For instance, you might set a per diem of $50 for a full day's meals in most US cities, but allow for actual expenses up to $100 in New York City or San Francisco. The key is to be transparent and consistent.

Setting Per Diem Rates Research and Resources

How do you determine fair per diem rates? Several resources can help. In the US, the General Services Administration (GSA) publishes per diem rates for federal employees, which are often used as a benchmark by private companies. For international travel, the U.S. Department of State provides foreign per diem rates. These resources offer a good starting point, but always consider your company's specific needs and the typical spending habits of your employees.

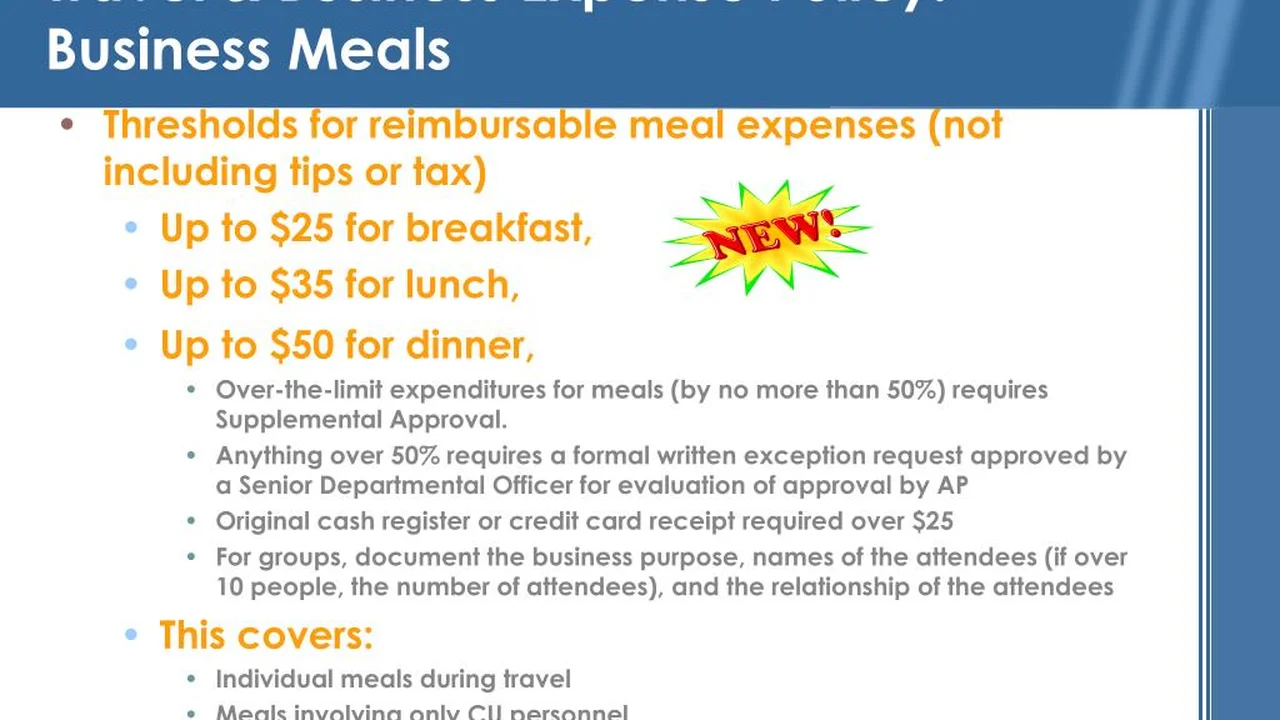

Meal Expense Categories Breakfast Lunch Dinner Incidentals

Break down meal expenses into clear categories: breakfast, lunch, and dinner. You might also include a small allowance for incidentals like snacks or non-alcoholic beverages. Clearly define what constitutes each meal and any time restrictions. For example, breakfast might be reimbursed if travel begins before 7 AM, or dinner if travel extends past 7 PM.

Receipt Requirements and Documentation for Meals

Even with per diems, it's wise to require some form of documentation, especially for higher-value meals or when actual expenses are reimbursed. For actual expenses, always require itemized receipts. This helps prevent fraud and ensures compliance. Digital receipt capture through expense management software can significantly streamline this process.

Crafting Entertainment Expense Policies Clear Guidelines

Entertainment expenses are often more complex than meals. They typically involve clients, partners, or prospects, and can vary widely in nature. Your policy needs to clearly define what is considered an allowable entertainment expense and what is not.

Defining Business Entertainment What Qualifies

Start by defining what constitutes 'business entertainment.' Is it taking a client to a sporting event? A concert? A round of golf? Be specific. Generally, the primary purpose must be to discuss or conduct business, and the expense should be ordinary and necessary for your business. Personal entertainment, even if it occurs during a business trip, should not be reimbursed.

Approval Processes for Entertainment Expenses Pre-Approval Thresholds

Given the potentially high cost of entertainment, pre-approval is often a good idea. Set clear thresholds: for example, any entertainment expense over $200 might require manager approval, while anything over $500 might need executive approval. This adds a layer of control and ensures that significant expenses are justified.

Guest Lists and Business Purpose Documentation

For every entertainment expense, require documentation of the business purpose and a list of attendees, including their names and affiliations. This is crucial for tax purposes and for demonstrating the legitimate business nature of the expense. Without this information, the expense might be disallowed by tax authorities.

Prohibited Entertainment Expenses Examples and Clarity

Be explicit about what is NOT allowed. This could include personal grooming services, lavish parties, or expenses for family members who are not directly involved in the business discussion. Clarity here prevents misunderstandings and potential abuse of the policy.

Integrating Technology for Expense Management Streamlining Processes

Managing meal and entertainment expenses manually can be a nightmare. This is where technology steps in. Expense management software can automate many aspects of your policy, from receipt capture to approval workflows and reporting.

Top 3 Expense Management Software for Meals and Entertainment

Let's look at some popular and effective tools that can help you manage these expenses:

1. Expensify

Overview: Expensify is a widely used expense management platform known for its user-friendly interface and SmartScan technology, which allows users to simply take a photo of a receipt and have the data automatically extracted. It integrates well with accounting software like QuickBooks, Xero, and NetSuite.

Key Features for Meals and Entertainment:

- SmartScan: Automatically captures merchant, date, and amount from receipts, reducing manual entry errors.

- Policy Enforcement: Allows you to set custom rules for meal and entertainment spending, flagging out-of-policy expenses.

- Per Diem Management: Supports setting and tracking per diems for various locations.

- Attendee Tracking: Easy to add attendees for entertainment expenses, fulfilling IRS requirements.

- Automated Approvals: Customizable approval workflows based on expense type, amount, or employee.

Use Cases: Ideal for businesses of all sizes looking for a highly automated and mobile-first solution. Great for sales teams who frequently entertain clients.

Pricing: Expensify offers various plans. Their 'Collect' plan starts at $5 per active user per month (billed annually) for basic expense reporting. The 'Control' plan, which includes advanced policy enforcement and integrations, starts at $9 per active user per month (billed annually). Enterprise pricing is custom.

Pros: Excellent mobile app, highly automated, strong integrations, good for compliance.

Cons: Can be more expensive for larger teams, some users find the initial setup complex.

2. SAP Concur Expense

Overview: SAP Concur is a comprehensive travel and expense management solution, particularly popular among larger enterprises. It offers a robust suite of tools for booking, expense reporting, and invoice management.

Key Features for Meals and Entertainment:

- Integrated Travel Booking: Can be linked with Concur Travel for a seamless booking and expense experience.

- Detailed Policy Configuration: Highly customizable rules engine to enforce complex meal and entertainment policies, including spend limits, attendee requirements, and per diems.

- Receipt Imaging: Allows for digital receipt submission and storage.

- Audit Trails: Provides detailed audit trails for all expenses, crucial for compliance.

- Reporting and Analytics: Powerful reporting tools to analyze spending patterns on meals and entertainment.

Use Cases: Best suited for medium to large enterprises with complex travel and expense needs, especially those already using other SAP products.

Pricing: SAP Concur's pricing is typically enterprise-level and not publicly disclosed. It's generally based on the number of users and modules implemented. Expect a higher investment compared to simpler solutions.

Pros: Very comprehensive, strong reporting, excellent for large organizations with complex needs, integrated travel booking.

Cons: Can be complex to implement and manage, higher cost, less intuitive for small businesses.

3. Rydoo

Overview: Rydoo is a modern, cloud-based expense management solution that focuses on simplicity and user experience. It's known for its quick setup and intuitive interface, making it easy for employees to submit expenses.

Key Features for Meals and Entertainment:

- Fast Expense Submission: Employees can submit expenses in seconds using their mobile app, including meal and entertainment receipts.

- Automated Policy Checks: Real-time policy checks flag non-compliant expenses before submission.

- Per Diem Management: Supports various per diem rules and calculations.

- Project and Client Tagging: Allows users to tag expenses to specific projects or clients, useful for entertainment cost allocation.

- Integrations: Connects with popular accounting systems like Xero, QuickBooks, and SAP.

Use Cases: Great for small to medium-sized businesses looking for an easy-to-use, efficient expense management tool with good policy enforcement capabilities.

Pricing: Rydoo offers tiered pricing. Their 'Essential' plan starts at €7 per user per month (billed annually) for basic expense management. The 'Pro' plan, with advanced features like per diems and custom fields, starts at €9 per user per month (billed annually). Enterprise pricing is available upon request.

Pros: User-friendly interface, quick setup, good mobile experience, strong policy enforcement.

Cons: May lack some of the deeper functionalities of enterprise-level solutions like Concur, less extensive reporting than some competitors.

Comparing Features and Pricing Choosing the Right Tool

When choosing between these tools, consider your company's size, budget, and specific needs. If you're a small business with straightforward needs, Rydoo or Expensify might be a better fit due to their ease of use and lower cost. For larger enterprises with complex global operations, SAP Concur's comprehensive suite might be more appropriate despite its higher price point and complexity. Always take advantage of free trials to see which platform best suits your workflow.

Best Practices for Meal and Entertainment Policies Ensuring Compliance

Beyond the technical aspects, there are several best practices that will make your meal and entertainment policy effective and well-received by employees.

Communication and Training Employee Understanding

A policy is only as good as its understanding. Clearly communicate your meal and entertainment policy to all employees. Conduct training sessions, especially for new hires or when significant policy changes occur. Use clear, concise language, and provide examples of what is and isn't allowed. Make the policy easily accessible, perhaps on your company intranet.

Regular Review and Updates Adapting to Change

The business landscape, travel costs, and tax regulations are constantly changing. Review your meal and entertainment policy at least annually. Are your per diems still realistic? Are there new types of entertainment expenses that need to be addressed? Are your approval workflows still efficient? Regular updates ensure your policy remains relevant and effective.

Fairness and Consistency Employee Morale

Apply the policy fairly and consistently across all employees and departments. Inconsistent enforcement can lead to resentment and a perception of unfairness, undermining the policy's effectiveness. Treat all employees equally when it comes to expense reimbursement, regardless of their position.

Tax Implications and Compliance IRS Guidelines

Be mindful of the tax implications of meal and entertainment expenses. In the US, for example, business meals are generally 50% deductible, while entertainment expenses are generally no longer deductible. Your policy should guide employees on how to properly document these expenses for tax compliance. Consult with your tax advisor to ensure your policy aligns with current tax laws.

Balancing Cost Control with Employee Experience

While cost control is paramount, don't forget the employee experience. A policy that is too restrictive can lead to frustration and impact morale. Strive for a balance that allows employees to conduct business effectively and comfortably, without excessive spending. For instance, allowing for a reasonable meal allowance in high-cost areas shows you understand their needs.

Handling Exceptions and Special Circumstances

No policy can cover every single scenario. Establish a clear process for handling exceptions or special circumstances. This might involve a higher level of approval or a specific form to justify the deviation from the standard policy. Flexibility, within reason, can prevent unnecessary friction.

Auditing and Reporting Identifying Trends

Regularly audit meal and entertainment expenses. Look for trends, anomalies, or areas where spending is consistently high. Use the reporting features of your expense management software to gain insights into where your money is going. This data can inform future policy adjustments and identify potential areas for savings.

By implementing a clear, well-communicated, and technologically supported policy for meals and entertainment, your company can achieve significant cost savings, improve compliance, and maintain a positive experience for your traveling employees.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)