Using Travel Insurance for Emergency Medical Evacuation: A Guide

Understanding Emergency Medical Evacuation Travel Insurance Coverage

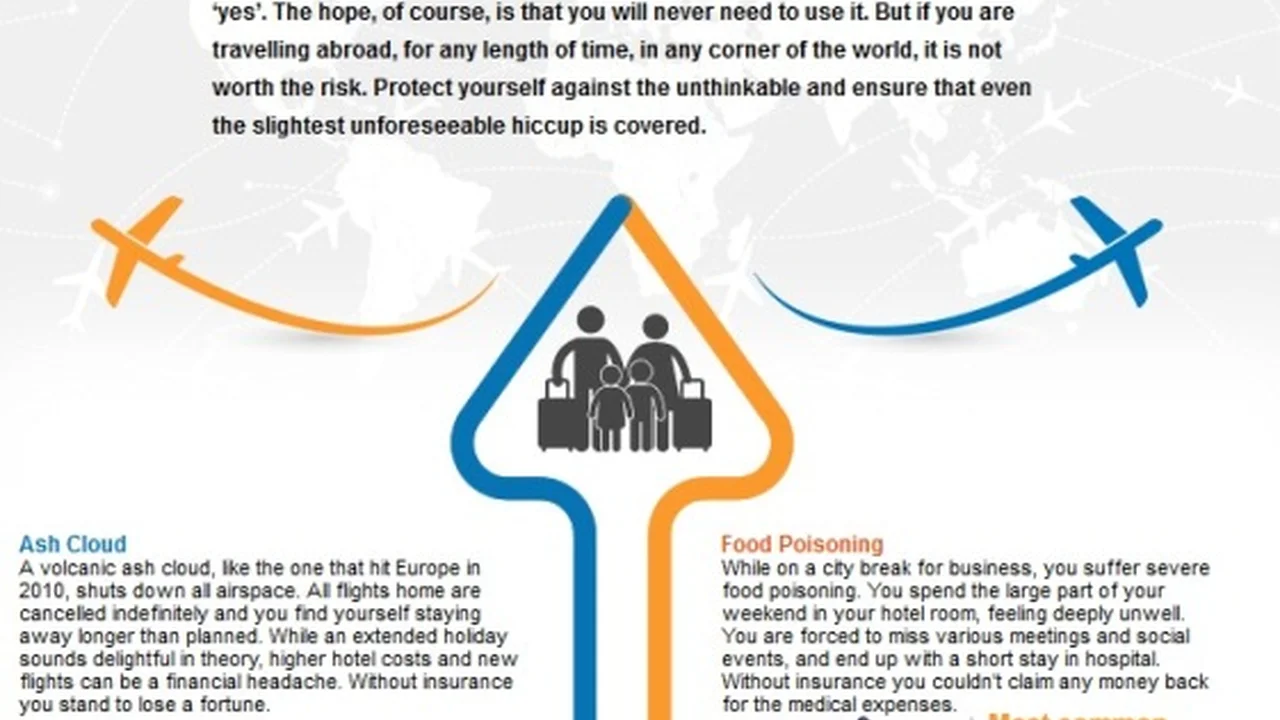

So, you're planning a trip – awesome! Whether it's backpacking through Southeast Asia, scaling mountains in the Andes, or just relaxing on a beach in the Caribbean, adventure awaits. But let's be real, sometimes things go sideways. Emergency medical evacuation isn't something we *want* to think about, but it's crucial to understand, especially when you're far from home and your regular healthcare.

Emergency medical evacuation, in a nutshell, means getting you from where you are (usually a remote or medically underserved area) to a place where you can receive adequate medical care. Think helicopter rides off a mountain, air ambulance flights to a specialized hospital, or even just a long, complicated ambulance journey across borders. This isn't your average doctor's visit; it's a complex logistical and medical undertaking, and it can be incredibly expensive.

Travel insurance policies that cover emergency medical evacuation are designed to help with these costs. But, and this is a *big* but, not all policies are created equal. You need to understand what your policy covers, what it doesn't, and what conditions apply.

Key Considerations Before You Need Emergency Medical Evacuation Insurance

Before you even pack your bags, dive deep into your travel insurance policy. Don't just skim it; actually read the fine print. Here's what you need to be looking for:

- Coverage Limits: How much will the policy pay out for emergency medical evacuation? $100,000 might sound like a lot, but trust me, it can disappear quickly when you're talking about international air ambulance services. Aim for at least $500,000, and ideally $1,000,000 or more, especially if you're traveling to remote or expensive regions.

- Pre-Existing Conditions: Does the policy cover pre-existing medical conditions? Many policies have exclusions or limitations. If you have a pre-existing condition, you'll likely need to purchase a specific rider or find a policy that explicitly covers it. Don't assume you're covered; confirm it in writing.

- Exclusions: What activities are excluded? Some policies won't cover injuries sustained while participating in extreme sports like rock climbing, paragliding, or scuba diving. Others might exclude injuries related to alcohol or drug use. Be aware of these exclusions and choose a policy that aligns with your planned activities.

- Definition of "Emergency": How does the policy define a medical emergency? This is crucial. Some policies require that your condition be life-threatening. Others might cover situations where adequate medical care isn't available locally, even if your condition isn't immediately life-threatening.

- Repatriation: Does the policy cover repatriation of remains? This is a morbid thought, but it's important. If the worst happens, you want to know that your body will be returned home, and that the costs will be covered.

- Deductibles and Co-pays: What's your deductible? What percentage of the costs will you be responsible for? A lower premium might mean a higher deductible, so weigh your options carefully.

- 24/7 Assistance: Does the insurance company offer 24/7 assistance? When you're dealing with a medical emergency in a foreign country, you need someone who can help you navigate the local healthcare system, arrange transportation, and communicate with the insurance company.

The Emergency Medical Evacuation Claim Process Step by Step Guide

Okay, so you've had an accident or become seriously ill while traveling. Here's what to do:

- Contact the Insurance Company Immediately: This is the most crucial step. Call the insurance company's 24/7 assistance line as soon as possible. They'll guide you through the process and help you arrange for medical evacuation. Don't make any decisions about medical treatment or transportation without consulting them first.

- Document Everything: Keep detailed records of all medical treatments, expenses, and communications with the insurance company. Get copies of all medical reports, bills, and receipts. Take photos or videos of the accident scene (if possible).

- Follow the Insurance Company's Instructions: The insurance company will likely have specific procedures for arranging medical evacuation. Follow their instructions carefully to avoid delays or denials.

- Authorize Release of Medical Information: You'll need to authorize the release of your medical information to the insurance company. This will allow them to assess your condition and determine the best course of action.

- Cooperate with the Insurance Company's Investigation: The insurance company may conduct an investigation to determine the validity of your claim. Cooperate fully with their investigation and provide them with any information they request.

- Keep a Record of All Communications: Keep a record of all phone calls, emails, and letters with the insurance company. Note the date, time, and name of the person you spoke with.

- If Your Claim is Denied: If your claim is denied, don't give up. Find out why the claim was denied and gather any additional information that might support your claim. You may need to file an appeal or seek legal assistance.

Travel Insurance Emergency Medical Evacuation Claim Denials Reasons

Unfortunately, emergency medical evacuation claims can be denied. Here are some common reasons why:

- Pre-Existing Conditions: As mentioned earlier, pre-existing conditions are a common reason for claim denials. If you didn't disclose your pre-existing condition when you purchased the policy, or if the policy doesn't cover pre-existing conditions, your claim could be denied.

- Excluded Activities: If you were injured while participating in an excluded activity, your claim could be denied.

- Failure to Contact the Insurance Company: If you didn't contact the insurance company before arranging medical evacuation, your claim could be denied. Many policies require pre-authorization for medical evacuation.

- Lack of Medical Necessity: If the insurance company determines that medical evacuation wasn't medically necessary, your claim could be denied. They may argue that you could have received adequate medical care locally.

- Policy Exclusions: Certain policies have exclusions that invalidate claims.

Comparing Emergency Medical Evacuation Travel Insurance Products

Okay, let's talk about some specific travel insurance products that offer emergency medical evacuation coverage. Remember, this isn't an endorsement of any particular product, and you should always do your own research and compare policies carefully.

World Nomads Explorer Plan Emergency Medical Evacuation Travel Insurance

World Nomads is a popular choice for backpackers and adventure travelers. Their Explorer Plan typically offers comprehensive coverage, including emergency medical evacuation. It's a good option if you're planning on participating in more adventurous activities. They are known for covering a wide range of activities, but read the fine print carefully.

Use Case: Imagine you're trekking in Nepal and suffer a serious leg injury. The World Nomads Explorer Plan would cover the cost of a helicopter evacuation to a hospital in Kathmandu, as well as your medical expenses.

Pros: Good coverage for adventure activities, 24/7 assistance, relatively easy to understand policy language.

Cons: Can be more expensive than other options, pre-existing condition coverage may be limited.

Estimated Price: $100 - $300 per month, depending on age, destination, and coverage options.

Allianz Travel Insurance Prime Plan Emergency Medical Evacuation Travel Insurance

Allianz Travel Insurance offers a range of plans, and their Prime Plan is a good option for travelers looking for comprehensive coverage. It typically includes emergency medical evacuation, trip cancellation, and baggage loss.

Use Case: Let's say you're on a cruise in the Caribbean and develop a severe infection. The Allianz Travel Insurance Prime Plan would cover the cost of an air ambulance flight to a hospital in Miami, as well as your medical expenses.

Pros: Comprehensive coverage, good customer service, often includes trip cancellation coverage.

Cons: Can be more expensive than other options, may have limitations on pre-existing condition coverage.

Estimated Price: $80 - $250 per month, depending on age, destination, and coverage options.

IMG Signature Travel Insurance Emergency Medical Evacuation Travel Insurance

IMG (International Medical Group) is a specialist in travel and international health insurance. Their Signature Travel Insurance plan is designed for travelers who want a high level of coverage, including emergency medical evacuation. They are often a good choice for long-term travelers or those with specific medical needs.

Use Case: You're teaching English in South Korea and require emergency surgery. IMG Signature Travel Insurance would cover the cost of the surgery, as well as any necessary medical evacuation to a specialized hospital in another country.

Pros: High coverage limits, good for long-term travelers, may offer more comprehensive coverage for pre-existing conditions (check policy details).

Cons: Can be one of the most expensive options, policy language can be complex.

Estimated Price: $150 - $400 per month, depending on age, destination, and coverage options.

Factors Influencing Travel Insurance Emergency Medical Evacuation Costs

Several factors affect the cost of travel insurance with emergency medical evacuation coverage:

- Age: Older travelers typically pay higher premiums.

- Destination: Traveling to remote or high-risk areas will increase the cost.

- Coverage Limits: Higher coverage limits mean higher premiums.

- Deductible: A lower deductible will result in a higher premium.

- Pre-Existing Conditions: Covering pre-existing conditions will increase the cost.

- Length of Trip: Longer trips will cost more.

- Activities: Participating in adventure sports will increase the cost.

Tips for Choosing the Right Emergency Medical Evacuation Travel Insurance

Here are some final tips to help you choose the right emergency medical evacuation travel insurance:

- Shop Around: Don't just buy the first policy you see. Compare quotes from multiple insurance companies.

- Read the Fine Print: Understand the policy's coverage limits, exclusions, and conditions.

- Consider Your Needs: Choose a policy that meets your specific needs and travel plans.

- Ask Questions: If you have any questions, don't hesitate to contact the insurance company.

- Keep Your Policy Information Handy: Make sure you have your policy number and contact information readily available.

Traveling is an amazing experience, but it's important to be prepared for the unexpected. By understanding emergency medical evacuation coverage and choosing the right travel insurance policy, you can protect yourself from potentially devastating financial burdens and ensure that you receive the medical care you need, wherever you are in the world. Safe travels!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)